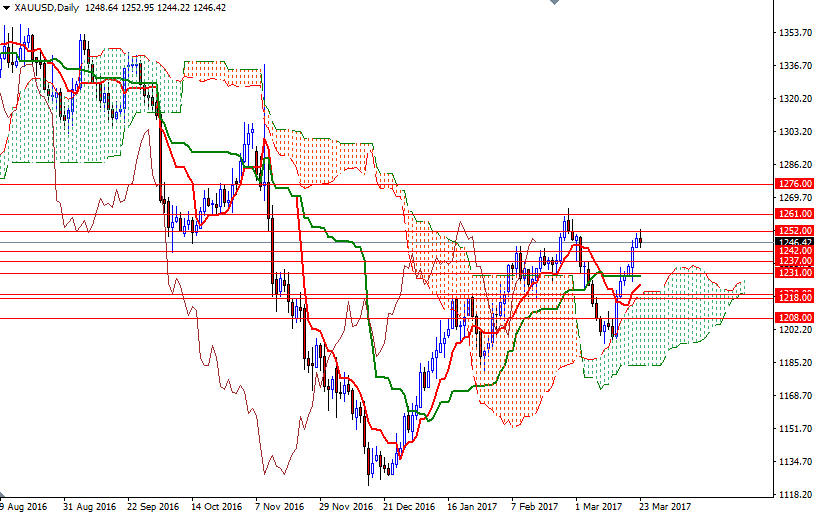

Gold prices edged down in Asian trade on Thursday as stocks firmed and the U.S. dollar recovered. The XAU/USD pair extended its gains after prices broke above resistance at 1246, and reached the 1252/0 area as expected. The key levels remains unchanged, as the market remains in a relatively tight range between 1252/0 and 1242.

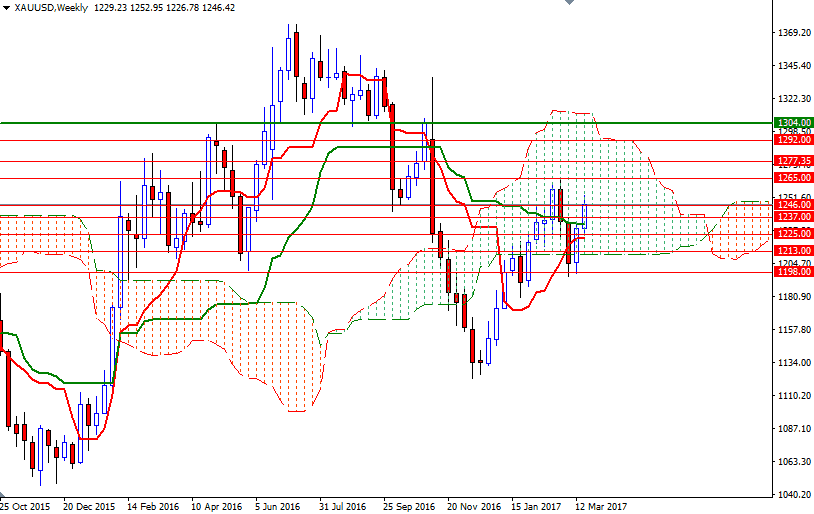

Technically, trading above the daily and the 4-hourly Ichimoku clouds suggests that gold is likely to maintain its bullish trend over the medium term. However, residing inside the weekly clouds indicates that there are tough barriers ahead. From an intra-day perspective, keep an eye on 1252 and 1242. The upside potential will be limited unless the resistance in the 1252/0 is broken. XAU/USD has to push its way through 1252/0 in order to tackle the resistance in the 1265/1 zone. A clean break out above the 1265 level would signal a further extension towards the 1277.35-1276 area.

Down in the 1242 level, we have the first minor support, which the bears have to overcome. A break down below 1242 could lead to a test of the support in the 1239/7 zone. If the market drops through 1239/7 then it is likely that the market will have a tendency to visit the 1231/29 area where the Kijun-sen (twenty six-period moving average, green line) sits on the daily chart.