Gold prices fell $4.06 on Tuesday, extending their losses to a second straight session, as investors grew more confident that the Federal Reserve could raise interest rates as early as this month. The XAU/USD pair traded as low as $1247.66 an ounce after hawkish comments from New York Federal Reserve President William Dudley pushed the dollar higher. Dudley said “I think the case for monetary policy tightening has become a lot more compelling”. A day earlier, Dallas Fed President Robert Kaplan reiterated his view that policy makers should move “sooner rather than later” to avoid falling behind the curve on inflation.

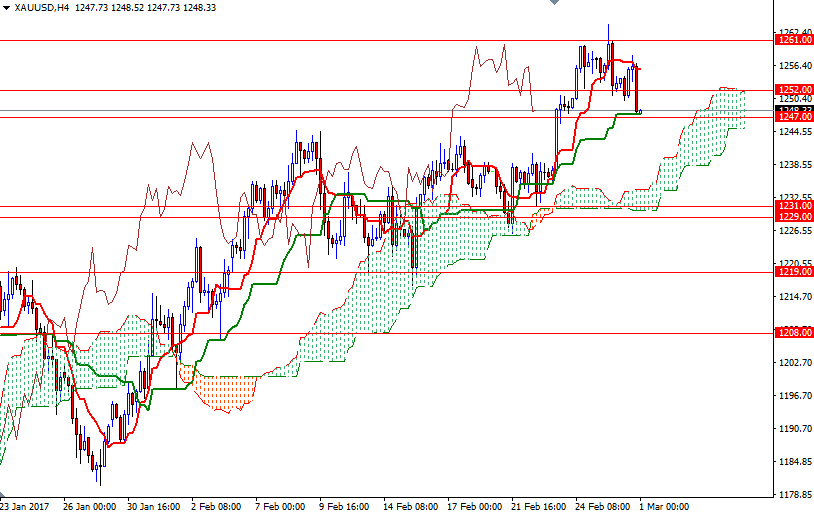

XAU/USD is testing the support in the 1247/6 area in early Asian session. Although the market ended the day above this minor support, the risk of a move towards 1243/2 remains high, unless prices climb back above 1252/0. Trading below the Ichimoku clouds on the M30 and H1 time frames also supports this theory. The 1243/2 area is the first strategic camp for the bears to capture if they intend to challenge the bulls on the 1238/5 battle field. Diving through 1238/5 would indicate that 1231/29 will be the next stop.

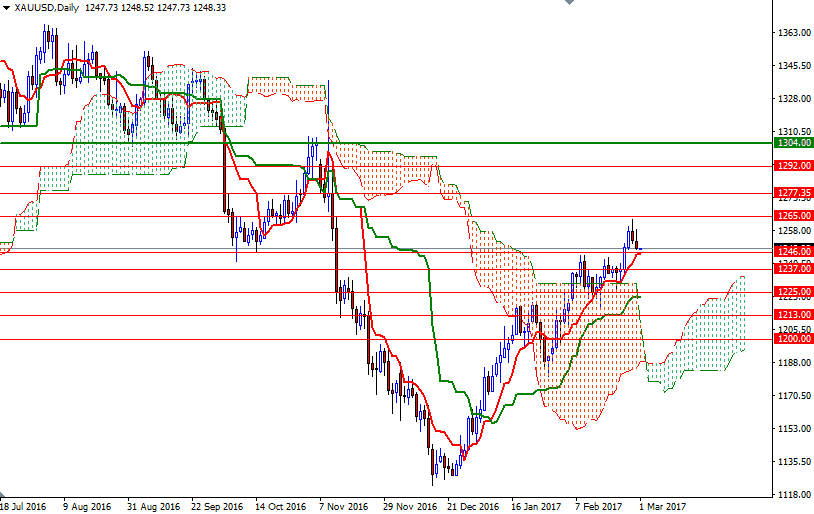

On the other hand, if the bulls manage to defend the aforementioned support (1243/2) and push prices beyond 1252, then 1258 and 1261 may be the next targets. Since a break up above 1261 would cause short-term charts to realign with the 4-hourly and daily charts, we might see a push up to the 1265 level. A daily close beyond 1265 would prolong the bullish momentum and open a path to 1277.35-1275.