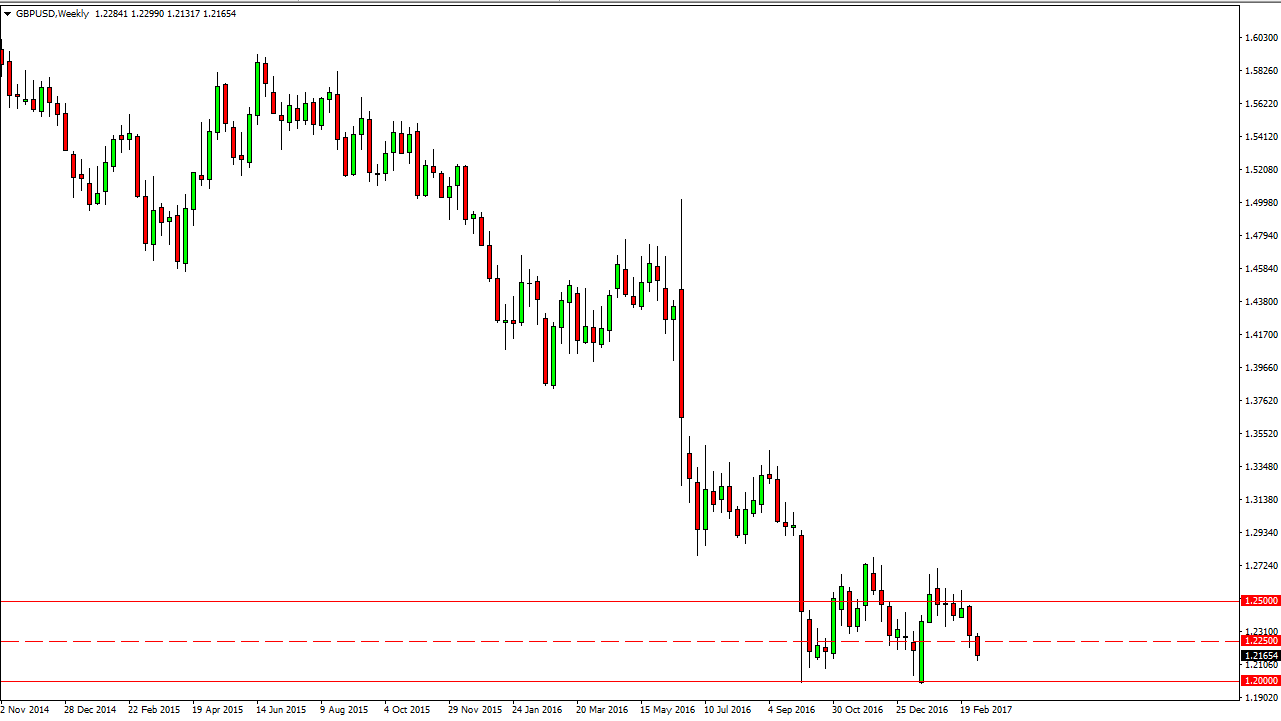

GBP/USD

The British pound had a negative week, breaking below the 1.2250 level. I think that rallies at this point are to be sold, as we should then reach towards the 1.2050 level. I believe that there should be plenty of support in that area, however I also believe that the Article 50 being triggered in the near-term will be the absolute worst-case scenario for the British pound. Alternately though, I think that will be the end of the bearish pressure.

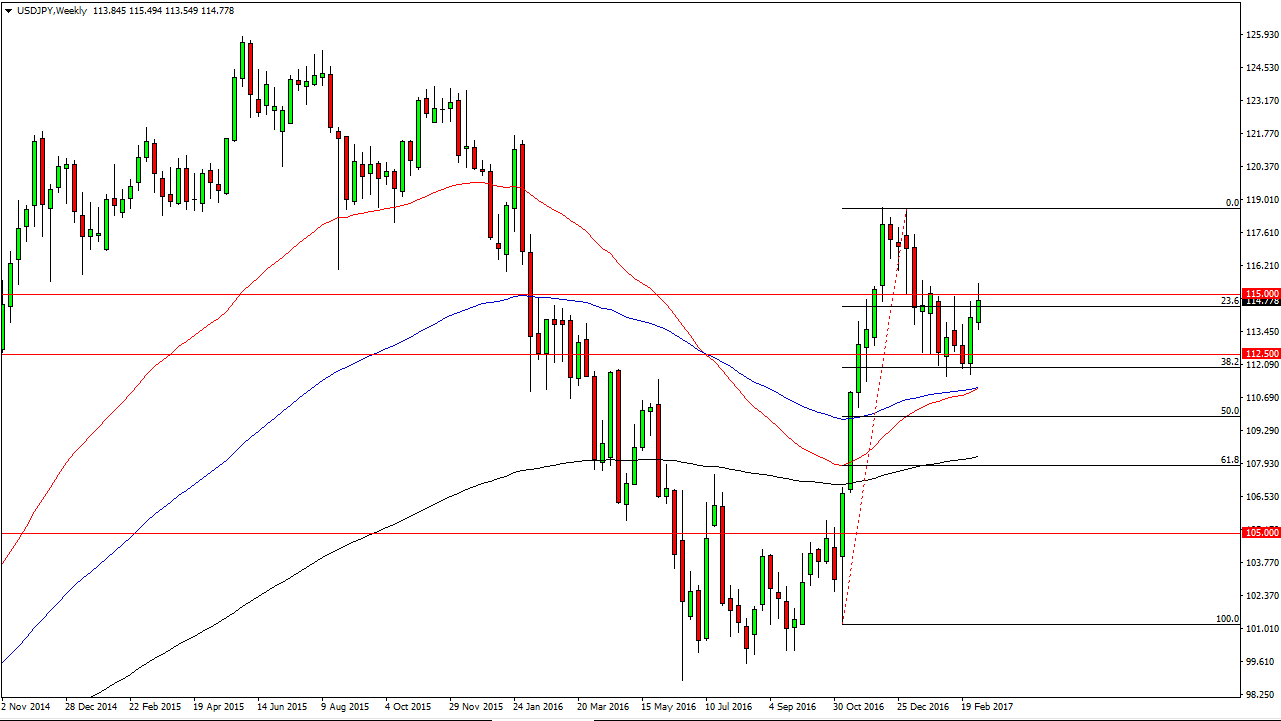

USD/JPY

The US dollar rallied against the Japanese yen most of the week, and even broke above the 115 level during the day on Friday. However, Friday ended up forming a shooting star so I think we are going to get a pull back. Alternately though, I do think that we continue to go much higher, perhaps reaching towards the 118.50 level.

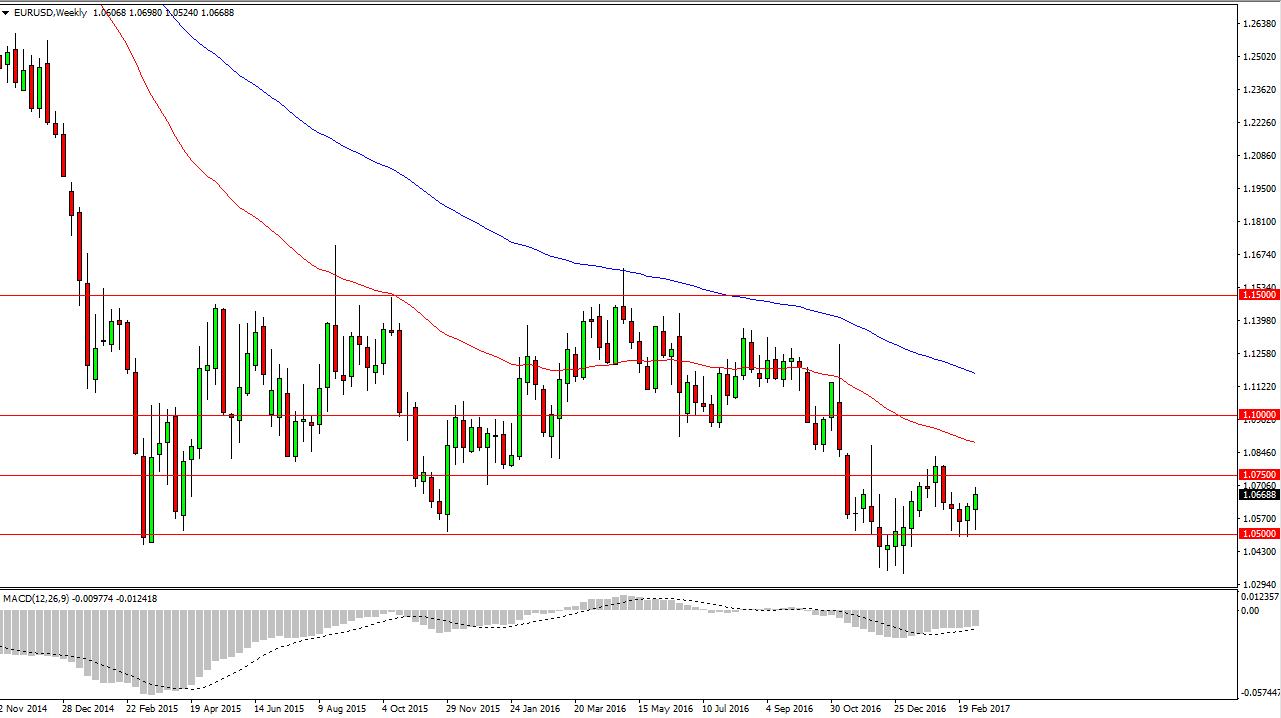

EUR/USD

The EUR/USD pair rallied after initially falling during the week, as the 1.05 level has continue to offer significant support. I think that the market will then reach to the 1.0750 level, and perhaps even higher. In short, I believe that initially we will see bullish pressure, but eventually the sellers will return.

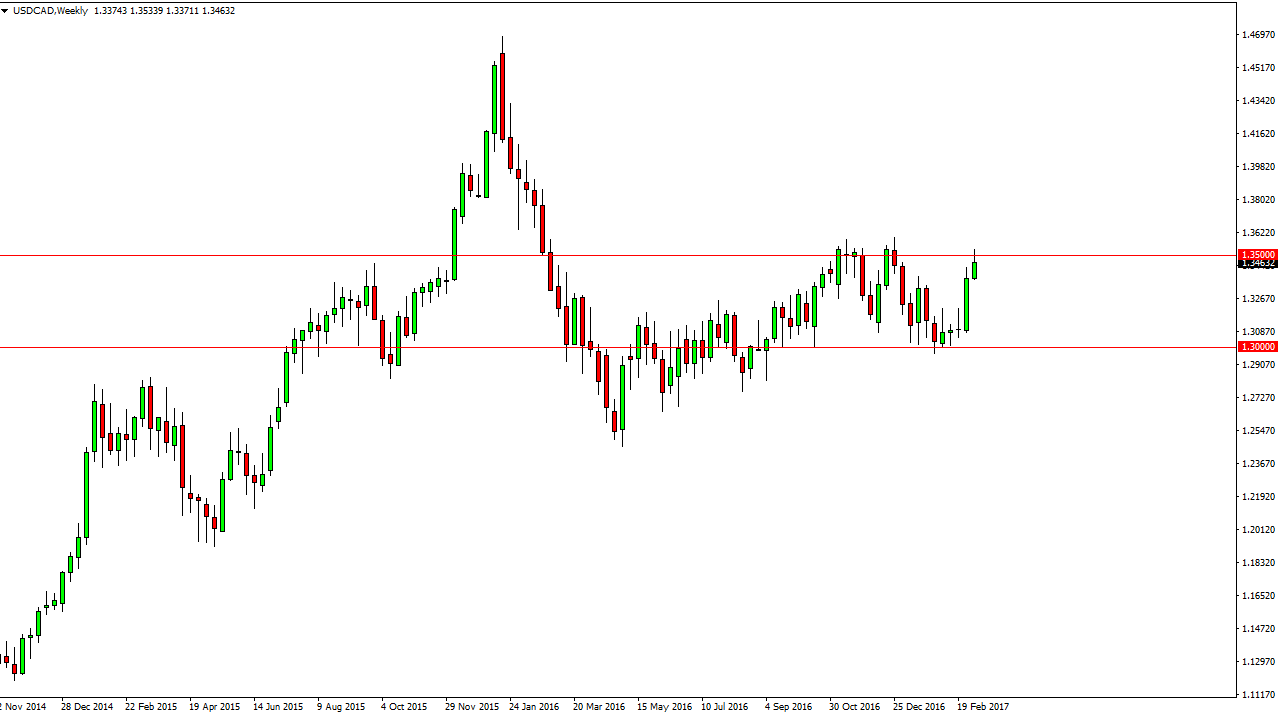

USD/CAD

The USD/CAD pair rallied during the week, reaching towards the 1.35 level. However, we did pull back slightly so I think that it’s only a matter of time before we break out above the highs of the week, and more importantly the 1.36 handle. Once we get above there, the market should continue to go much higher, perhaps the 1.45 level. I think this week will be slightly negative in the beginning, but eventually we should see increased momentum to the upside.