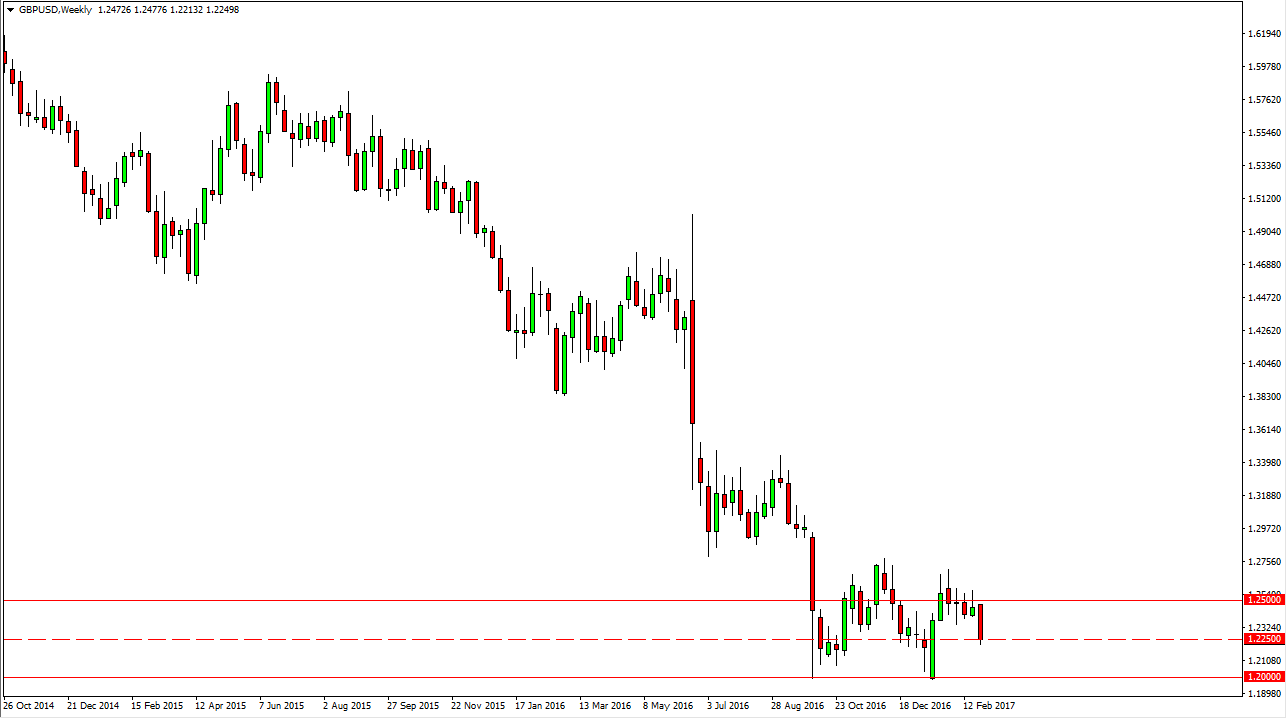

GBP/USD

The GBP/USD pair fell during the week, reaching towards the 1.2250 level. That’s an area that has been minor support and resistance recently, so we could bounce. The Friday candle was a hammer so I think we will more than likely see a little bit of a bounce towards the 1.24 level. Alternately, if we break down below the bottom of the range for Friday, then the market should go towards the 1.2050 handle.

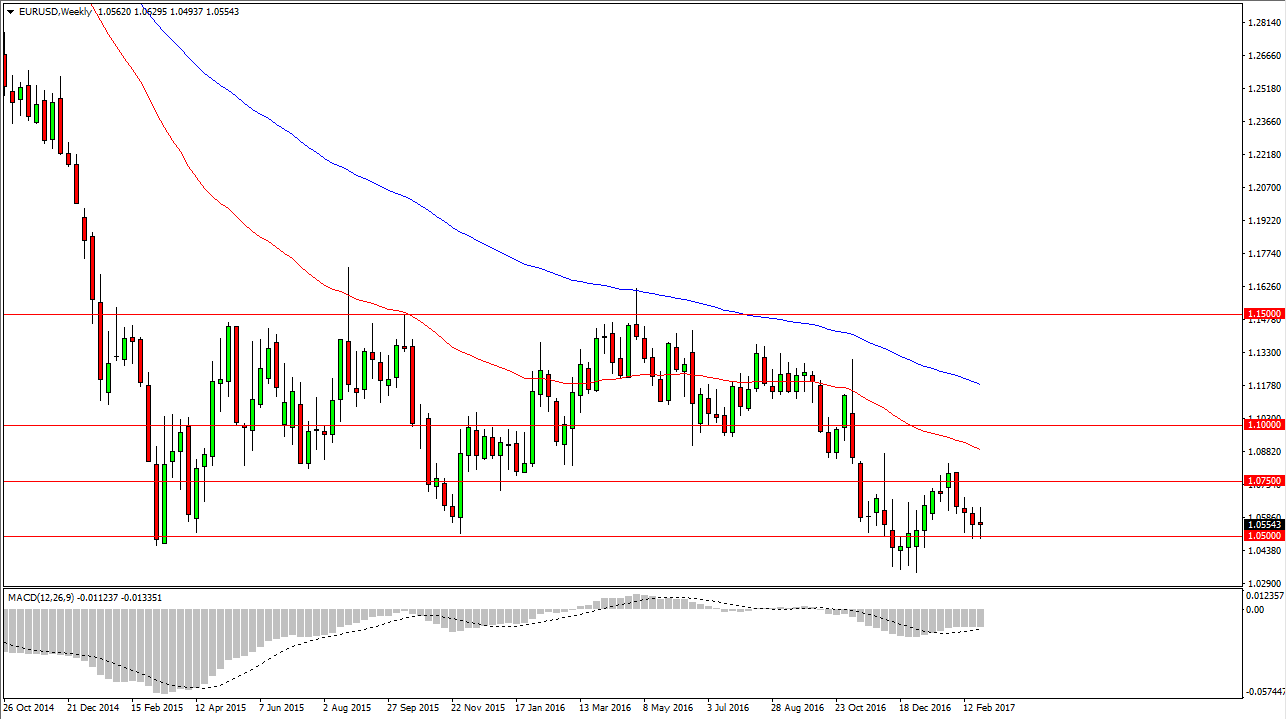

EUR/USD

The EUR/USD pair went back and forth during the week, showing quite a bit of choppiness. The 1.05 level underneath continues to be supportive, so if we can break down below there I think that the market should then reach to the 1.0350 level. Rallies at this point should continue to be resistive, and I believe in the longer-term negative story.

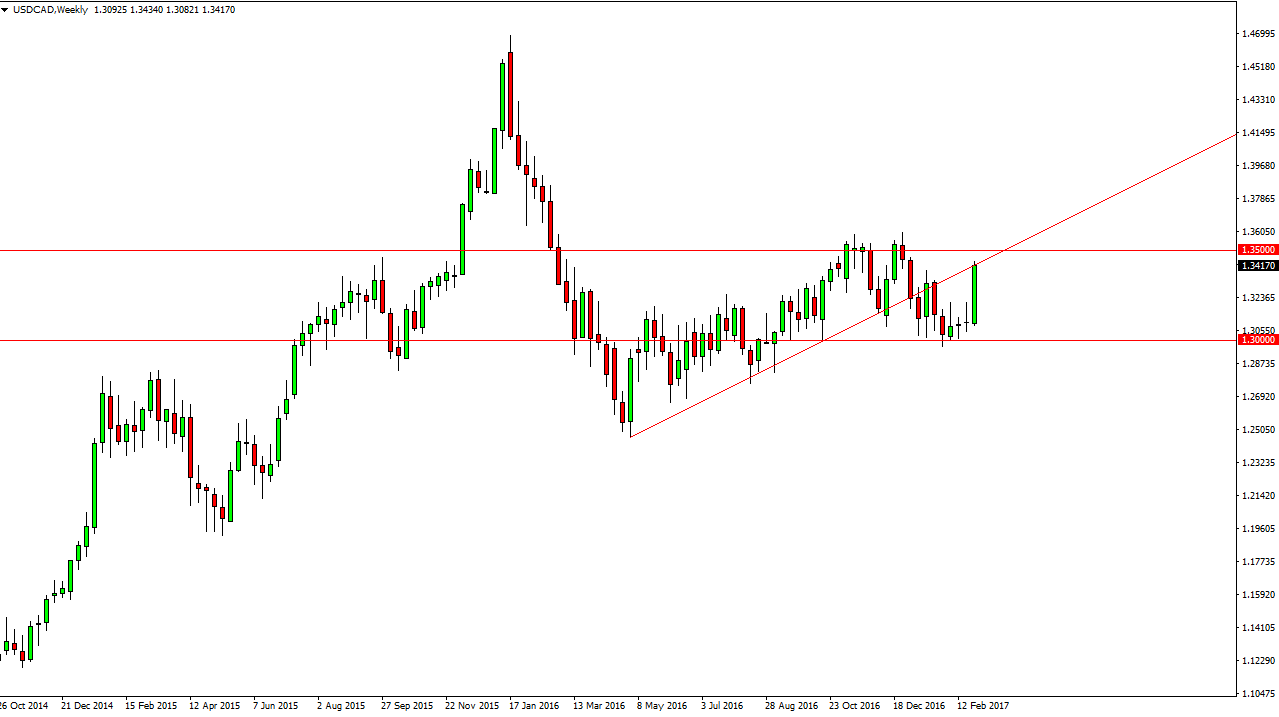

USD/CAD

The USD/CAD pair rallied during the week, testing the bottom of the previous uptrend line. Because of this, if we can break above the 1.35 level, I believe that the market should continue to go much higher. Ultimately, I think that if we pull back and will only attract more buyers as this market looks very healthy. If oil falls, that should only help.

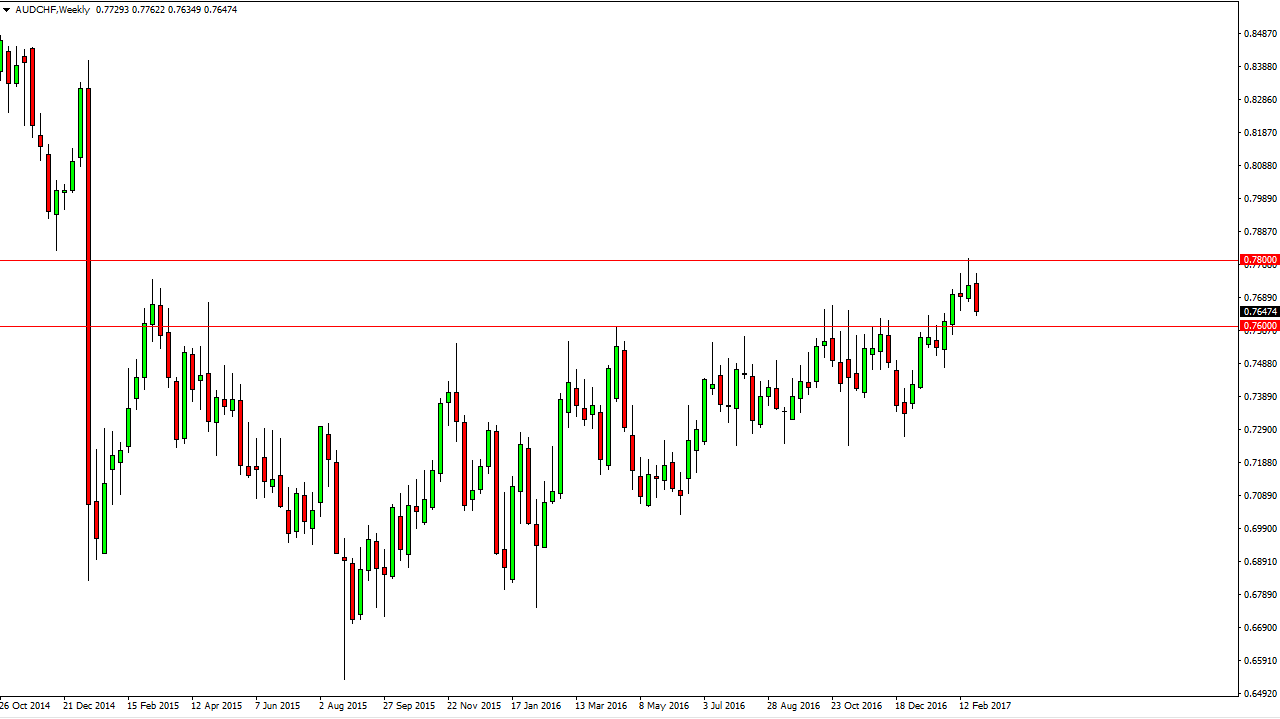

AUD/CHF

The AUD/CHF pair rolled over during the week, but I think that were going to see quite a bit of support at the 0.70 level. If we can find a bounce from there, I’m willing to go long as the market should reach towards the 0.78 level. If we can break above there, the market then continues to go even higher.