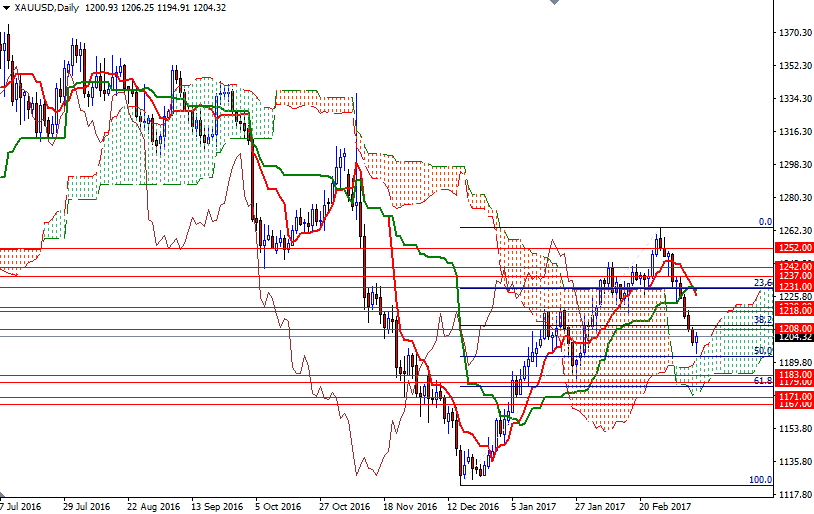

Gold prices settled at $1204.32 an ounce, falling 2.32% over the course of the week, as pressure from a stronger dollar weighed on investor appetite for the precious metal. The XAU/USD pair initially tried to move higher but came under fresh selling pressure at around the anticipated $1237 resistance level. Gold extended its losses after prices pierced below a support in the $1219/7 region and dipped to a low of $1194.91, a level last seen on January 31, before climbing back above the $1200-1198 area. Friday’s data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 133685 contracts, from 163798 a week earlier.

Gold has been suffering for some time as improvement in U.S. data cleared the way for the Federal Reserve to raise short-term interest rates. In one of her recent speeches, Fed Chair Janet Yellen stated “The economy has essentially met the employment portion of our mandate and inflation is moving closer to our 2% objective”. It seems that higher interest rates in the United States and a renewed appetite for riskier assets will continue to work against gold in the near-term but inflation, political uncertainties and overvalued equities should be positive for the metal over the medium-term.

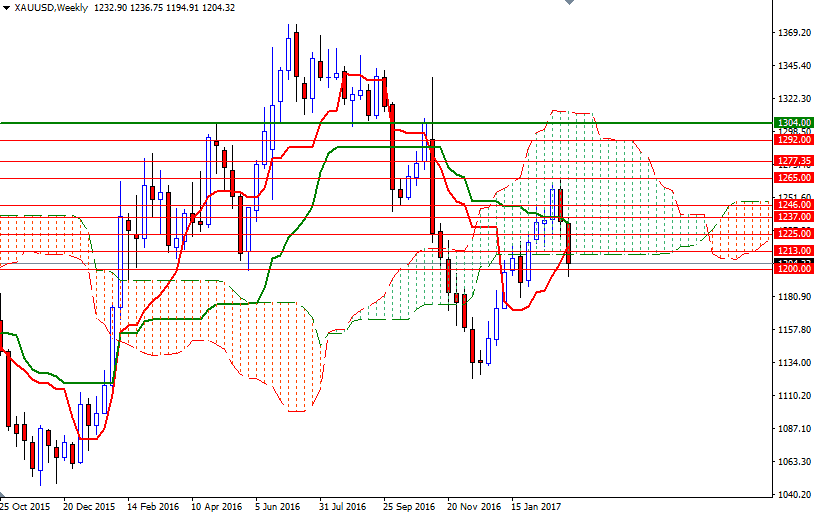

On the weekly and 4-hourly charts, the XAU/USD pair is currently residing below the Ichimoku clouds and this suggests that the bears currently remain in control. However, gold’s reaction following February’s non-farm payrolls report, which showed that the economy added 235K jobs last month, indicates that the specter of an imminent rate hike may have been priced into the market, at least to a degree. Down below, there is a key support at around the 1193 level, which represents the 50% retracement of the bullish run from 1122.63 to 1263.84. The top of the daily cloud also sits in the same area so the market has to get down below 1193/1 in order to continue to the downside and test 1183 and 1179/6. Further weakness below 1176 could encourage a move towards 1171/67. On the other hand, if the daily cloud prevents the market from diving deeper and prices can pass through 1210/08, then 1214/3 may be the next stop. The bulls will have to overcome this barrier in order to set sail for 1220/18. Closing above 1220 on a daily basis would make me think that the market will proceed to 1226/5. If this resistance is broken, then the 1231 level could be the next port of call.