Gold prices settled at $1229.28 an ounce on Friday, scoring a gain of 2% on the week, as the dollar came under pressure after the U.S. Federal Reserve signaled it would raise interest rates more slowly than market players had initially thought. Since the first rate hike of 2017 is out of the way, the focus will shift to the timing of future rate increases and geopolitical risks. The U.S. economic calendar is relatively light this week but it will be full of Fed speakers.

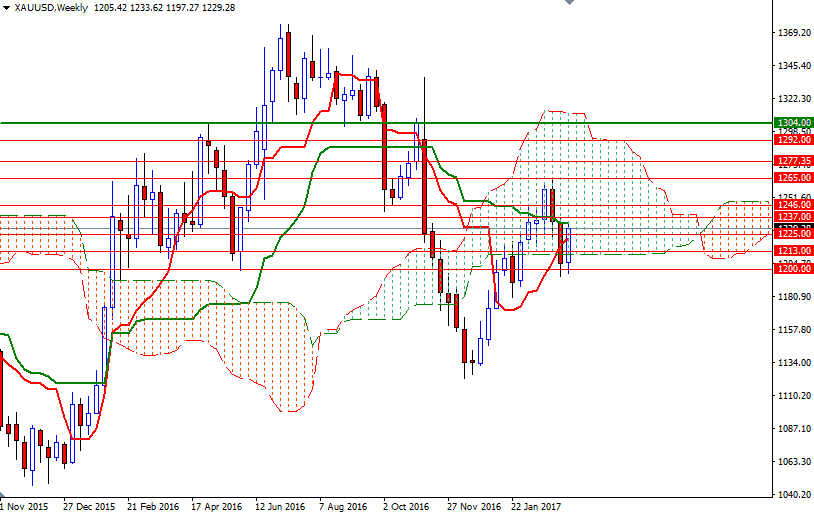

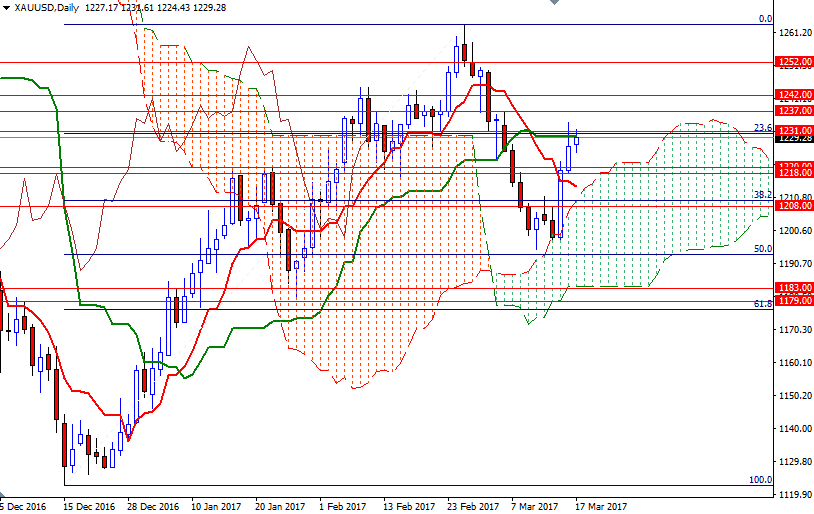

Last week’s strong bounce following the Fed's rate hike gave the bulls technical momentum they lacked previously, and pushed the XAU/USD pair above the Ichimoku clouds on the 4-hour time frame. Residing beyond both the daily and 4-hourly charts, along with the positive Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) crosses, suggests that there is still more room to the upside. Although the bulls have momentum on their side, they have to overcome the nearby resistance in the 1234/1 area. If the bulls remain in control and the market can pass through this barrier, which also represents the 23.6% retracement of the bullish run from 1122.63 to 1263.84, look for further upside with 1238/7 and 1246/2 as targets. Beyond there the first solid resistance is located in the 1252/0 zone. Closing above 1252, at least on a daily basis, is essential for a bullish continuation towards 1265/1.

However, if the aforementioned resistance in the 1234/1 region prevents the market from going higher and prices reverse, it is likely that we will visit the 1225 level. A break down below 1225 would indicate that the 1220/18 area might be the next port of call. The bears have to capture this initial key support so that they can have an opportunity to challenge the support in the 1214/3 zone. A successful break below 1213 could see a fall to 1210/08.