Gold ended the week down $22.99 at $1234.54, breaking a four-week winning streak, as an extreme shift in expectations of interest rate hikes weighed on the market. Two weeks ago, investors were pricing in a 20% chance of a rate hike; however, following hawkish comments from several Fed officials, the odds of an increase in rates this month climbed above 80%. Speaking to the Executives’ Club of Chicago, Federal Reserve Chair Janet Yellen said “Indeed, at our meeting later this month, the committee will evaluate whether employment and inflation are continuing to evolve in line with our expectations, in which case a further adjustment of the federal funds rate would likely be appropriate”.

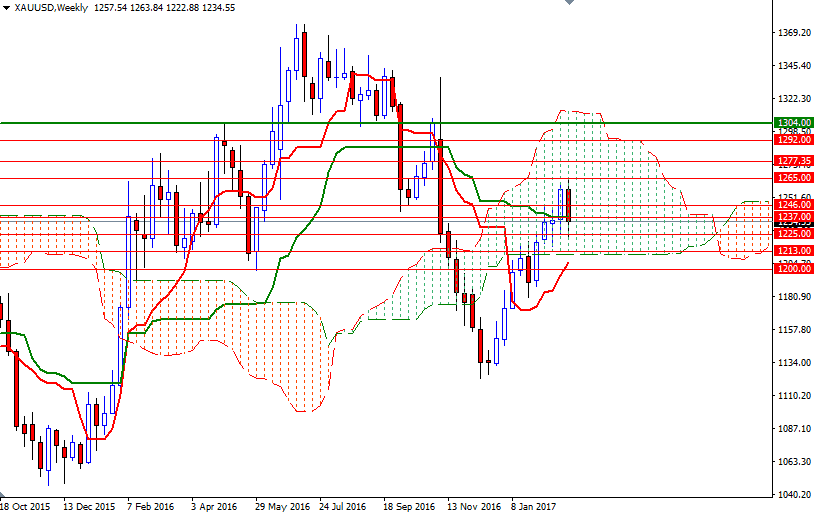

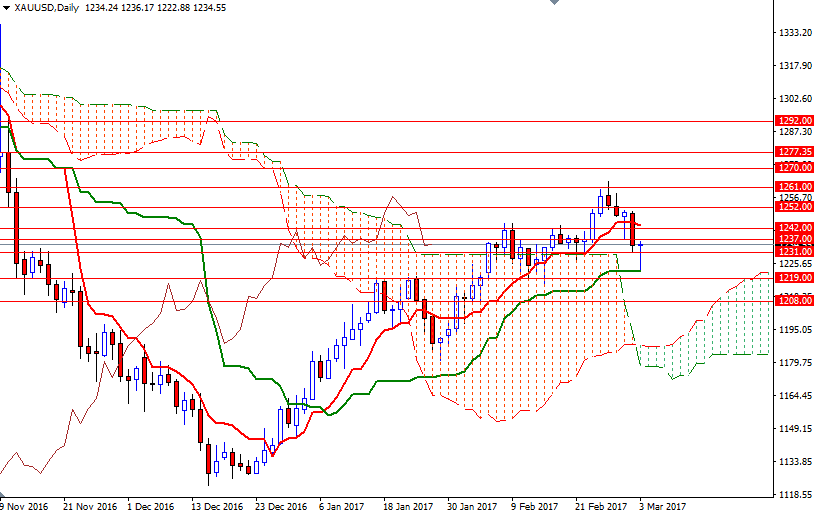

The February jobs report, which is scheduled to be released on March 10, could give the Federal Reserve the green light to raise rates this month. Just a week ago, after XAU/USD failed to penetrate the 1265/1 area, I had warned about the possibility of a pullback before gaining enough momentum to move towards the top of the weekly cloud. Trading above the Ichimoku clouds on the daily chart and positively aligned Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-period moving average, green line) lines suggest that the market has a tendency to go higher over the medium-term. The long lower shadow of Friday’s candle also indicates that the expectations are somewhat factored into the market.

To the upside, the initial resistance stands in the 1238/7 area. The XAU/USD pair has to push its way through 1238/7 in order to gain momentum and tackle the critical 1146/2 barrier. If the market can cleanly break above the 1246 level, then the 1252/0 zone could be the next target. Once beyond 1252, look for further upside with 1261 and 1265 as targets. Despite a medium-term positive outlook, residing below the 4-hourly cloud implies that the upside potential will be limited. Weekly bearish engulfing candle supports this view. If prices fall through 1231/29, the market will probably revisit the 1225 level. Down below, there is a strategic support in the 1219/7 region. So, we need to get down below there in order to continue to the downside and ultimately test the 1213/1 area, where the bottom of the weekly cloud sits.