Gold prices rose in Asian trade on Friday after the U.S. launched missile strikes against Syria. U.S. President Donald Trump said, “Tonight I call on all civilised nations to join us in seeking to end this slaughter and bloodshed in Syria and also to end terrorism of all kinds and all types.” Support from the heightened geopolitical tensions offset a better-than-expected reading on unemployment claims and helped the market to break through the resistance at $1261. XAU/USD traded as high as $1269.27 an ounce, the highest level November 11, before pulling back to the current levels.

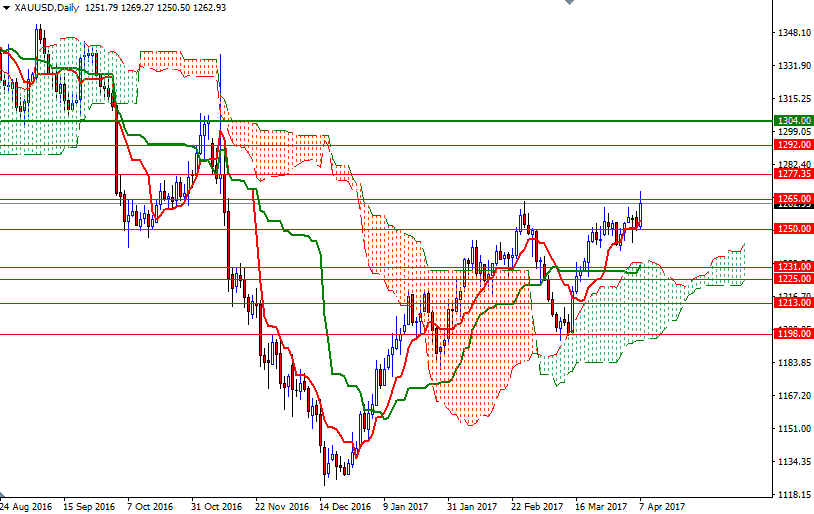

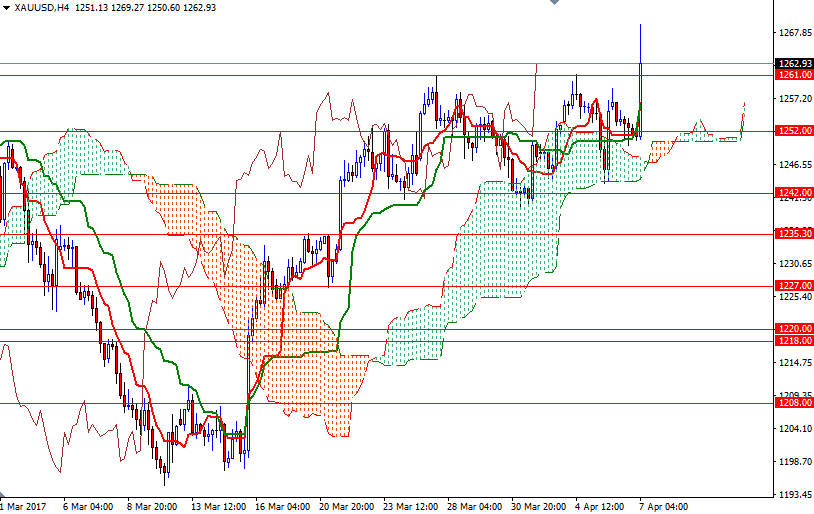

Geopolitical flare-ups usually provide the bulls new opportunities to push prices higher, but keep in mind that price gains solely based on demand for protection against volatility tend to be transitory. At this point, the bulls will need to hold the market above 1261 and push prices back above 1265 so that they can march towards 1277.35-1276. On its way up, an interim resistance can be found at around 1271.50.

However, if the bears increase pressure on the market and drag prices below 1261, we may return to the 1258/6 area. Below there, keep an eye on the 1252/0 zone where the 4-hourly Ihcimoku cloud currently resides. Eliminating this support 1242/39 could pave the way towards 1235.30.