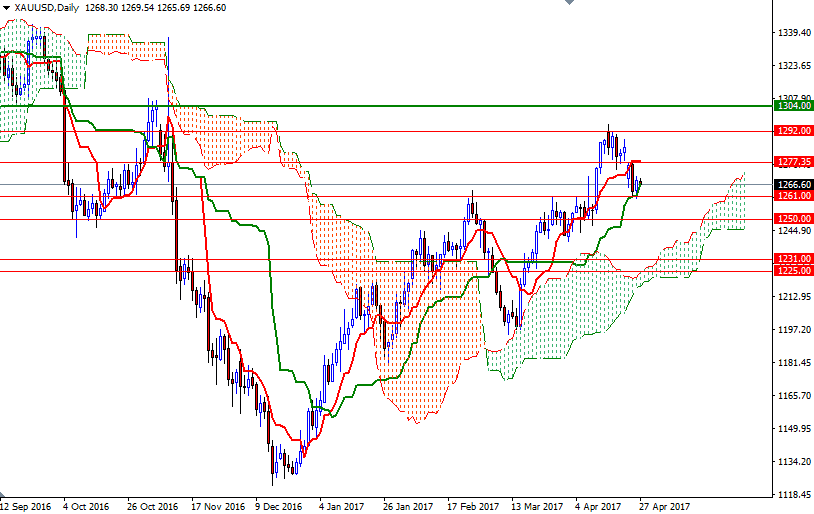

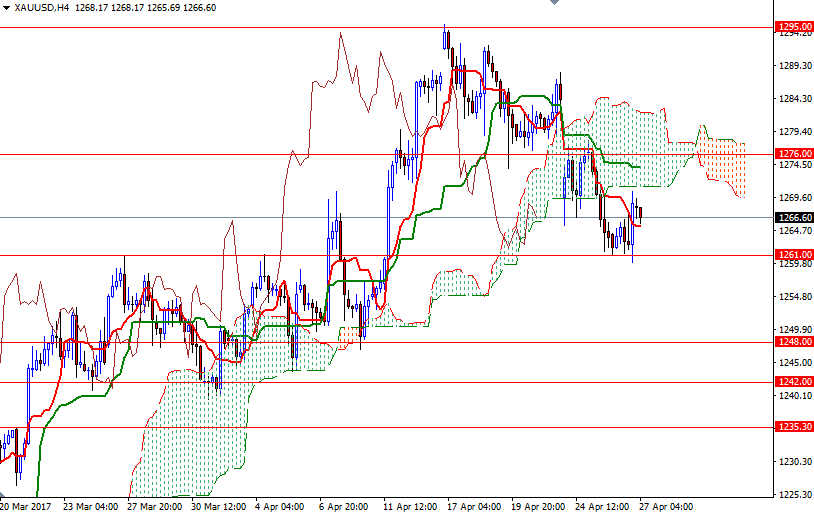

Gold rose on Wednesday, edging away from two-week lows reached in the previous session, as lower prices enticed buyers back to the market. The market’s focus is now on ECB’s monetary policy meeting. The key levels remain unchanged, as the market continues to consolidate between the daily Tenkan-sen (nine-period moving average, red line) and the daily Kijun-sen (twenty six-period moving average, green line).

The bulls still have the medium-term advantage but the short-term charts are slightly bearish at the moment. The first solid support at around 1261 remains intact, but the bulls have to push prices back above the 1270.60-1268.50 zone if they don’t to give up. In that case, they may find an opportunity to challenge the 1277.35-1276 resistance. Anchoring somewhere above the 4-hourly Ichimoku cloud could see a test of 1285.

However, if XAU/USD breaks down below 1261 and take out yesterday’s low, then the market will probably visit the 1257/5 area afterwards. Below there, the 1250/48 zone stands out and the bears will have to demolish this significant support so that they can march towards 1242.