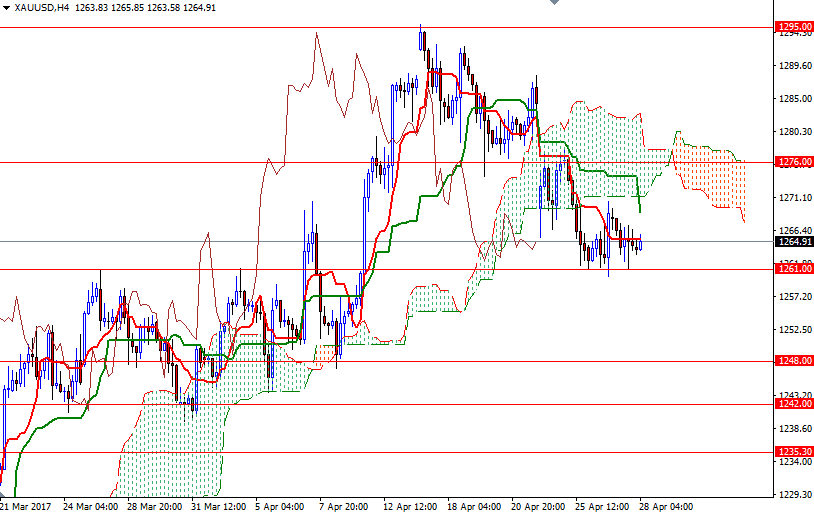

Gold edged lower on Thursday, giving up the gains made in the previous session, as the dollar strengthened after comments from European Central Bank President Mario Draghi weakened the euro. The precious metal is trading at $1264.91, slightly higher than the opening price of $1264.11 but remains within the trading range of the past two days.

From a chart perspective, trading below the 4-hourly Ichimoku cloud, along with the negatively aligned Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line), implies that the short-term downside risks remain.

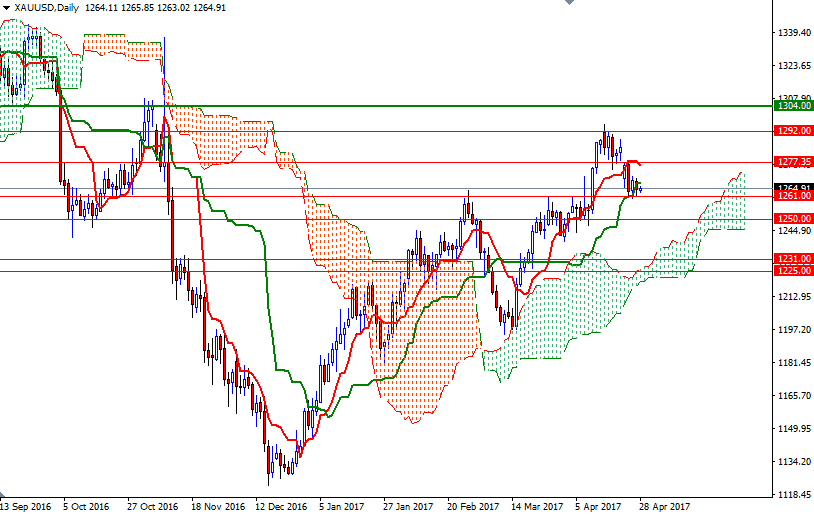

Technically, Ichimoku clouds not only identify the trend but also represent support and resistance zones. The thickness of the cloud is relevant, as it is more difficult for prices to break through a thick cloud than a thin cloud. The bulls have managed to defend their camp at the 1261 level so far, but they still need to lift prices above the 1277.35-1276 area so that they can take the reins and proceed to 1285. However, if the support at 1261 is broken, it is likely that we will visit the 1257/5 area. The bears will have to overcome this barrier in order to set sail for 1250/48.