By: DailyForex

This week we’ll begin with our monthly and weekly forecasts of the currency pairs worth watching. The first part of our forecast is based upon our research of the past 11 years of Forex prices, which show that the following methodologies have all produced profitable results:

- Trading the two currencies that are trending the most strongly over the past 3 months.

- Assuming that trends are usually ready to reverse after 12 months.

- Trading against very strong counter-trend movements by currency pairs made during the previous week.

- Buying currencies with high interest rates and selling currencies with low interest rates.

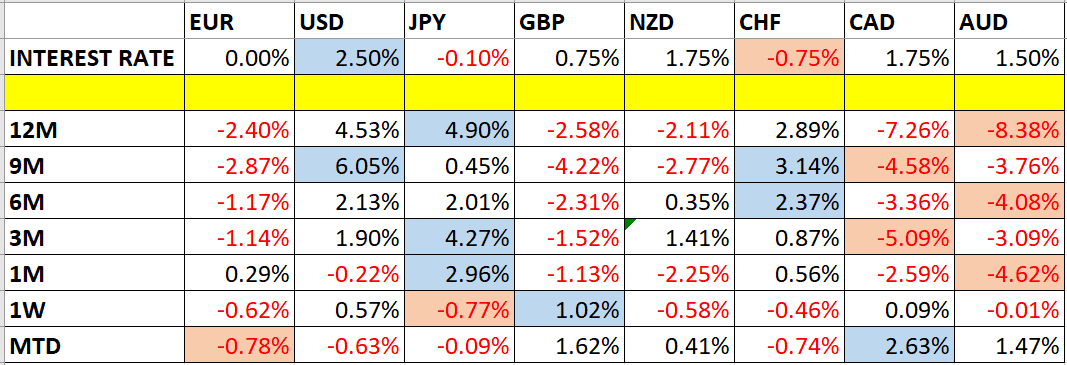

Let’s take a look at the relevant data of currency price changes and interest rates to date, which we compiled using a trade-weighted index of the major global currencies:

Monthly Forecast April 2016

This month we forecast that the highest-probability trades will be long GBP/USD and short USD/JPY.

Weekly Forecast 2nd April 2017

Last week, we forecasted that the AUD/JPY currency cross would rise in value. It did so, by 0.14%.

This week, we make no forecast, as there were no strong counter-trend movements.

This week has been dominated by relative strength in the British Pound, and relative weakness in the Euro.

Volatility was slightly higher than last week, with only one third of the major and minor currency pairs changing in value by more than 1%. Volatility is likely to be higher still over this coming week.

You can trade our forecasts in a real or demo Forex brokerage account.

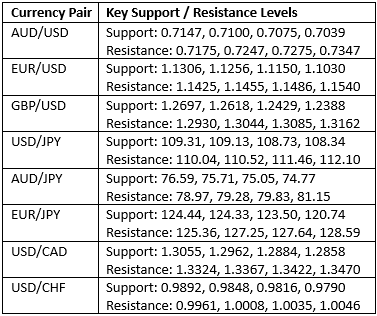

Key Support/Resistance Levels for Popular Pairs

We teach that trades should be entered and exited at or very close to key support and resistance levels. There are certain key support and resistance levels that should be watched on the more popular currency pairs this week, which might result in either reversals or breakouts:

Let’s see how trading two of these key pairs last week off key support and resistance levels could have worked out:

GBP/USD

We had expected the level at 1.2610 might act as resistance, as it had acted previously as both support and resistance. Note how these “flipping” levels can work well. The H1 chart below shows the how the price hit this level early during the New York session last Monday, which can be a great time of day for entries in this currency pair. Entry was signaled by the bearish outside candle which formed immediately after the price was hit, marked by the down arrow within the chart below. This short trade has given an excellent maximum reward to risk ratio of more than 7 to 1 to date, if the stop had been placed just above the swing high at the entry candlestick.

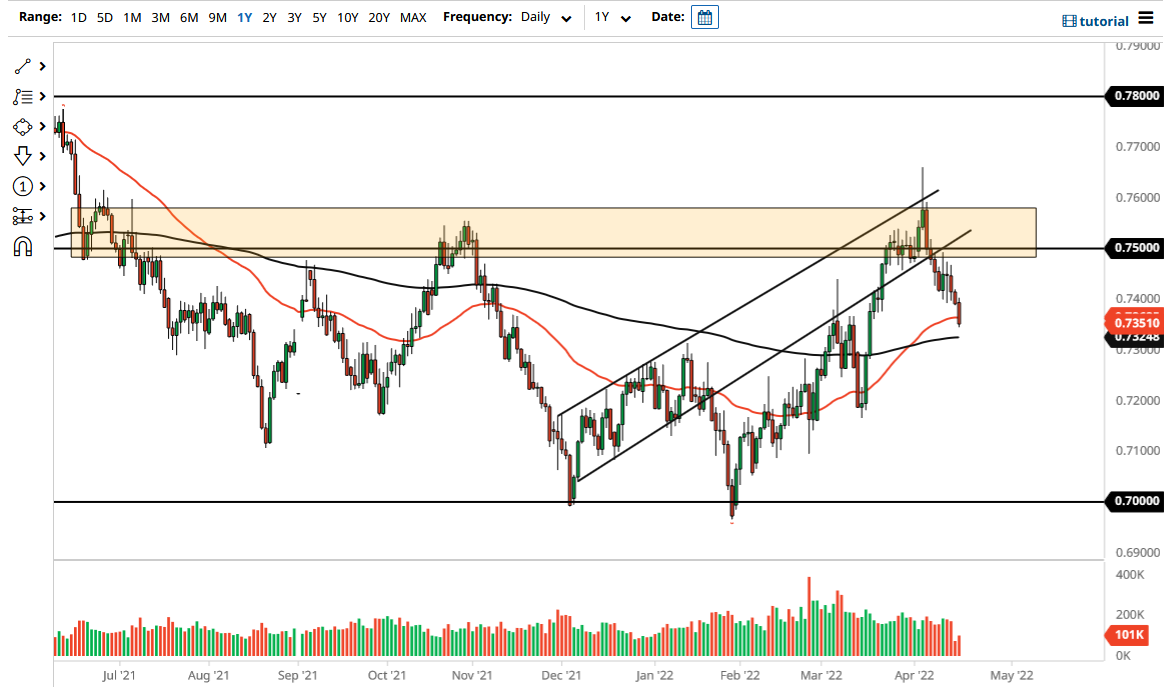

AUD/USD

We had expected the level at 0.7588 might act as support, as it had acted previously as both support and resistance. Note how these “flipping” levels can work well. The H1 chart below shows the how the price hit this level early during the London session last Tuesday, which can be a great time for entries in this currency pair. Entry was signaled by the bullish inside candle which formed immediately after the price was hit, marked by the up arrow within the chart below. This long trade has given an excellent maximum reward to risk ratio of more than 4 to 1 to date, if the stop had been placed just below the swing low at the entry candlestick.

That’s all for now. Our next newsletter will be coming to you next week, on Sunday 9th April.

You can trade our forecasts in a real or demo Forex brokerage account.

Adam Lemon

Chief Instructor

FX Academy