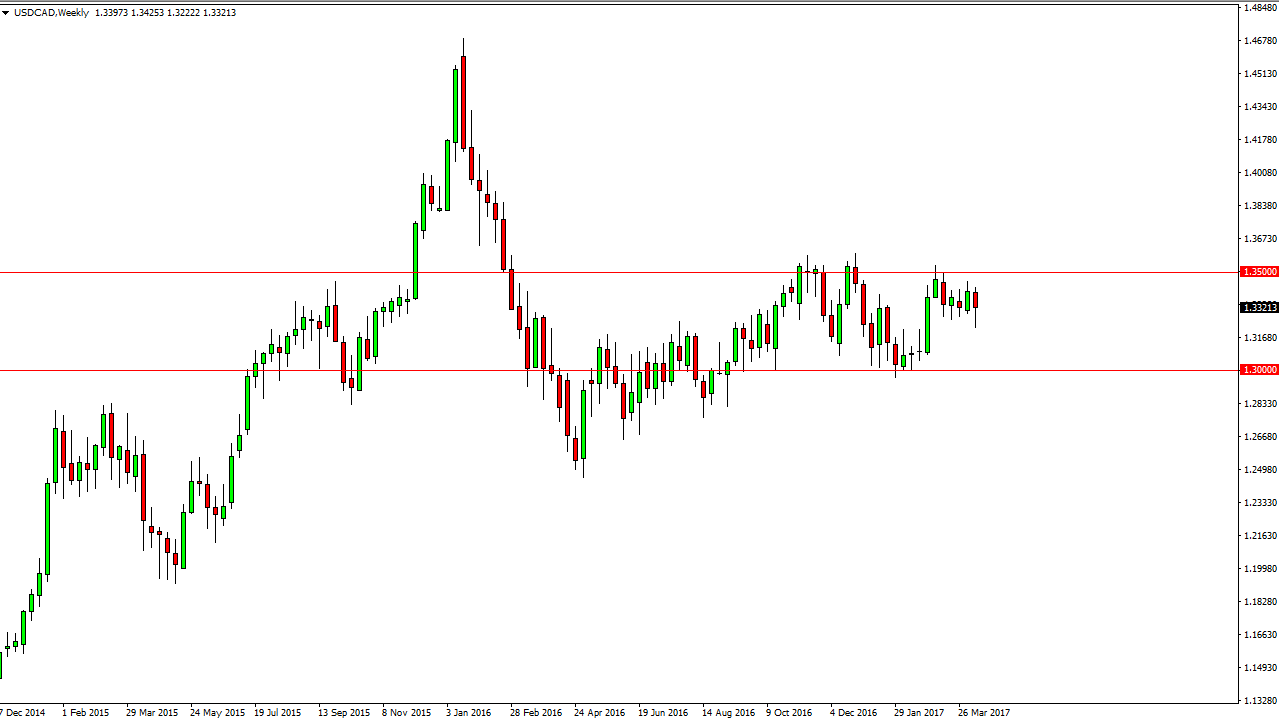

USD/CAD

The USD/CAD pair fell during the week, but turned around to form a hammer. As you can see, it looks very bullish, but the 1.36 level above is massively resistive. I think if we can break above there, this pair will take off to the upside. If the oil markets roll over, and they look like they’re getting ready to for the short-term, we should see positive pressure.

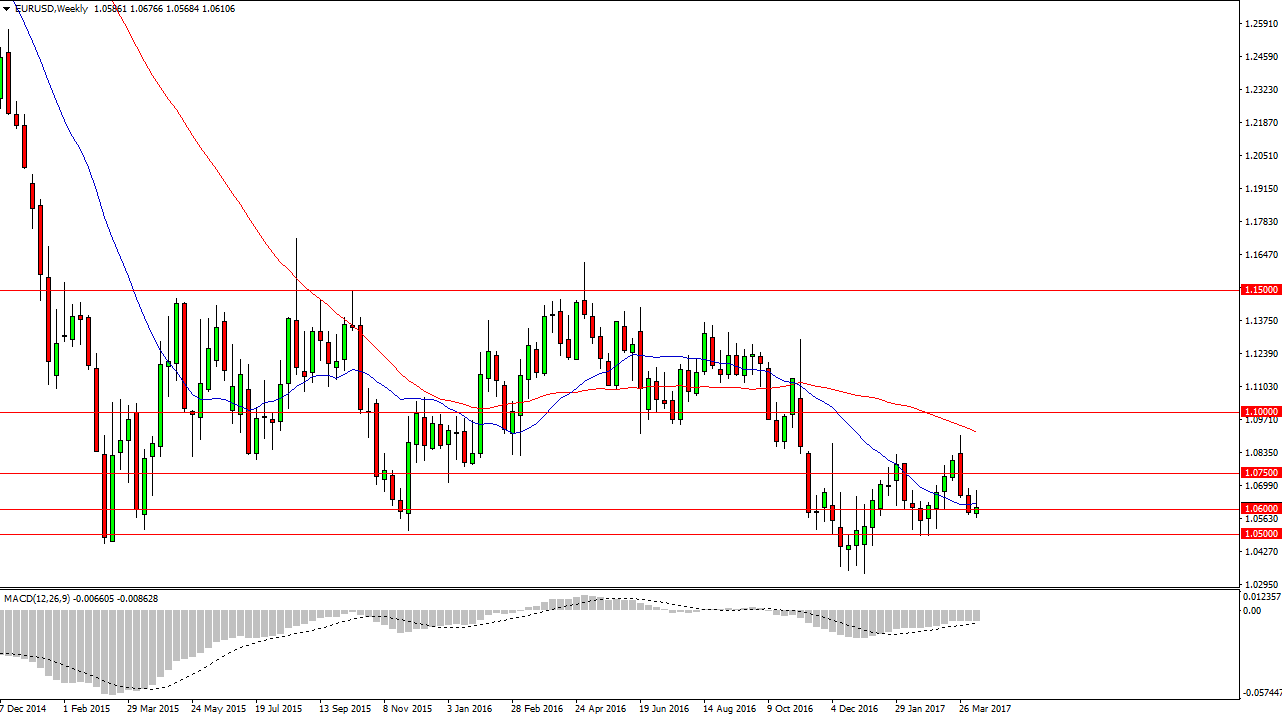

EUR/USD

The EUR/USD pair initially tried to rally during the week, but found enough resistance at the 1.07 level to turn things around and form a shooting star. The shooting star suggests to me that we are going to continue to go lower, perhaps reaching towards the 1.05 level. I think that the market will continue to show bearish pressure as it looks like we are going to have a “risk off” week.

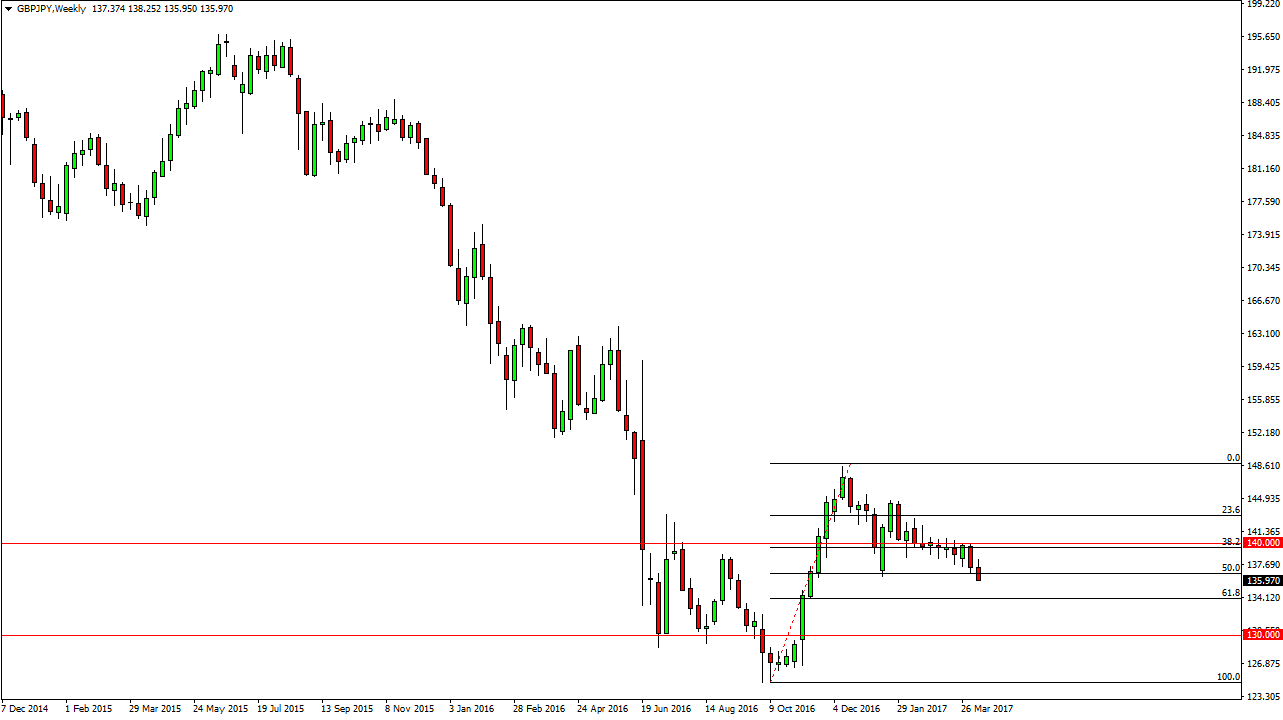

GBP/JPY

The British pound broke below the 50% Fibonacci retracement level against the Japanese yen, which is most certainly a negative sign. I think the market is going to reach towards the 61.8% Fibonacci retracement level underneath, which has a target of roughly 134. This goes in line with a “risk off” week, as this pair is highly sensitive to risk appetite.

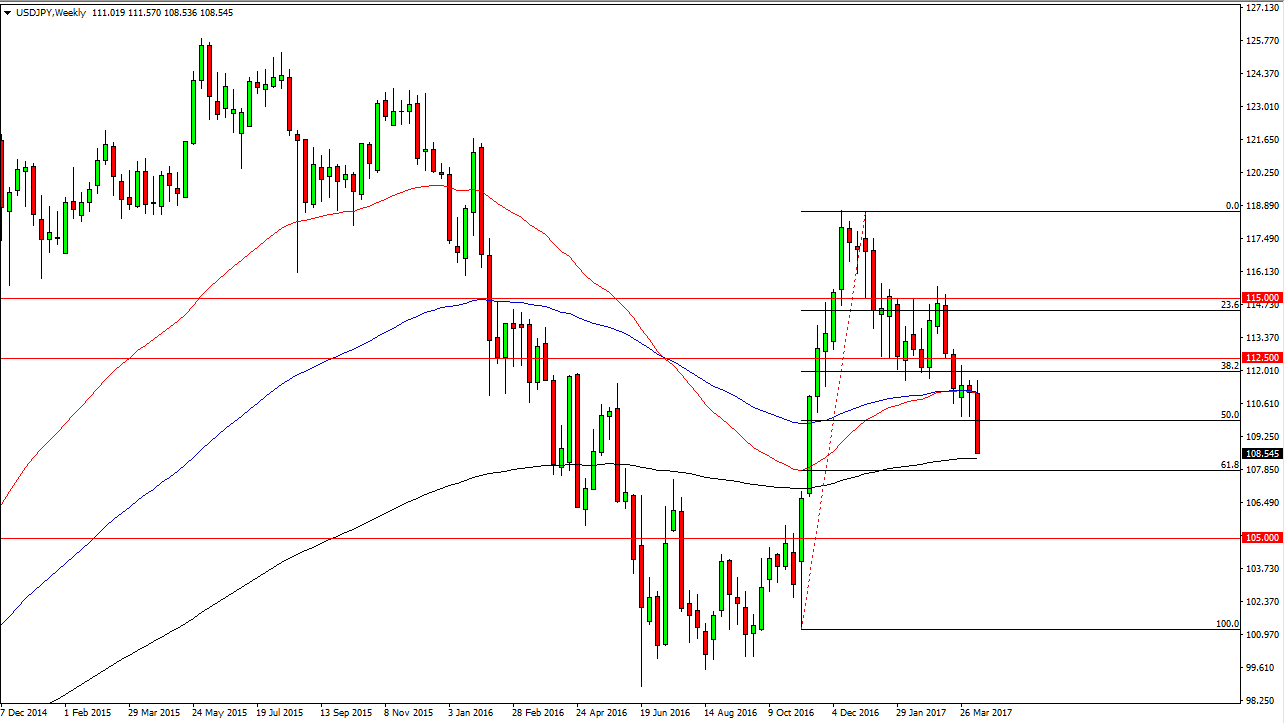

USD/JPY

The US dollar fell against the Japanese yen, and close out the week at the absolute lows. Typically, this means continuation so I look at rallies as selling opportunities as we should now find this market looking for the 108 level below, which is the 61.8% Fibonacci retracement level.