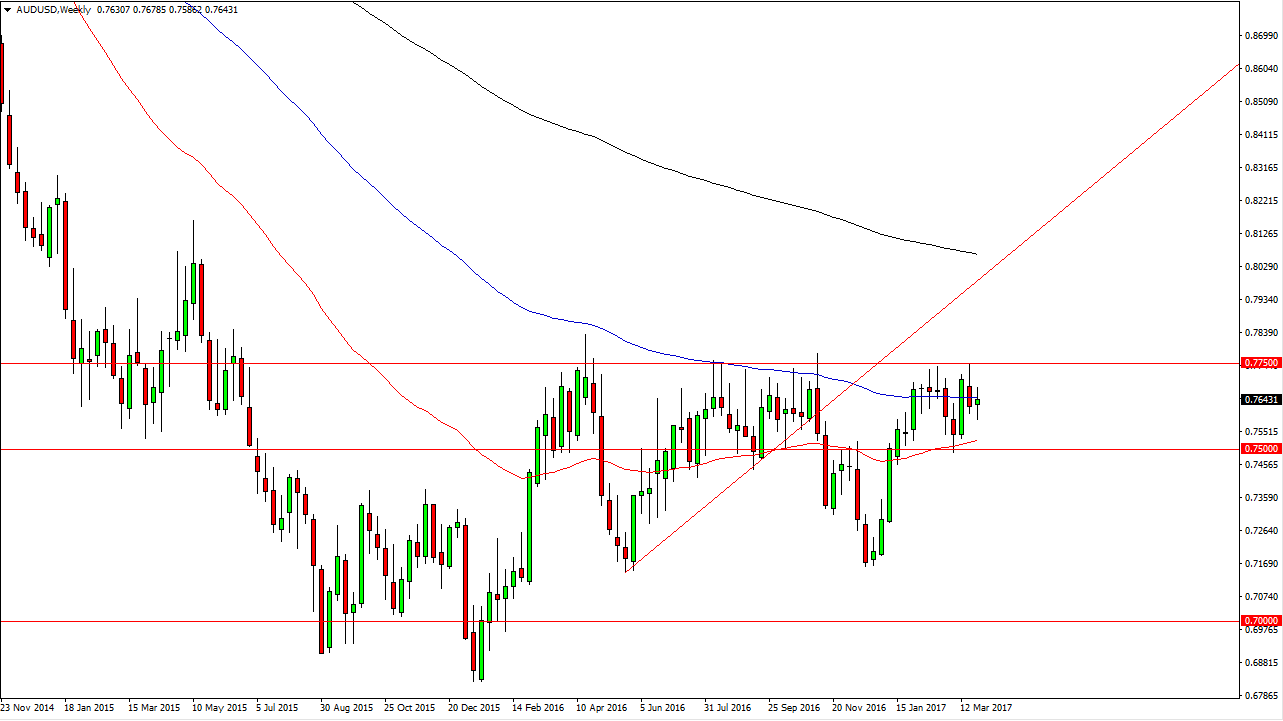

AUD/USD

The Australian dollar had a very volatile week, going back and forth quite rapidly. The most important thing to think about what the Australian dollar is the gold markets and how they are trying to break above significant resistance at the $1260 area. If we get that, this market should intern break above the 0.7750 level, sending this market to the 0.80 level above.

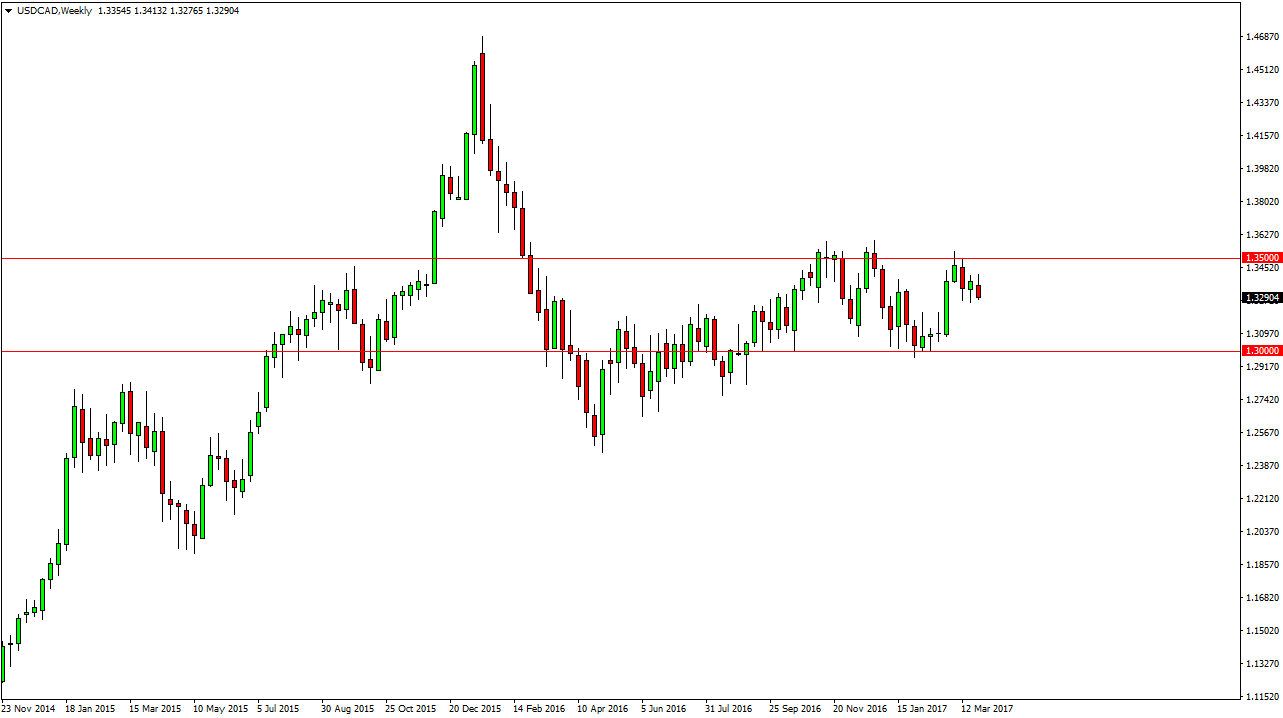

USD/CAD

The USD/CAD pair initially tried to rally during the week, but turned around to form a negative candle. This was due to the WTI Crude Oil market breaking above the $50 handle on Thursday. Because of this, if we can continue to rally in the oil markets, this pair should drop towards the 1.30 level underneath.

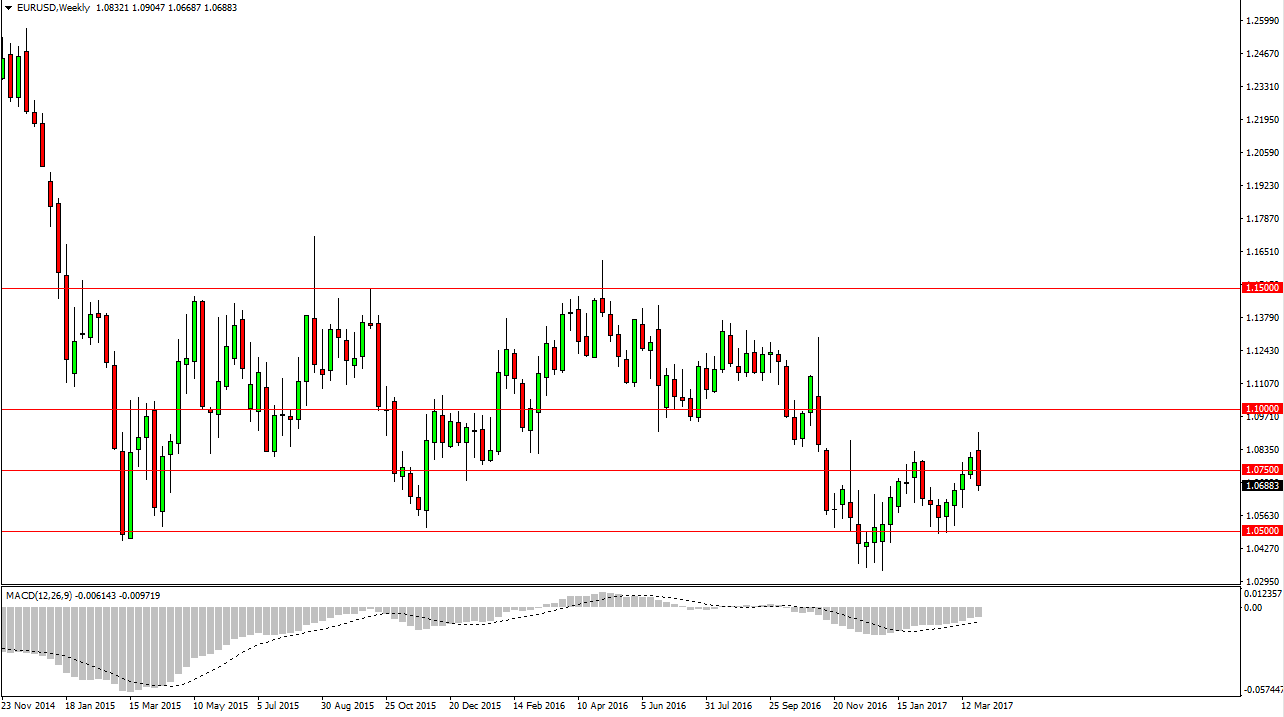

EUR/USD

The EUR/USD pair initially tried to rally during the week but found quite a bit of resistance and ended up dropping significantly. The 1.07 level offered support, at least for the short term but it looks as if we could go lower from here. At this point, I’m expecting the market to find the 1.05 level underneath to be massively supportive. Expect quite a bit of volatility in this pair, as the European Union deals with the United Kingdom leaving.

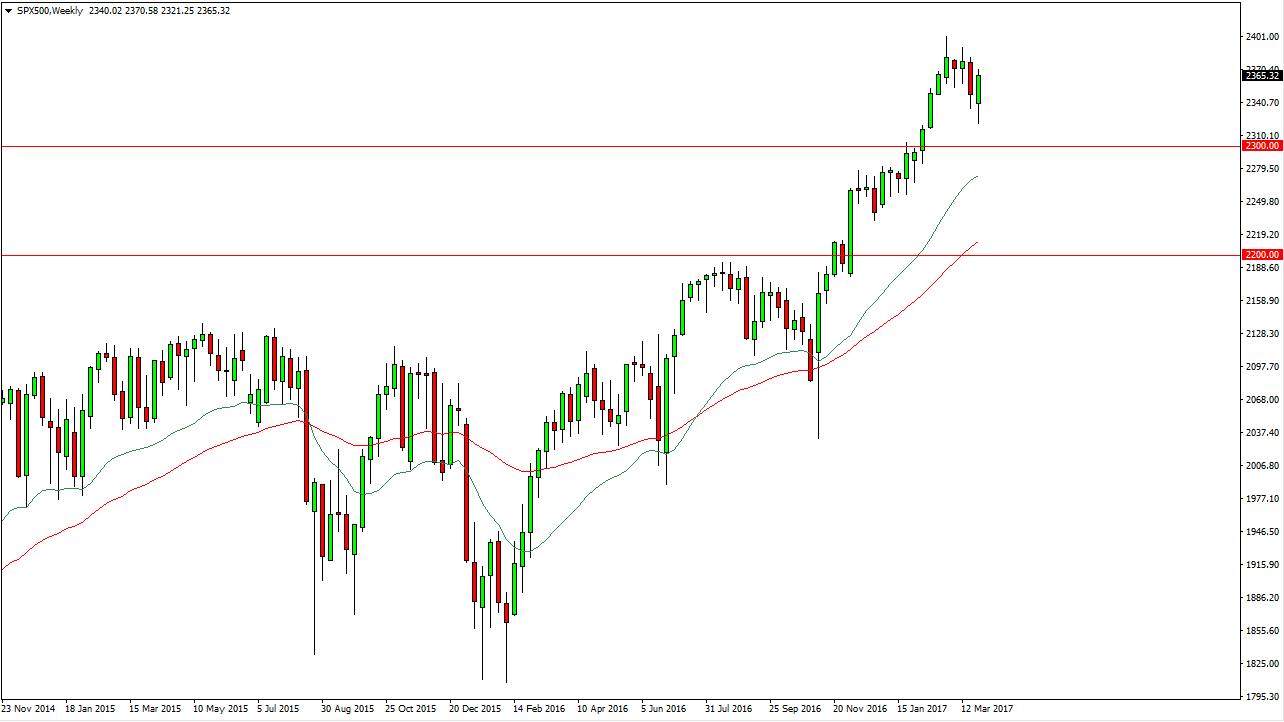

S&P 500

The S&P 500 initially fell during the week but turned around to form a very positive candle. If we can break out to the upside, I think that the market will test the 2400 level, and then eventually break above there. I still believe that the 2300 level underneath should continue to be a bit of a “floor” in this market, as we have been in a very strong uptrend for quite some time. I have a longer-term target of 2500, but I recognize that there will more than likely be quite a bit of choppiness between here and there.