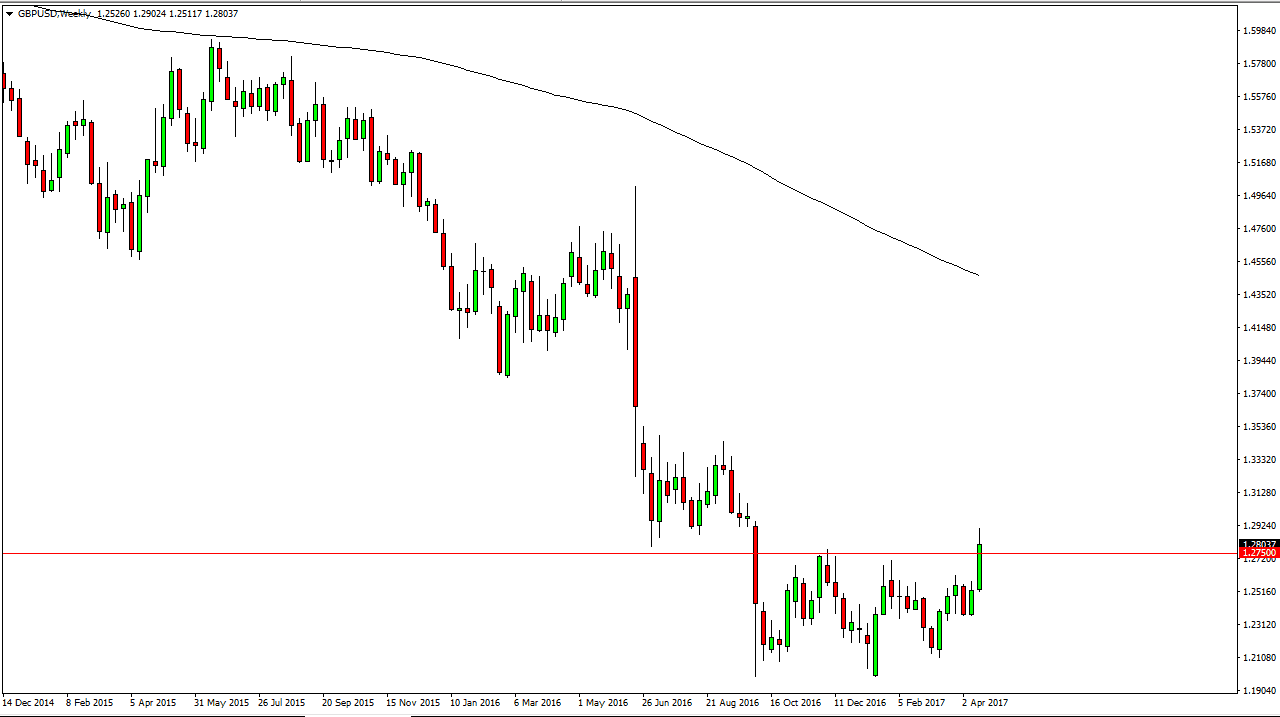

GBP/USD

The GBP/USD pair broke out during the week, clearing the 1.2750 level. Because of this, I believe that this market will continue to go higher, and perhaps reach as high as the 1.3450 level over the next couple of weeks. I have no interest in selling, and I believe that pullbacks offer value the traders will continue to take advantage of.

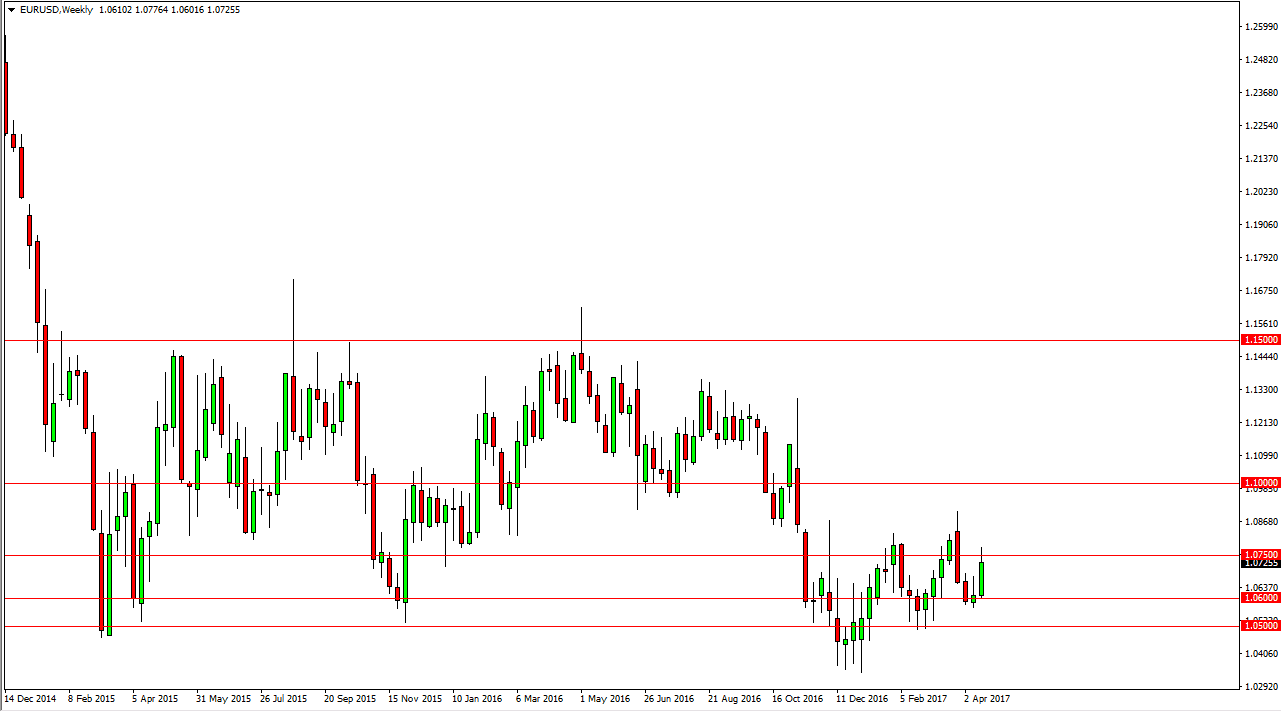

EUR/USD

The EUR/USD pair rallied during the week, breaking above the 1.0750 level. More importantly, it broke above the top of the shooting star from the previous week. Because of this, I believe that the market is going to continue the slight upward channel that we have seen as of late. Pullbacks should offer value, but I’m not looking for anything major.

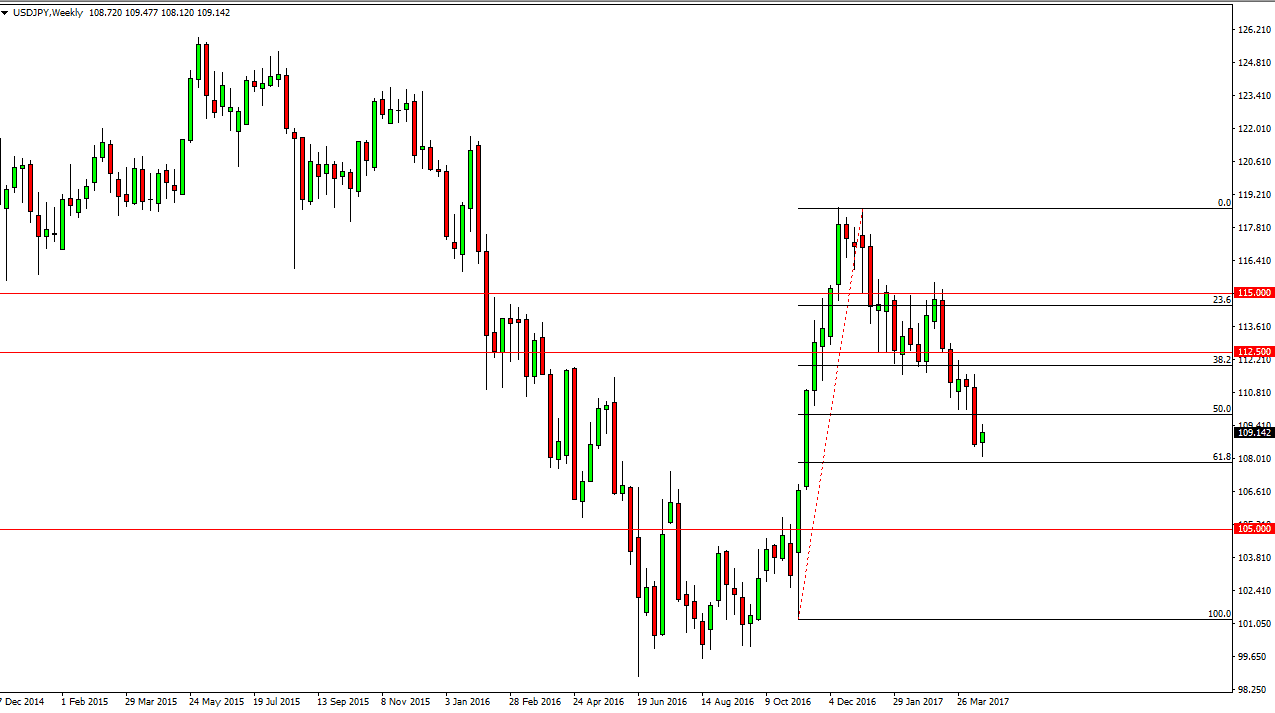

USD/JPY

The US dollar fell initially during the week, but found enough support at the 61.8% Fibonacci retracement level to turn around and form a hammer. Because of this, I believe that the buyers are coming back and we should continue to find bullish pressure. On a break above the top of the range for the week, I think the next target will be 110, followed by 112. Alternately, if we break down and close on a daily chart below the 108 handle, the market will more than likely go looking for the 105 level.

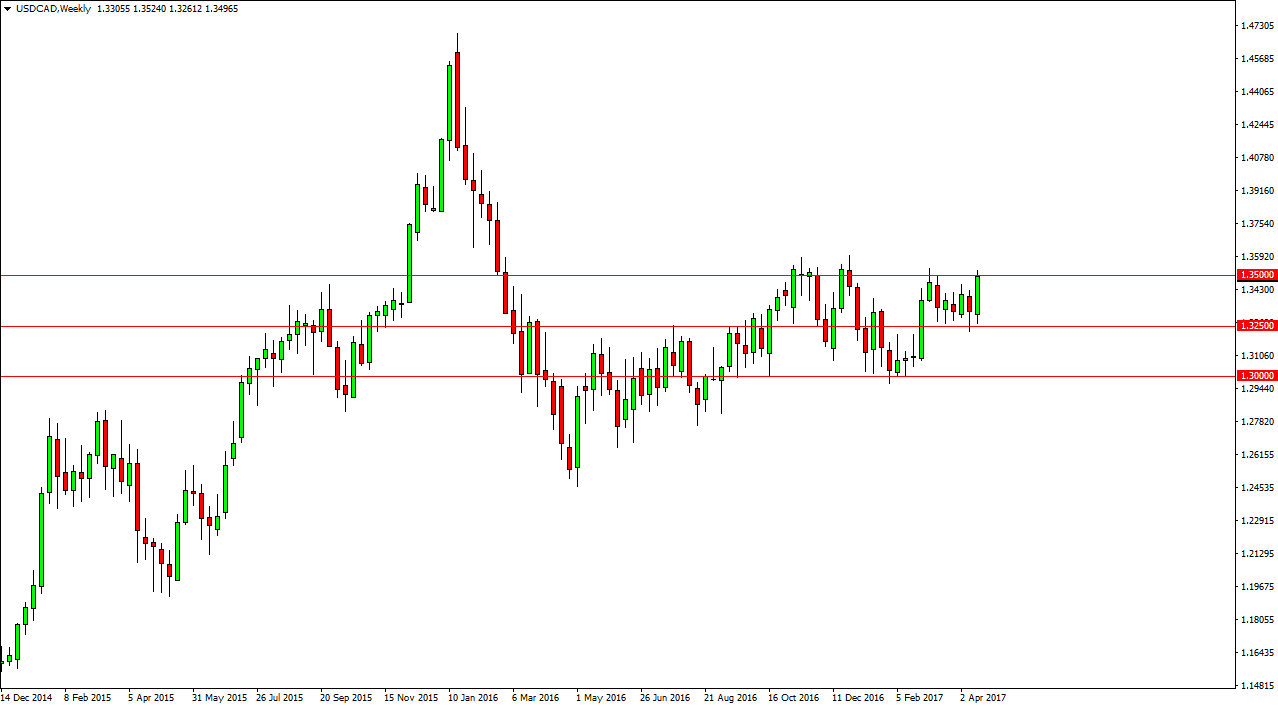

USD/CAD

The USD/CAD pair initially fell during the week but found the 1.3250 level supportive enough to turn the market around. By forming a very bullish candle in the fact that oil fell drastically, I believe it’s only a matter of time before this market breaks out, and move above the 1.36 level is a “buy-and-hold” type of situation for the longer-term trader. I have no interest in shorting.