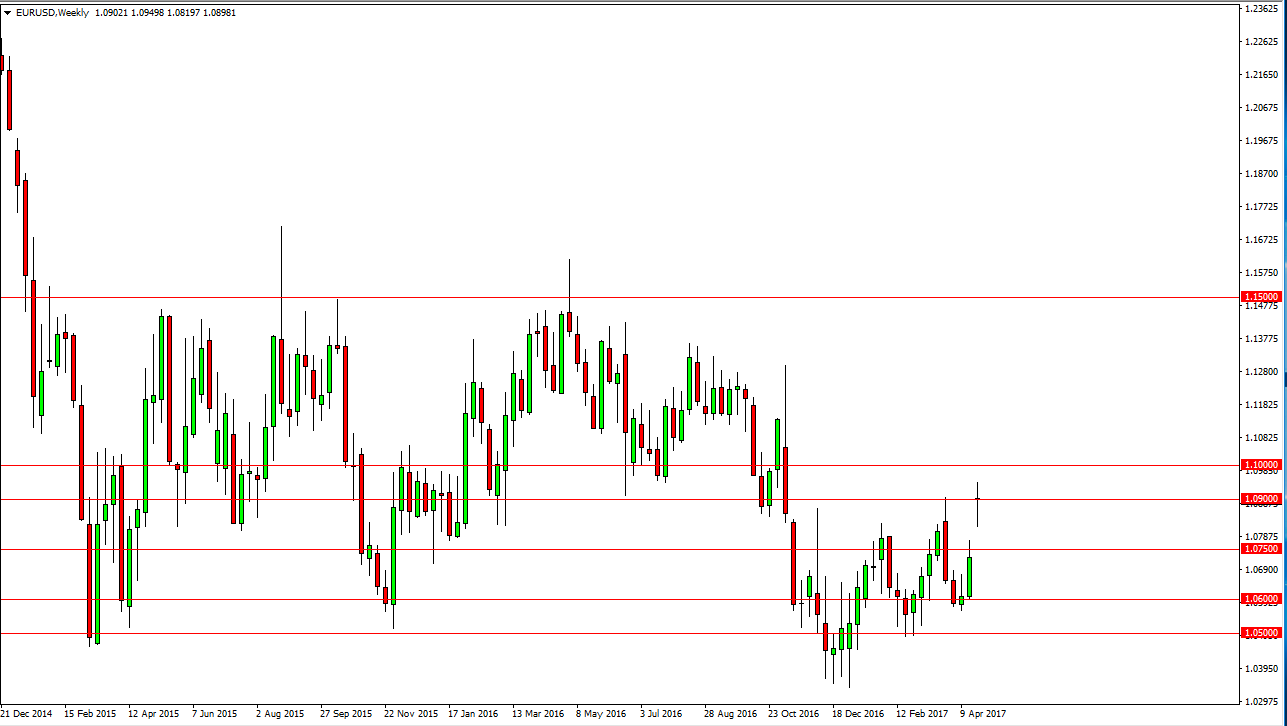

EUR/USD

The EUR/USD pair initially gapped higher on Monday in relief from the French elections. The market had a volatile couple of sessions after that, and we have now formed a bit of a hammer. I think the gap below will continue to offer support though, so a pullback should be looked at as value. I believe that the 1.0750 level should be a floor.

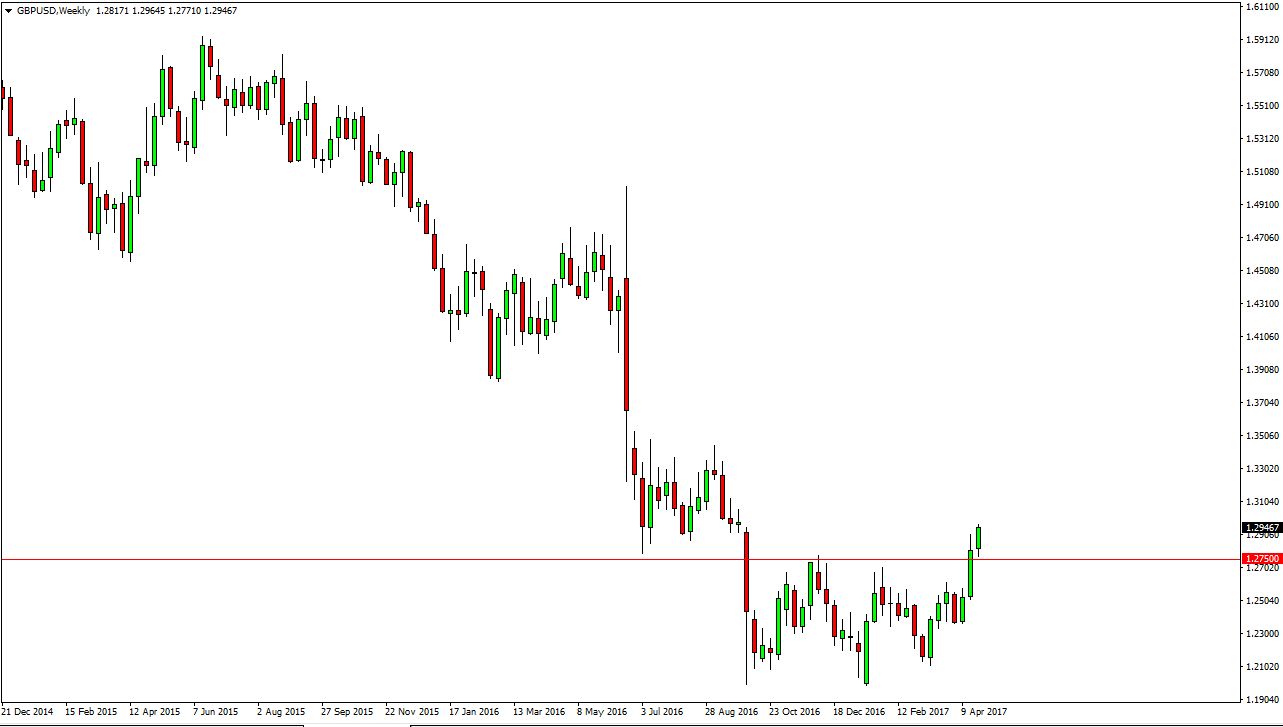

GBP/USD

The British pound initially fell during the week but found support at the 1.2750, the site of previous resistance. Because of the bounce, I think that we will continue to go higher, and that short-term pullback should be nice buying opportunities as the market will go to the top of the previous consolidation area in this region, the 1.3450 level above.

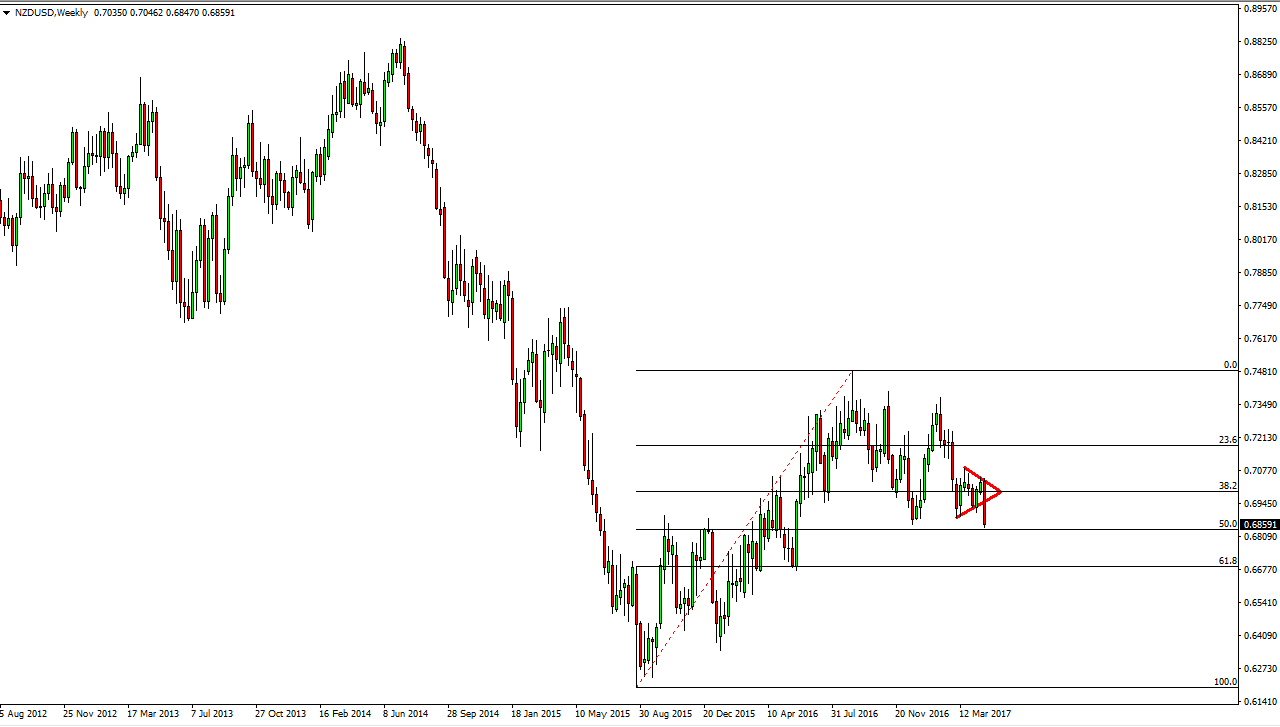

NZD/USD

The New Zealand dollar fell during the week, breaking below the bottom of asymmetrical triangle showing quite a bit of weakness. The 50% Fibonacci retracement level offered support, as it had been resistance in the past. I think the market will find quite a bit of support in this area. Having said that, if we break down below the 0.68 handle, the market will more than likely reach towards the 61.8% Fibonacci retracement level, near the 0.67 handle. Alternately, if we bounce from here, we may go back to the 0.6950 level.

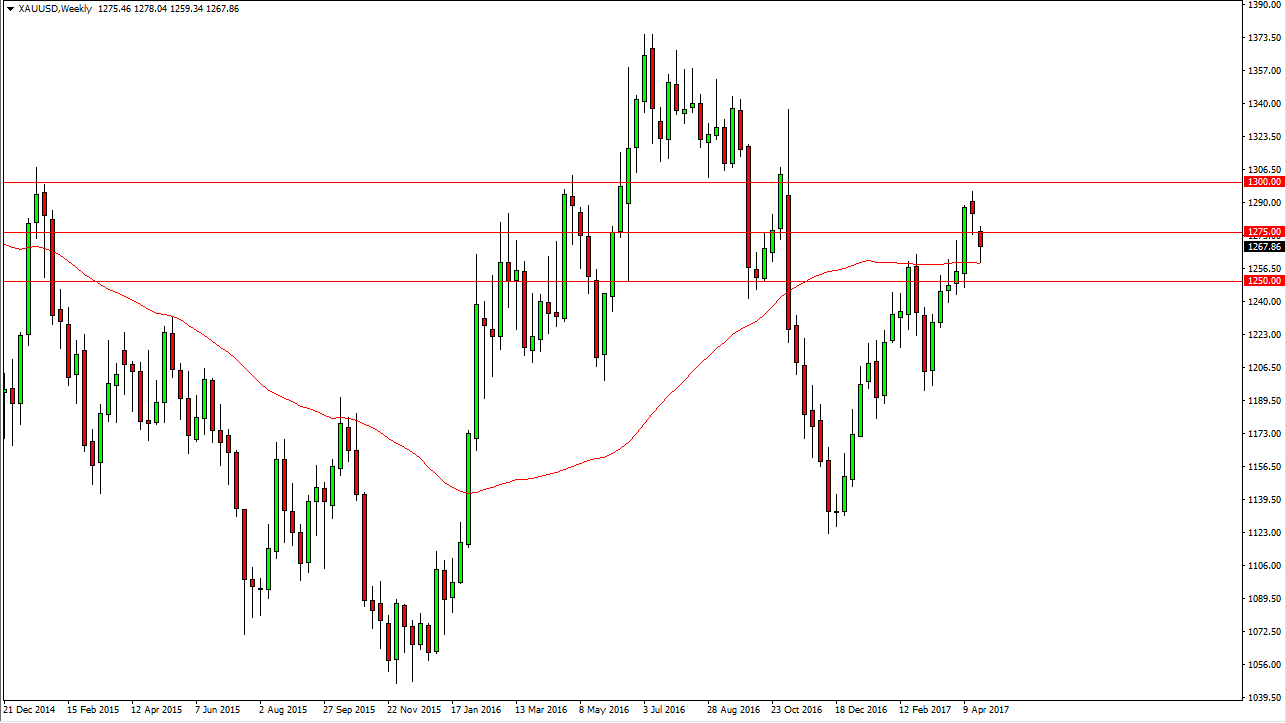

Gold

Gold markets gapped lower at the open on Monday, and then drove down to the 50-exponential moving average on the weekly chart, and then bounced enough to form a hammer. I believe there is a certain amount of value hunting going on out there, so I would anticipate the gold should go a bit higher by the end of the week. Certainly, there is more than enough geopolitical risk out there to make gold interesting.