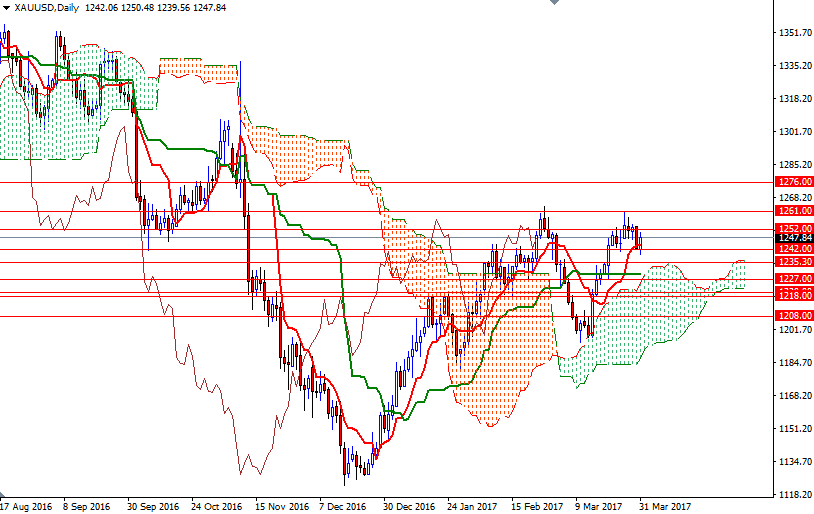

Gold started the week on a positive note, testing the $1261 level after prices climbed above the $1252/0 zone, but the failure to break through this barrier weighed on the market. As a result, the precious metal settled at $1247.84 an ounce on Friday, ending the week where it started. Apparently the dollar's appreciation and renewed interest in stocks put downward pressure on the price of the precious metal; however, the official launch of Brexit and the upcoming French presidential elections will likely be supportive for gold over the medium term.

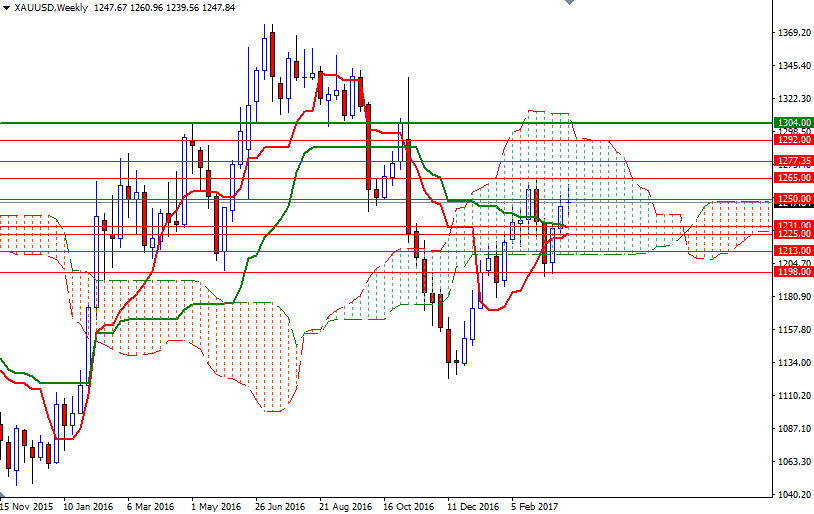

The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 137820 contracts, from 116252 a week earlier. Trading above the daily and the 4-hourly charts indicates that XAU/USD is likely to continue to benefit from the bullish medium-term outlook, but like I pointed out last week, this won't be an easy ride as the market resides within the borders of the weekly cloud. Negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on the weekly and 4-hourly time frames also support this theory.

A daily close above 1261 would help gold’s case but in order to reach there, the bulls have clear nearby resistances such as 1252 and 1255. If the bulls take the reins and push prices beyond 1265, then the market will be aiming for 1277.35-1276 next. Penetrating that barrier would imply that XAU/USD is ready to test the 1292 level. If the market fails to hold above 1242/39, look for further downside with 1235.30 and 1231 as targets. The bears will need to push prices back below 1231 so that they can make an assault on 1227/5. Closing below 1225 would pave the way for the 1220/18 zone which acted as both support and resistance in the past.