The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 7th May 2017

Last week, I predicted that the best trade for this week was likely to be long the British Pound and short of the U.S., Canadian, and New Zealand Dollars. This combination trade was a little unprofitable overall, as although the GBP/USD currency pair rose by 0.24%, the USD/CAD currency pair fell by 0.04%, and the NZD/USD pair rose by 0.83%, producing an overall average loss of 0.21%.

The Forex market is in a mood to look to currencies other than the U.S. Dollar right now, as although we just had the FOMC Statement and Non-Farm Payrolls, they have not produced a decisive market sentiment or any dramatic price movements. The fact that moderately bullish data from the U.S.A. has failed to spark a strong Dollar gain suggests underlying weakness in the greenback. As for political developments, the French election has continued to look as if it will be comfortably won by the centrist candidate today, with the Euro continuing its recent rise.

The greenback remains in neutral, with the British Pound the most clearly strong currency, while Silver has moved into a strong long-term bearish trend with obvious weakness. The Euro is also likely to be strong. Therefore, I suggest that the best trades of the coming week will be long the British Pound and Euro, and short of Silver.

Fundamental Analysis & Market Sentiment

The major elements affecting market sentiment this week are likely to be the result of the French Presidential Election which should become clear late Sunday evening in Europe, followed by some U.S. economic data releases at the end of the week.

Technical Analysis

USDX

The U.S. Dollar printed a bearish candle this week. It is a small candle rejecting a broken resistant trend line. The bullish trend line is broken. The price is lingering within an area I had identified as supportive, shown by the blue line in the chart below. The price is still below its level from 3 months back, but above its level of 6 months, so has no long-term trend. The signs are bearish, but it would not be a surprise if the bearish movement fails here, at least for a short while. Alternatively, a break below 12203 couldtrigger a sharp fall in the greenback and a more decisively bearish outlook. The price is trapped between support and resistance.

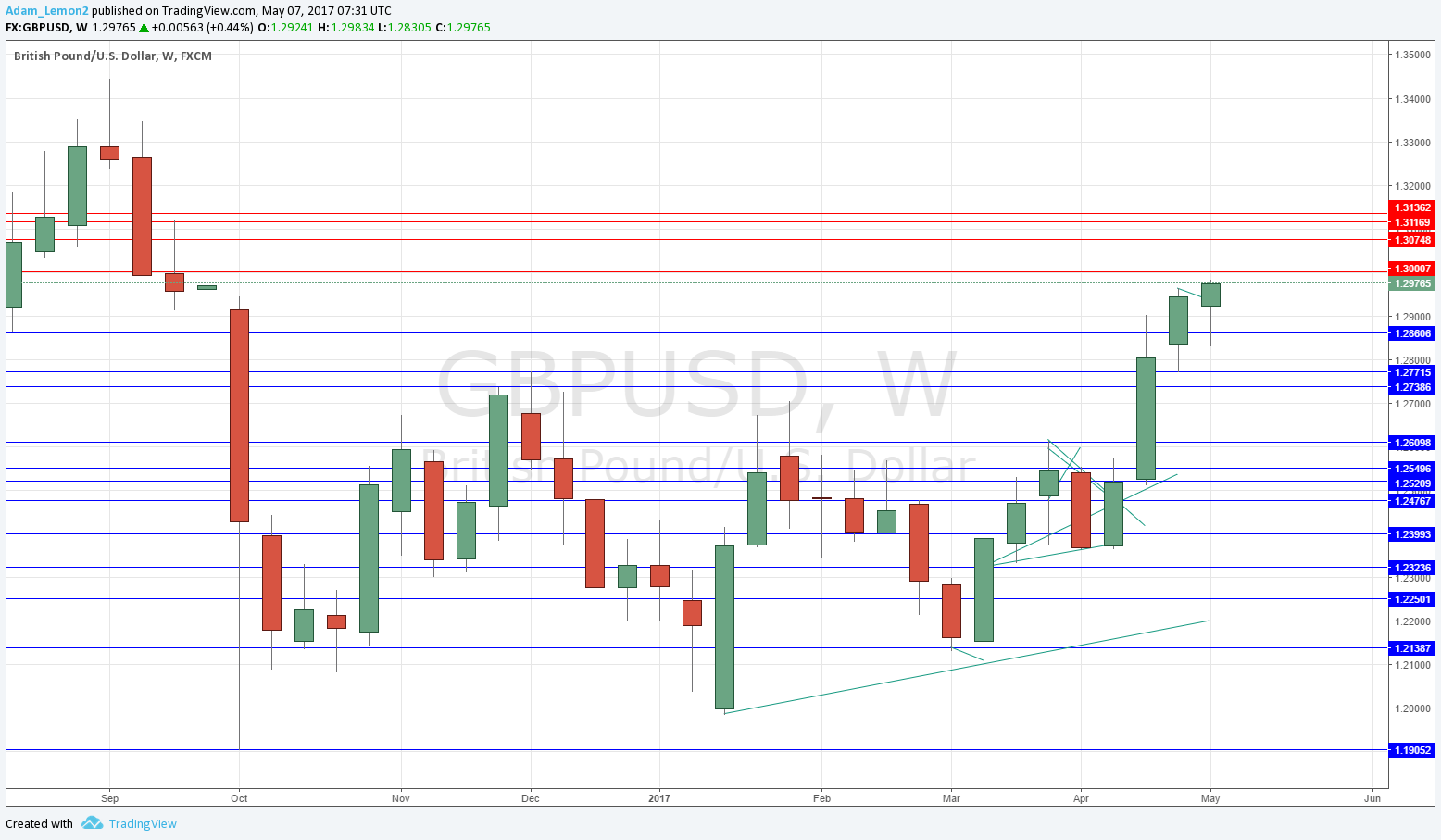

GBP/USD

The weekly chart below shows that this currency pair remains in a strengthening upwards trend, printing a strongly bullish candle which continued a breakout from a long-term consolidation area and made a new 8-month high. The price is also well above its recent historical levels from both and 3 and 6 months. The candle closed very near its high, which is a bullish sign. However, the price is now very close to a confluence of a large round number as well as historical congestion around 1.3000, so this upwards thrust may not have a great deal further to run over the short term.

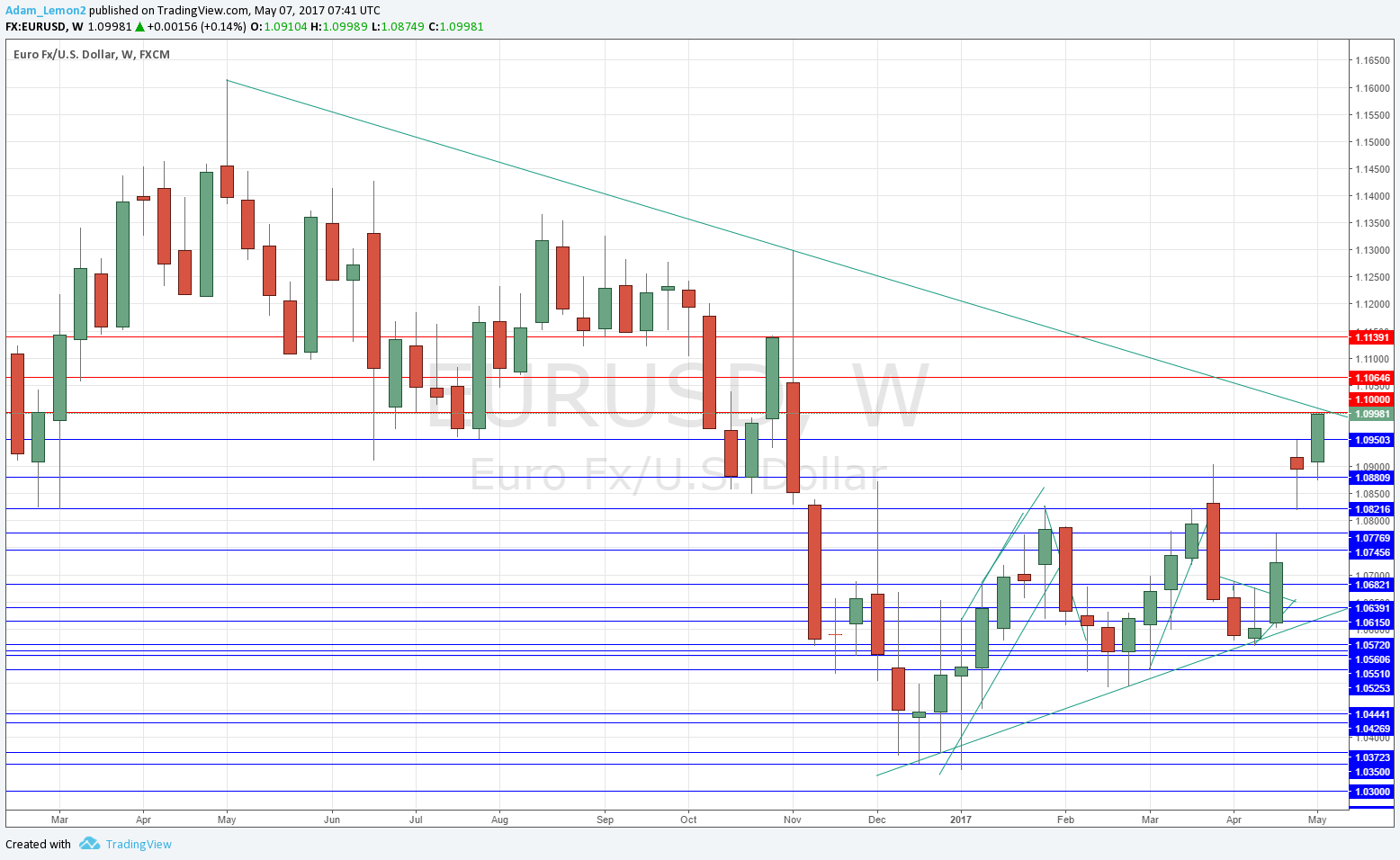

EUR/USD

The weekly chart below shows that this currency pair is poised at a very significant level just below a bearish trend line which has formed and held over 1 year, as well as a big psychological number at 1.1000. The price is well above its level of 3 months and almost above its level of 6 months. A strong victory by Macron in the French Election should see a bullish breakout.

SILVER

The weekly chart below shows that this metal in USD terms has gone back into a long-term bearish trend, printing a strongly bearish candle which made a new 4-month low. The price is also below its recent historical levels from both and 3 and 6 months. The weekly candle is long and strong, and closed very near its low, which is a bearish sign. It is significant that although the price of Gold has also been falling, Silver is in a more pronounced bearish trend, so the overall outlook is bearish.

Conclusion

Bullish on the British Pound and Euro; bearish on Silver.