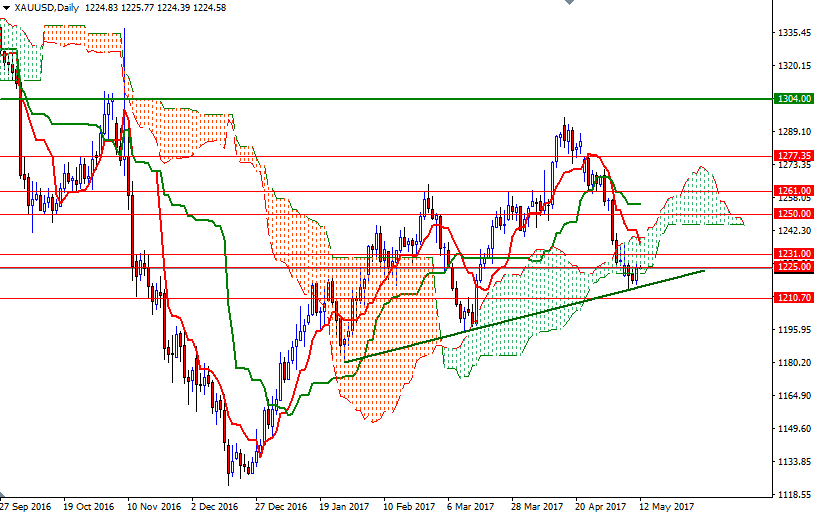

Gold prices rose $5.93 an ounce on Thursday, erasing most of the losses posted earlier in the week, as falling U.S. stocks prompted a bit of safe-haven demand. The market was able to stay above the key support in the $1218/5 area yesterday, and it seems as if we are going to see some more short-covering ahead of the weekend. The XAU/USD pair is trading right below the $1227.70-1225 area, which continues to act as resistance, in Asia session.

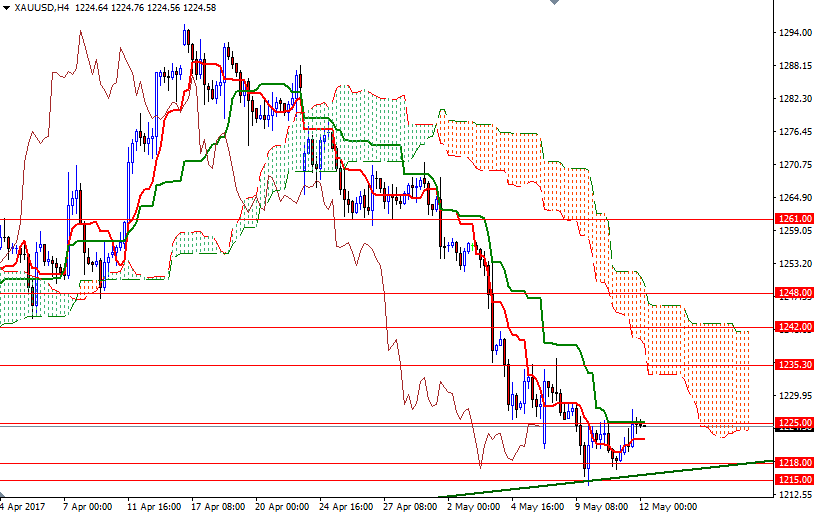

Although prices remain below the 4-hourly Ichimoku cloud and we have negatively aligned Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-period moving average, green line) lines, the shorter-term (H1 and M30) charts are bullish at the moment. With that in mind, I think the bulls may have a chance to lift prices towards 1235.30 if they can break through the aforementioned resistance in 1227.70-1225. Closing beyond 1332/0 might see a push up to 1242. However, keep in mind that the daily and the 4-hourly Ichimoku clouds overlap in the 1250-1235 zone, so the first attempt to break through could attract sellers.

A failure to sustain a push above 1227.70-1225 would weigh on the market and drag prices towards 1218/5. On its way down, support can be seen at 1221. A break down below 1215 would encourage sellers and foreshadow a move to 1210.70-1207. The bears will have to capture this camp so that they can challenge the next support in the 1210.70-1207 zone.