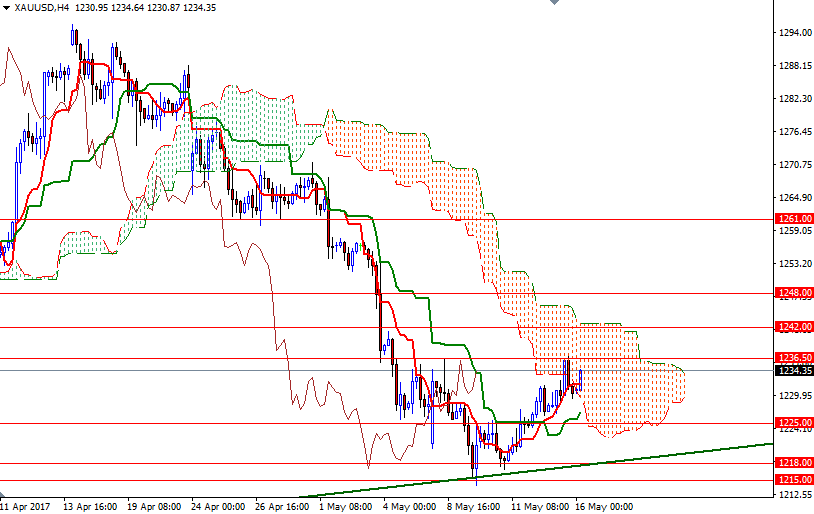

Gold prices ended Monday’s session up $2.26, extending their gains to a third straight session, as the dollar eased after U.S. manufacturing data came in weaker than expected. Although some of earlier gains eroded as the New York session progressed, the XAU/USD pair looks as if it will retest the $1236.50-1235.30 area today.

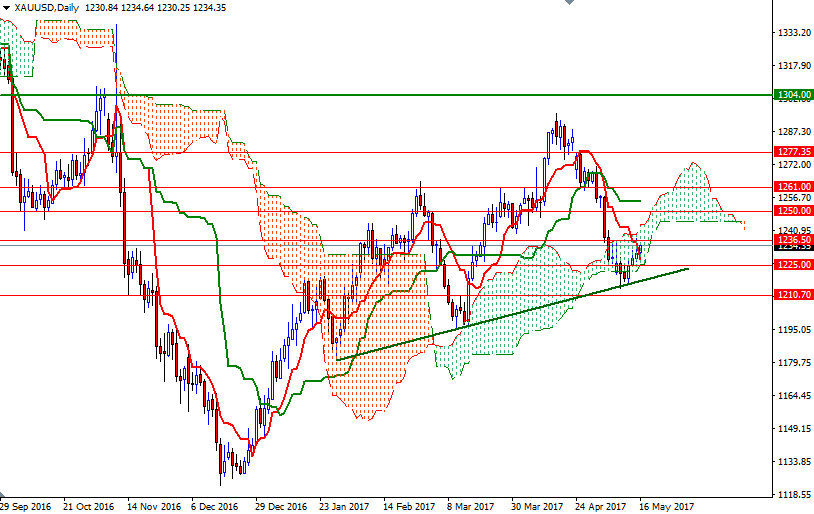

Positively aligned Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) lines on the H4 and the H1 charts, along with trading above the Ichimoku clouds on the H1 and the M30 time frames, indicate that a continuation towards 1243.90-1242 is likely if the market successfully penetrates 1236.50-1235.30. The top of the daily cloud currently sits at 1243.90, so the bulls will have to lift price above there to gather momentum for 1250/48.

However, note that the market is residing within the borders of the daily and the 4-hourly Ichimoku clouds, and that suggests a range bound movement. If prices can’t stay above 1229.50 (the top of the hourly cloud), then 1225.80-1225 and 1222.50 will probably become the next targets. A break below there could send prices back to 1218/5 area.