Gold prices dropped $18.65 yesterday as the U.S. dollar rallied after the Federal Reserve signaled it was likely to continue raising short-term interest rates gradually this year. “The Committee views the slowing in growth during the first quarter as likely to be transitory and continues to expect that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace, labor market conditions will strengthen somewhat further, and inflation will stabilize around 2 percent over the medium term,” the Federal Open Market Committee said in a statement after its two-day meeting. The market will focus on U.S. monthly non-farm payroll number. Yesterday’s ADP employment data showed that the private sector added 177K jobs in April, broadly in line with expectations.

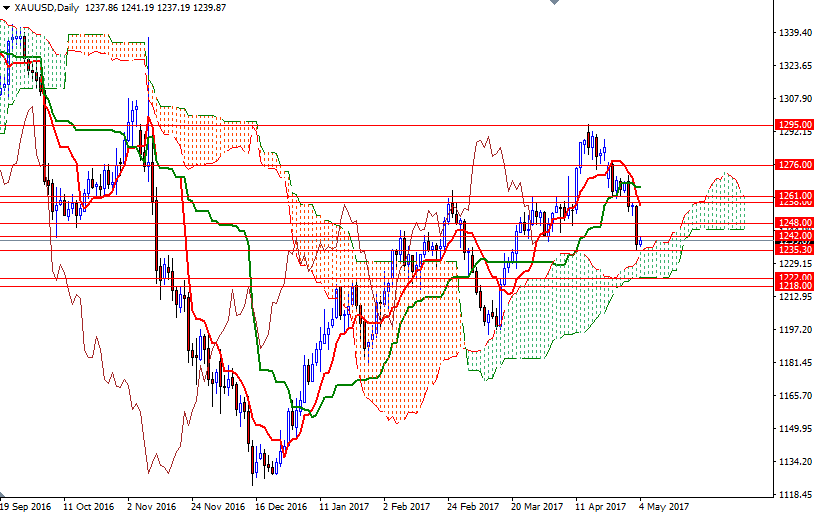

Technical selling was also behind gold’s 1.5% drop yesterday. The XAU/USD pair extended its losses as expected after prices broke below the 1250/48 zone, and tested the support at 1235.30. Although this area triggered some short covering, the market will remain under pressure unless prices climb back above the 1242/0 area. If the bulls can successfully push prices beyond 1242, then 1245.15 and 1250/48 may be the next targets. Only a daily close above 1250 may help gold’s case and imply that the bulls are getting ready to head towards 1261.

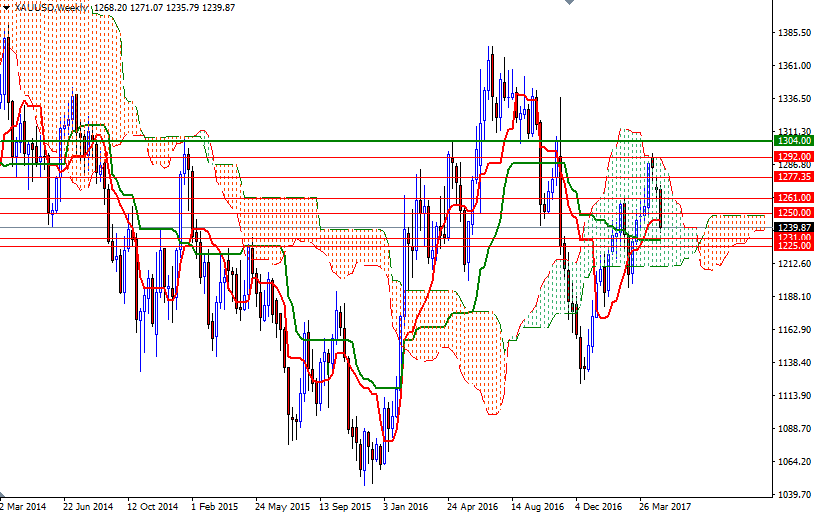

However, if XAU/USD falls through 1235.30-1234 (the top of the daily Ichimoku cloud), the bears will be aiming for 1231/0 next. The weekly Kijun-sen (twenty six-period moving average, green line) also sits in the same area, so the market has to get down below there in order to continue to the downside and test 1225/2 (the bottom of the daily Ichimoku cloud).