Gold prices rose $5.91 an ounce on Tuesday as a pullback in U.S. stock indexes prompted investors to move away from risky assets and to rush to safe havens. The continued weakness in the dollar also helped provide a lift to gold. The greenback remained under pressure on weaker-than-expected U.S. housing data. XAU/USD is trading at $1243.53, higher than the opening price of $1237.17.

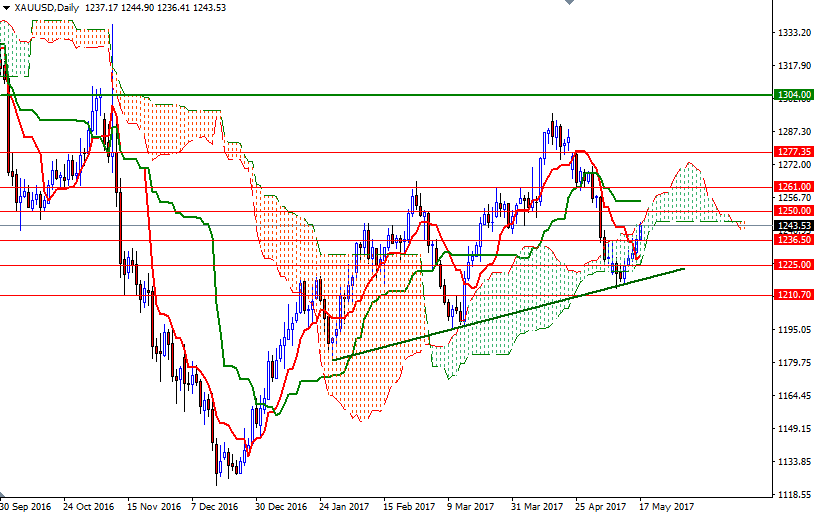

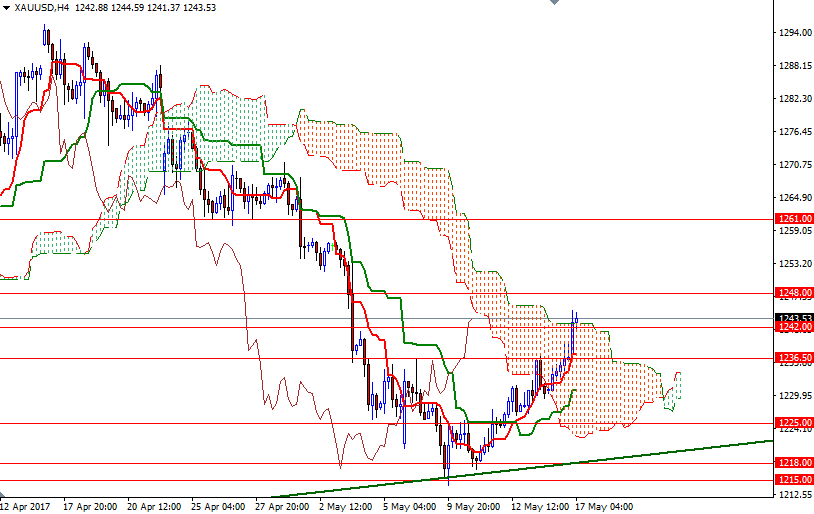

The short-term charts are bullish at the moment, with prices residing above the Ichimoku clouds on the H4 and the H1 time frames. In addition to that, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned. Despite this bullishness, the top of the daily cloud currently sits right above at 1243.90, and because of that I think buyers should take caution at this point.

If the market can cleanly break above the 1244 level, then the 1250/48 zone will be the next target. Once beyond 1250, look for further upside with 1257.60 and 1261 as targets. The bears will have to drag prices back below the 1242/1 area, if they don’t intend to give up. In that case, intra-day supports in 1238.70-1238.40 and 1236.50-1235.30 may be tested. A break down below 1235.30 implies that the bears will be aiming for 1231-1229.50.