Gold prices ended a choppy, two-sided trading session slightly higher yesterday. XAU/USD initially fell to its lowest level in three weeks but reversed losses and closed the day at $1256.74. Market players are understandably cautious ahead of Fed's policy statement. Almost everybody expects Federal Reserve officials to keep interest rates on hold at the conclusion of their two-day meeting today. However, the wording of the FOMC statement will be parsed for any clues on the timing of future rate hikes and policy adjustments.

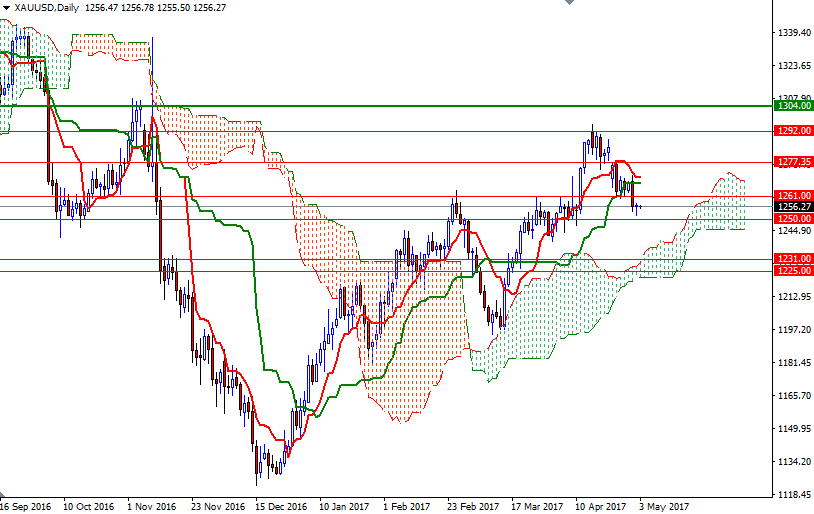

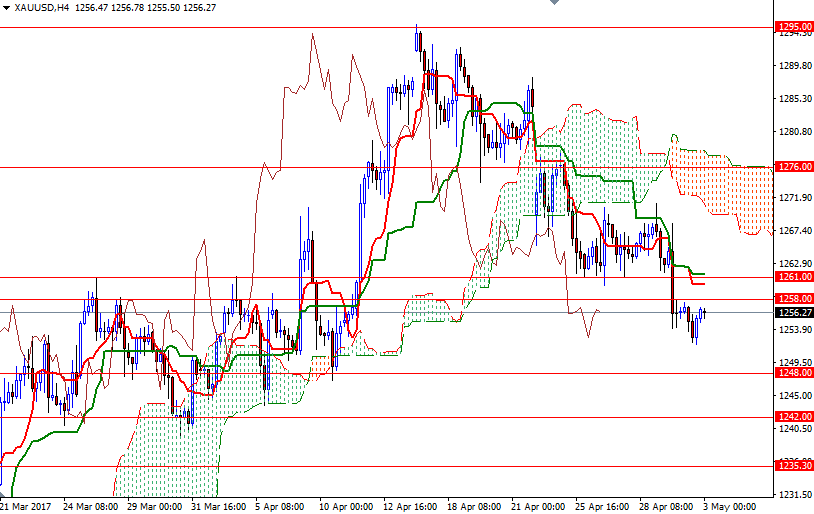

Although the market found support near the 1250 level, the short-term charts are still bearish - prices are below the Ichimoku clouds on the H4 and the H1 charts. If the resistance at the 1261 level remains intact, it is possible to see the bears challenging the support in the 1250/48 area. Falling through 1248 could encourage sellers and pull the market back to the 1242/0 area.

The Ichimoku cloud on the H1 chart currently occupies the area between the 1258 and the 1261 level, so therefore the bulls will need to push prices beyond there in order to march towards the 4-hourly cloud. In that case, 1264 and 1270.60-1269.65 will probably be the next targets. A daily close above 1270.60 could provide the bulls the extra fuel they need to reach the next barrier sitting in the 1277.35-1276 area (the top of 4-hourly cloud).