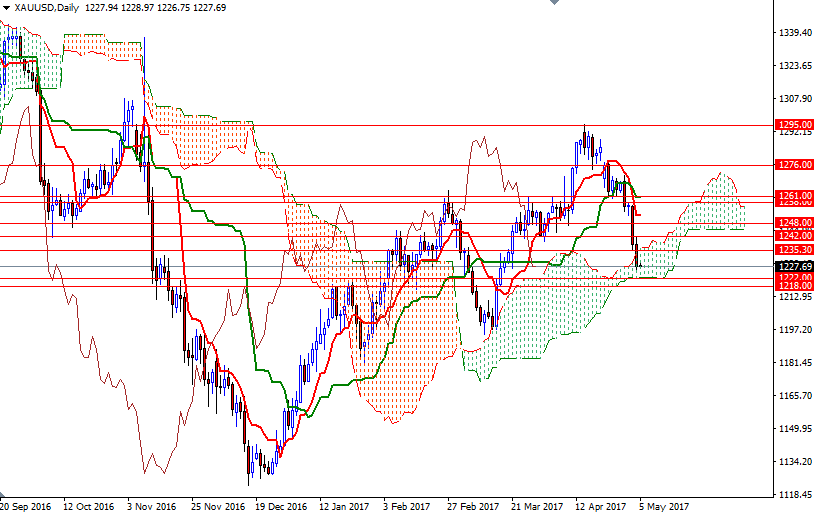

Despite weakness in the dollar, gold prices fell for the third time in four days and hit the lowest level since March 17. The XAU/USD pair initially tried to pass through the 1242 resistance level but found heavy resistance and headed back to the 1235.30-1234 area. Not surprisingly, prices came under further pressure after this support was broken, and fell all the way back to the 1225/2 zone.

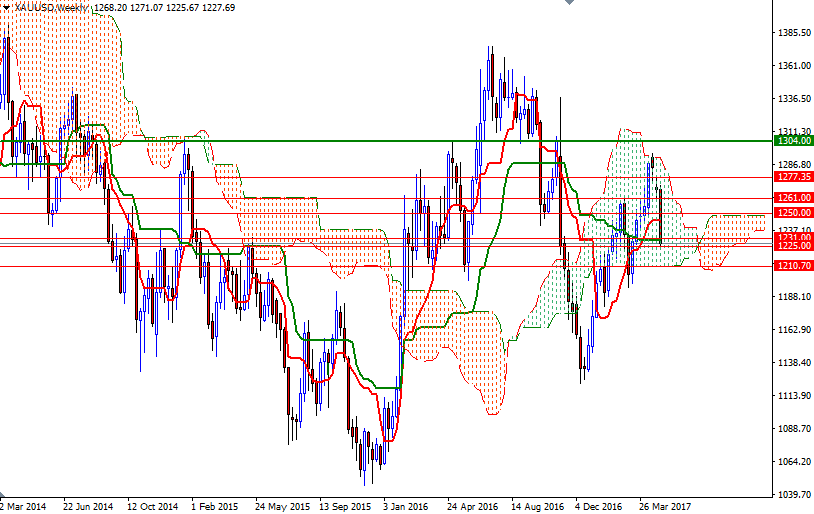

I have been bearish since the market broke down below 1277.35-1276 but I would advise a bit of caution at this point as we enter the daily Ichimoku cloud. There are critical supports such as 1225/2 and 1218 down below, so I wouldn’t eliminate the possibility of a bounce towards 1235.30-1234. The bulls have to capture this camp (i.e. push prices back above the daily cloud) in order to make an assault on 1242. Closing above 1242 could pave the way for a test of the 1250/48.

However, keep in mind that downside risks are likely to remain until prices anchor somewhere above 1250/48, an area occupied by the 4-hourly cloud. If XAU/USD drops through 1218, then the market will probably continue to retreat and visit the next solid support at the 1210.70 level, the bottom of the weekly cloud.