Gold prices fell $14.06 on Thursday, ending a five-day streak of gains, as the dollar strengthened and stock markets recovered ground. The greenback clawed back some of its recent losses after stronger-than-expected U.S. economic data put the focus back on the Federal Reserve’s June meeting. The Federal Reserve Bank of Philadelphia said its manufacturing index jumped to 38.8 from 22.0 the prior month. A report released by the U.S. Labor Department showed that the number of first-time applicants for jobless benefits decreased 4K to 232K

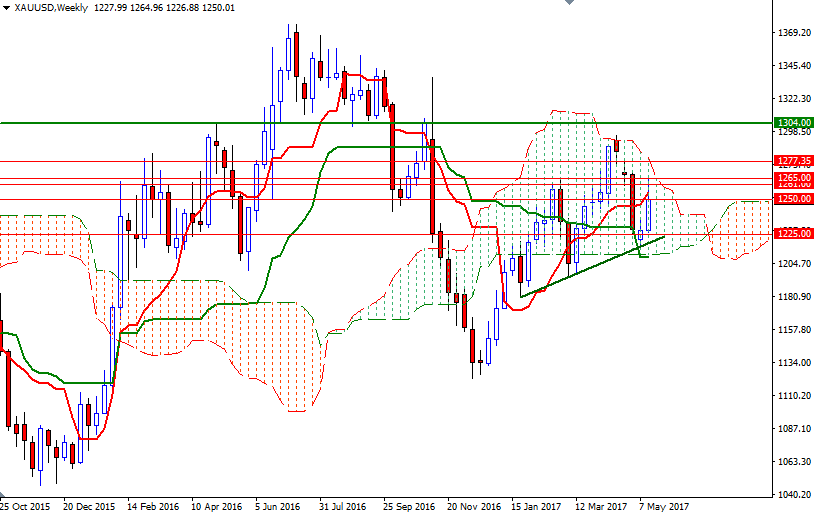

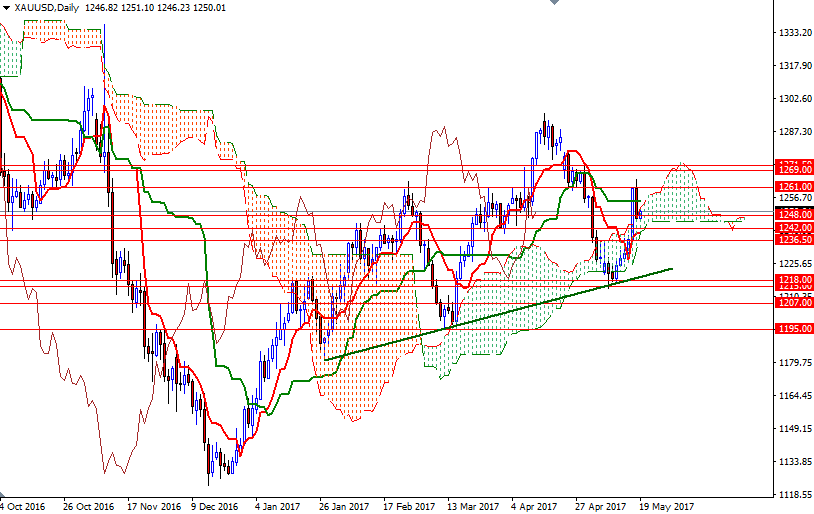

World stock markets were mostly higher yesterday. Markets in the Asia-Pacific region seems steady today. The XAU/USD pair was not able to pass through the 1265/1 area, which acted as a strong resistance in the past, and consequently, prices pulled back to 1250/48. From a technical perspective, the daily Ichimoku cloud should be supportive. However, the shorter-term (H1 and M30) charts are slightly bearish at the moment. If prices dive below the bottom of the hourly cloud and takes out the intra-day support at 1245.30, then XAU/USD may extend losses and test the strategic support in the 1242/39 area.

To the upside, there are hurdles such as 1250 and 1252 (the top of the daily cloud). If the bulls can push prices back above 1252, it is likely that the market will challenge 1256.70-1255 (the top of the hourly cloud). XAU/USD needs penetrate this barrier to gather momentum for a retest of 1265/1.