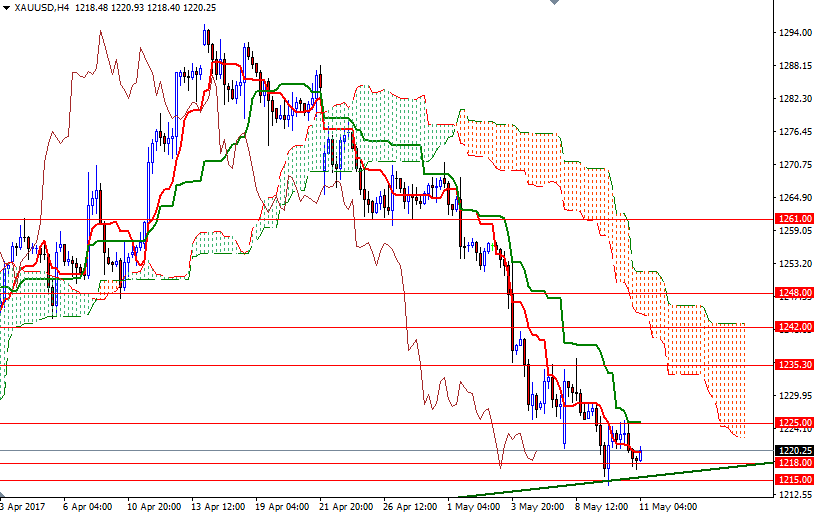

Gold prices fell for a second day, but the trading range was relatively tight as none of the nearest key levels were broken. The 1225-1227.70 area acted as resistance as expected and sent prices down. However, the market has found some support in the 1218/5 zone in early Asia trading today.

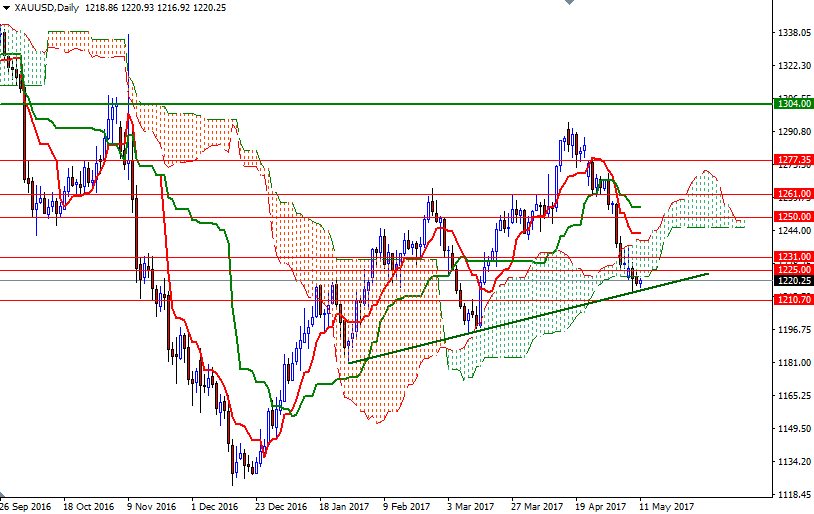

Trading below the Ichimoku clouds on the daily and the 4-hourly time frames, along with the negative Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-period moving average, green line) crosses, suggests that the XAU/USD pair will remain under selling pressure. But at this point, I think we should pay extra attention to the key technical supports down below such as 1218/5 (the confluence of a horizontal support and a medium-term bullish trend line) and 1210.70-1207 (the bottom of the weekly cloud) - especially when the Tenkan-sen and the Kijun-sen are in a flat position, indicating lack of momentum.

If the bulls can defend 1218/5, we may see another attempt to pass through 1225-1227.70. A break through there brings in 1231 and possibly 1235.30. XAU/USD needs to close above 1235.30 to gather momentum for 1242. On the other hand, if the market drops through 1218/5, I think the bears will be aiming for 1210.70-1207. A break below 1207 would set XAU/USD up for a test of the support in the 1198/5 zone.