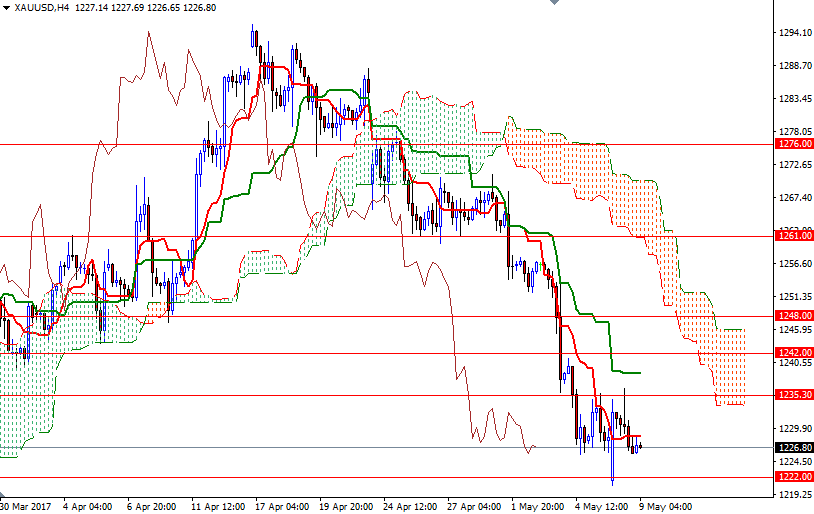

Gold prices opened with a gap down yesterday as there were no market-sensitive news developments over the weekend to rattle the markets. The XAU/USD pair traded as low as $1220.71 an ounce in early Asia trading but found support in the vicinity and headed back to the $1235.30 level. The anticipated resistance in this area kicked in, and blocked the bulls’ way. The market is currently trading at $1226.80, trying to stay above the intra-day support at $1225.

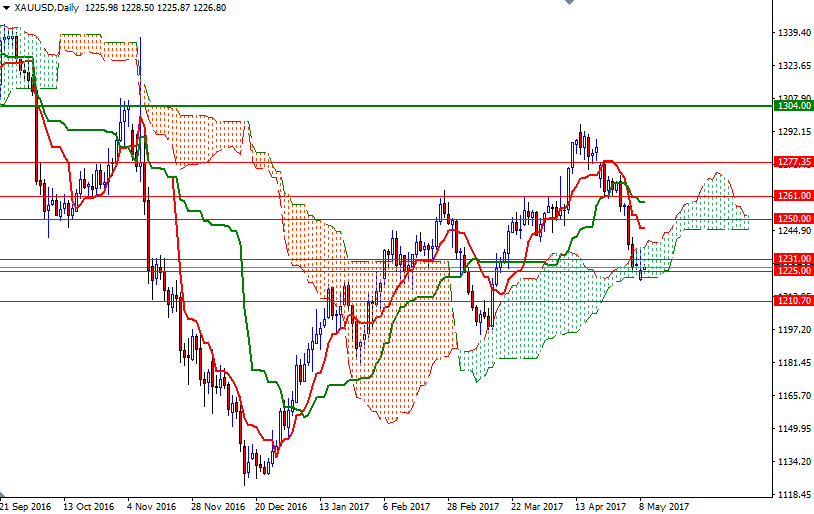

From a technical point of view, short-term charts suggest that a retest of 1222/18 is likely if the market successfully breaks through 1225. Although we have bearish Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) crosses on both the daily and 4-hourly charts, prices are within the borders of the weekly and the daily Ichimoku clouds. That being the case, the market looks as if it will tend to consolidate between the 1242 and 1210.70 levels.

The bulls will have to successfully push the market above 1235.30 if they don’t intend to give up, and make a move towards the next barrier at the 1242 level. A break above 1242 could give gold bulls short-term confidence they need to make an assault on 1250/48, which is the first important barrier ahead. On the other hand, if the support around the 1225 level is invalidated, XAU/USD may revisit the 1222/18 zone. Once below there, the next stop will be 1215. Closing below 1215 on a daily basis open up the risk of a drop to 1210.70-1207.