Gold prices ended Wednesday’s session up $23.72, hitting the highest level in two weeks, as investors sought refuge from volatility in the wider markets. Major stock markets around the globe were mostly lower yesterday, pressured by mounting uncertainty over U.S. President Donald Trump’s future. Doubts about Donald Trump’s political future also weighed on the dollar.

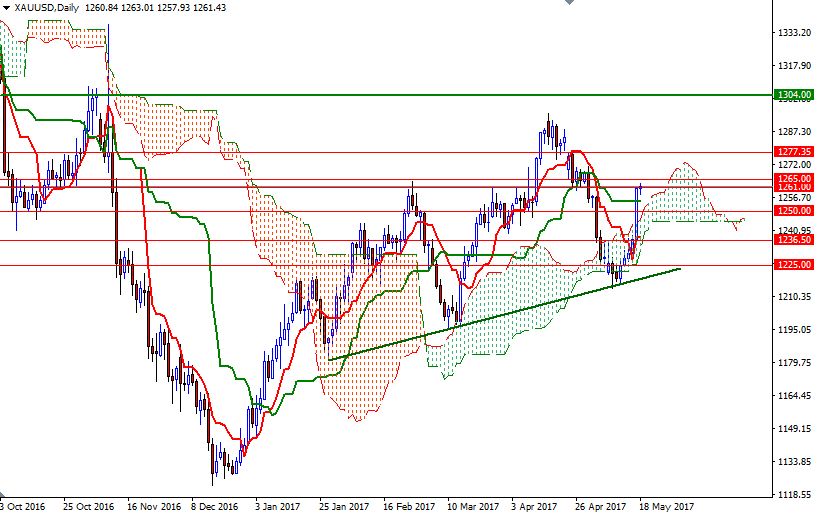

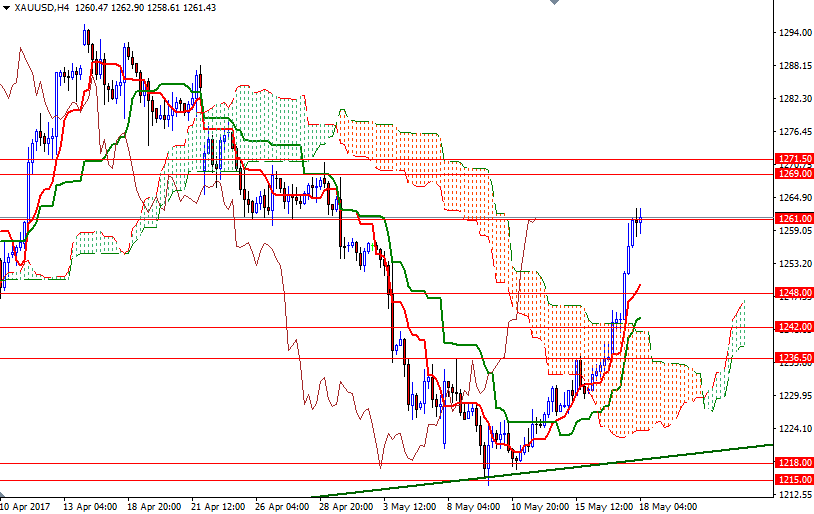

Gold is reacting to what we are seeing in the equities market, and that is fueling more demand for gold. From a chart perspective, trading above the Ichimoku clouds (on both the daily and the 4-hourly time frames) suggests the bulls have the overall technical advantage. However, as you can see on the charts, the area between the 1261 and the 1265 levels acted as solid resistance in the past, so it is not really surprising to see prices are stalling.

If this resistant area causes a pause in the upwards movement, then expect a pullback to 1256/4 where the daily Kijun-sen (twenty six-period moving average, green line) sits. The bears have to drag prices below there to make an assault on the 1250/48 area. A successful break above 1265, on the other hand, could help gold’s case and trigger a push up to 1271.50-1269. If XAU/USD passes through 1271.50-1269, the market will probably visit the 1277.35-1276 area afterwards.