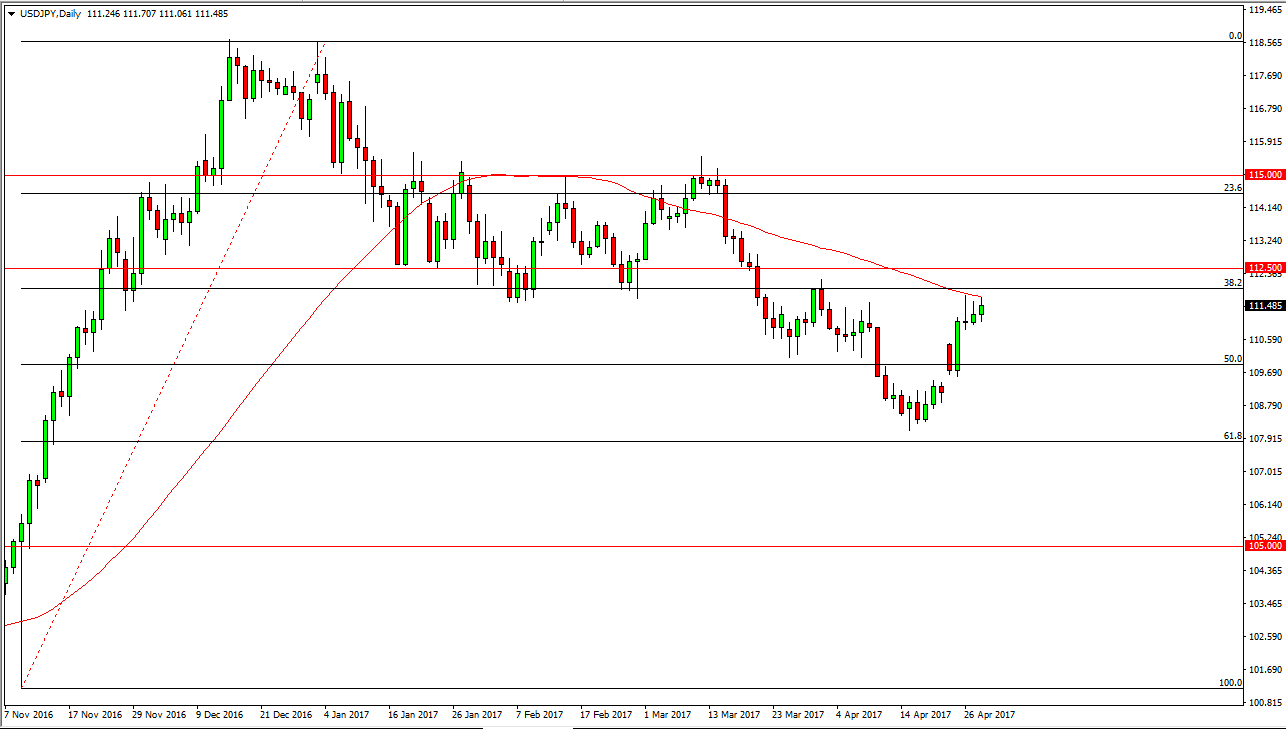

USD/JPY

The US dollar rallied on Friday against the Japanese yen, testing the 50-day exponential moving average again. For the last several days, we have tested this moving average, and it has formed quite a bit of resistance. However, I think that the real fight is closer to the 112 handle, and if we can break above there and more importantly even the 112.50 level, the market should reach even higher and continue to grind towards the 115 handle above. That was the high of the previous consolidation area, and should be an area that cause quite a bit of resistance. I think that might be the target, but we need to break out to the upside first. In the meantime, a breakdown below the bottom of the Wednesday shooting star would be a negative sign and send this market looking for the 110 level.

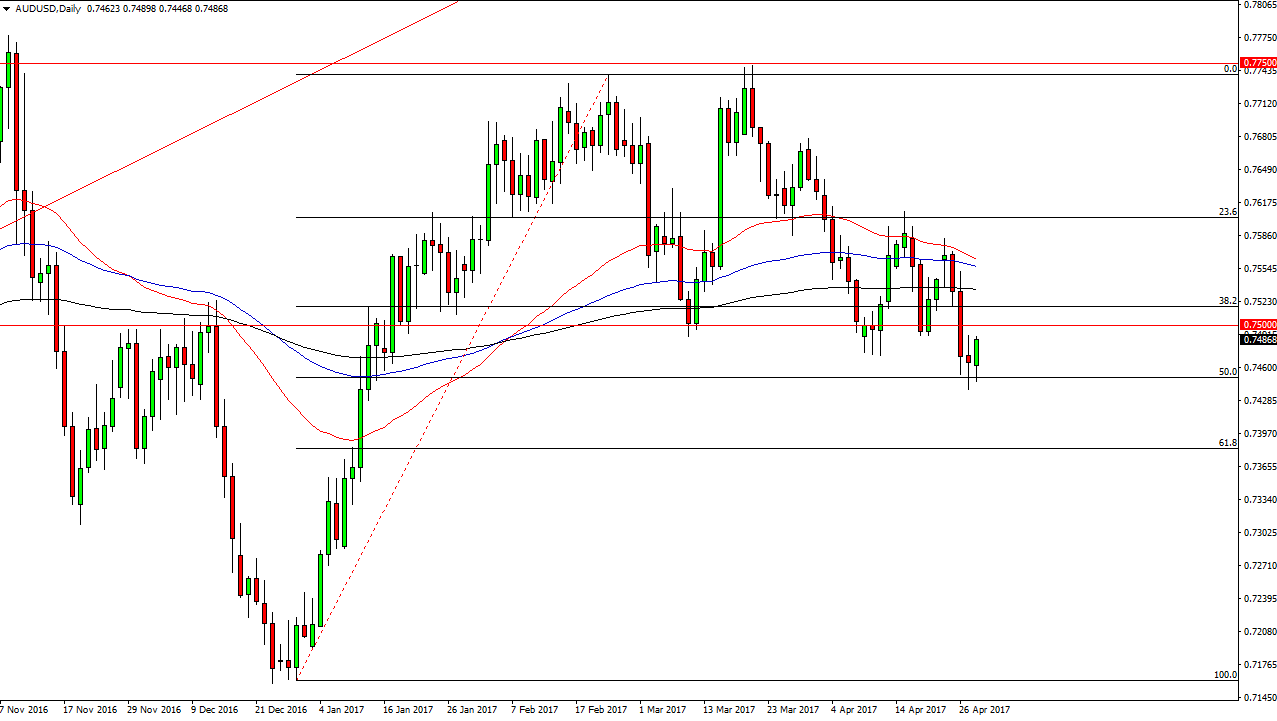

AUD/USD

The Australian dollar initially fell on Friday but found enough support at the 50% Fibonacci retracement level, essentially the 0.7450 level, to bounce and form a positive candle. The 0.75 level above is massively resistive, and that being the case it’s likely that we will see continued volatility. If we can break above the 0.75 level on a daily candle close, then I would consider buying but I also recognize that we need help from the gold markets simultaneously. If the gold market rallies along with the candle, then I could have a proclivity to start buying.

Alternately, if we break down below the bottom of the candle from the Thursday session, the market should reach towards the 0.7375 level which was the 61.8% Fibonacci retracement level. I expect a lot of volatility regardless what happens, and that being the case I would have to be very nimble if I were to place trays as I think a lot of noise is about to enter the AUD/USD pair.