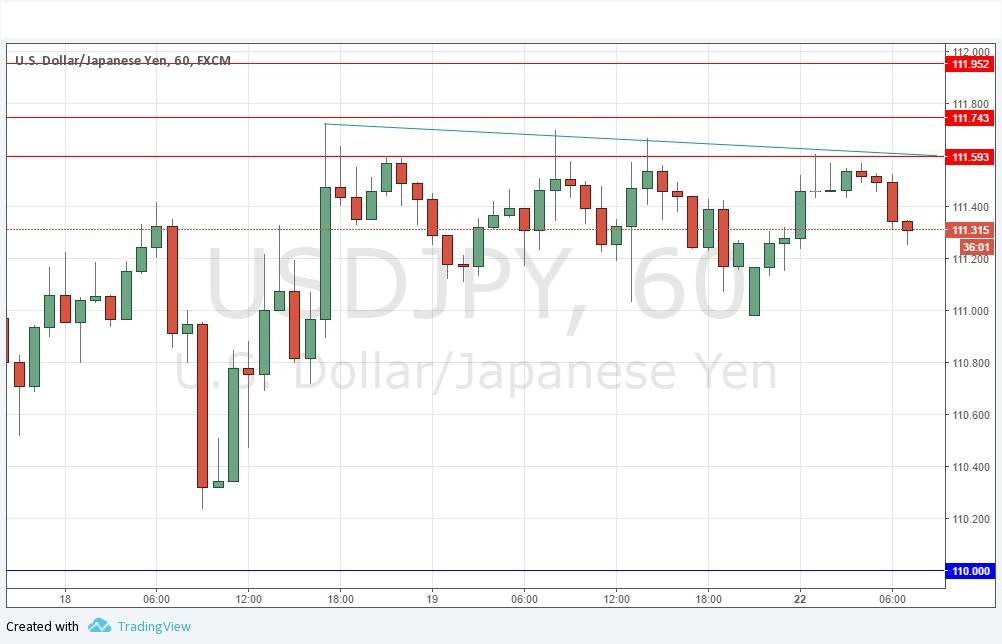

Last Thursday’s signals produced a short trade from the bearish inside candle rejection of the resistance level identified at 111.59. This trade would still be open now and in profit. It would probably be an excellent idea to take partial profits so a loser would break even very soon.

Today’s USD/JPY Signals

Risk 0.75%.

Trades must be taken from 8am New York time until 5pm Tokyo time, during the next 24-hour period.

Short Trade 1

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 111.59, 111.74 or 111.95.

- Place the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

- Go long following a bearish price action reversal on the H1 time frame immediately upon the next touch of 110.00.

- Place the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/JPY Analysis

This pair is in a long-term bearish trend, and although this trend against the USD is nowhere near as strong as the trend in the EUR, it is starting to move this morning while the European currencies are stalling. The shorter-term technical picture shows the price failing to rise above the beginning of the resistant area at 111.59, so the line of least resistance looks to be downwards, in line with the long-term trend.

There is nothing due today concerning either the JPY or the USD.