Yesterday’s signals were not triggered as there was no bearish price action at either 112.91 or 113.55.

Today’s USD/JPY Signals

Risk 0.75%.

Trades may only be taken from 8am New York time until 5pm Tokyo time, over the next 24-hour period.

Short Trade 1

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 114.08.

- Put the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trades

- Go long following a bearish price action reversal on the H1 time frame immediately upon the next touch of 112.91.

- Put the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

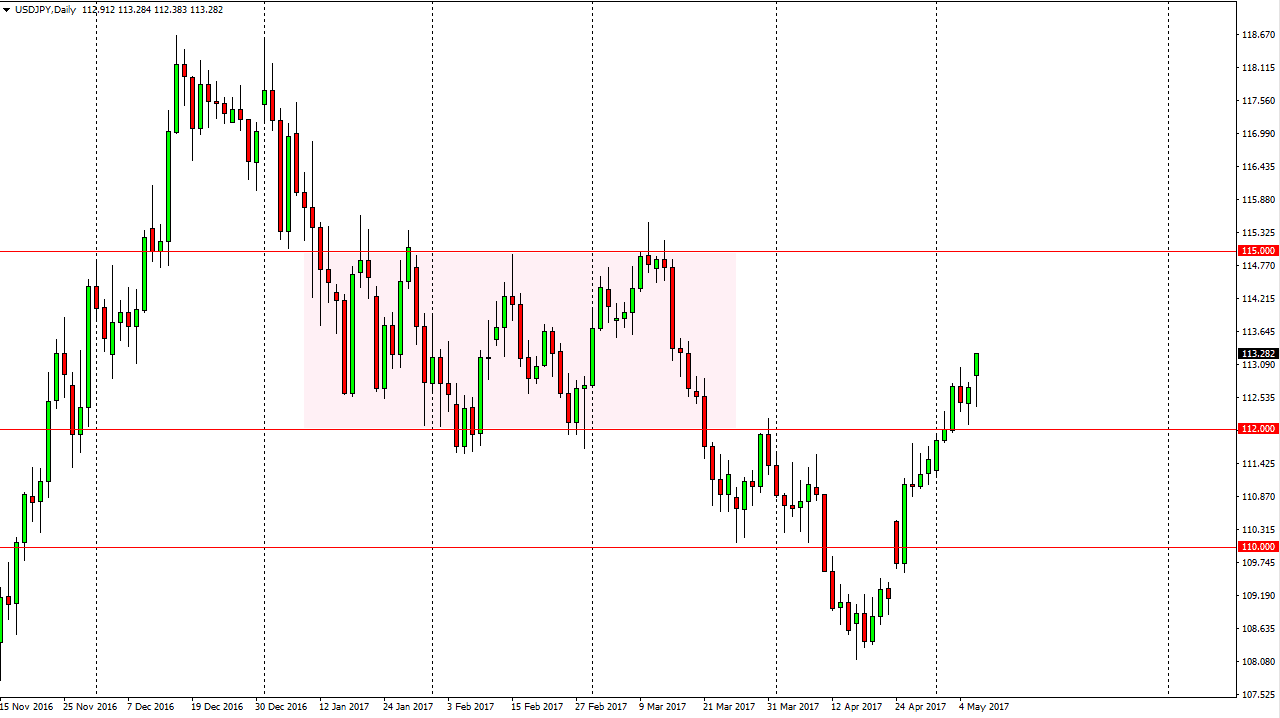

USD/JPY Analysis

This pair has passed a crucial test and is right at the heart of the market along with the EUR/USD currency pair, by breaking up bullishly above the key resistance level and very long-term bearish trendline at 112.91. Within the last hour, the price has also broken the resistance level at 113.55 which adds to the bullish picture. The price is trending up on all time frames, from short to long, and looks a good buy on dips over the short-term.

There is nothing due today concerning either the JPY or the USD.