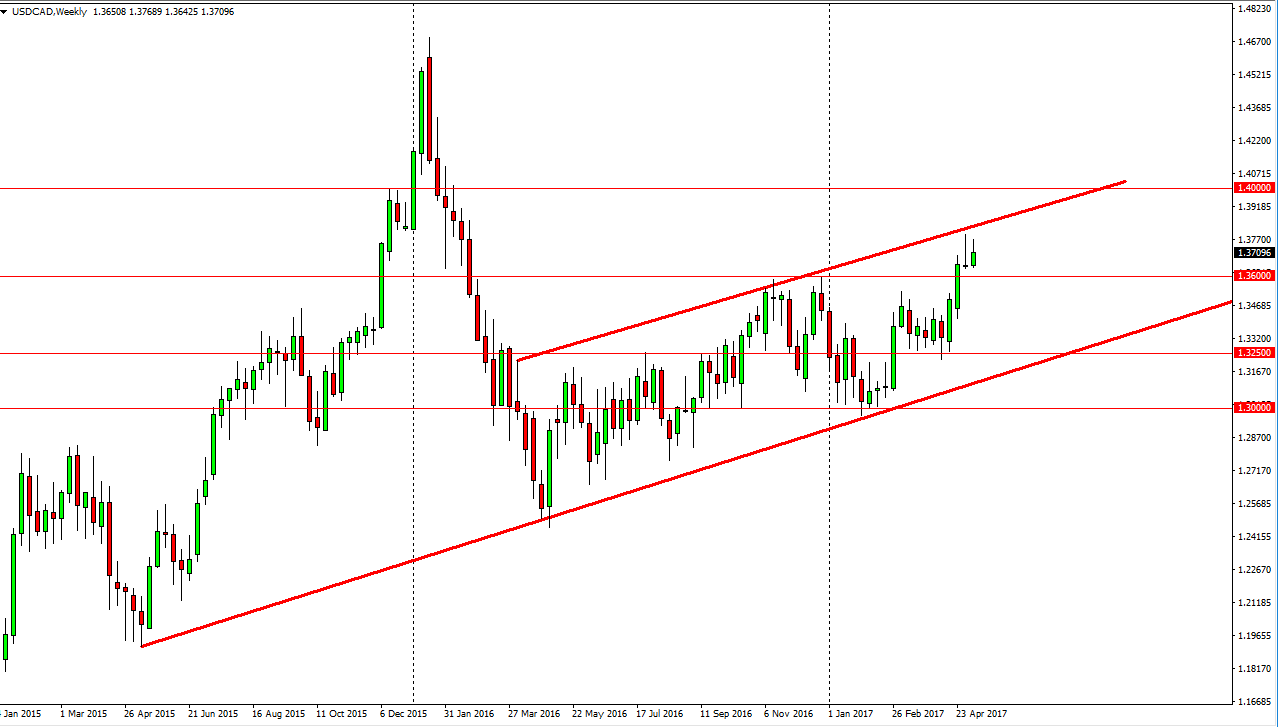

USD/CAD

The US dollar rallied again against the Canadian dollar during the previous week, but as you can see I have a channel drawn on the chart. On top of that, the previous candle on the weekly chart was a shooting star so I think we may struggle to go higher in the short term. I expect a little bit of a pullback this week but I also believe that the 1.36 level could offer support. If we break down below there, then we go much lower. Pay attention to oil, it will decide how much the Canadian dollar is worth.

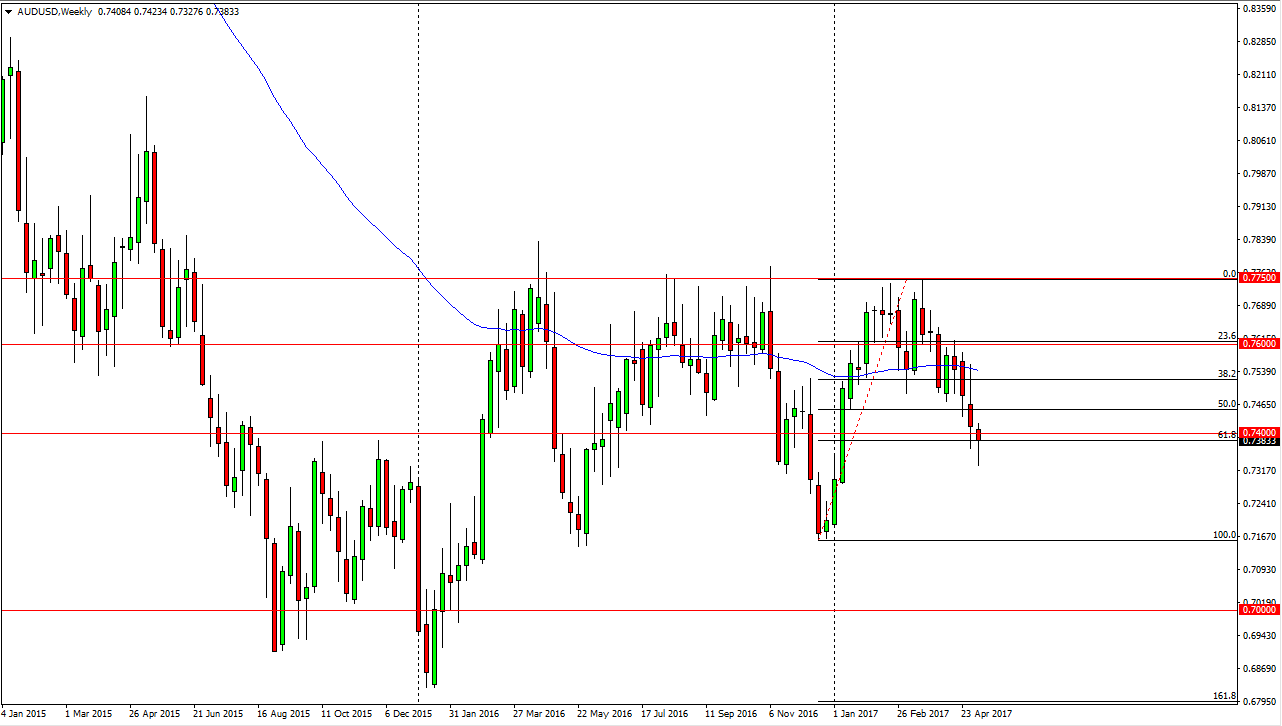

AUD/USD

The Australian dollar fell during most of the week, but found a bit of reprieve later in the week as gold markets rallied. The fact that we formed a perfect hammer at the 61.8% Fibonacci retracement level is very intriguing to me, and if we can break above the top of the range for the week I believe it’s a buying opportunity. However, the Friday candle was a shooting star so pay attention to if we can break down below the bottom of the hammer for the week, that would be very bearish and should send this market down to the 0.7150 level. This could be a very interesting week for the Aussie.

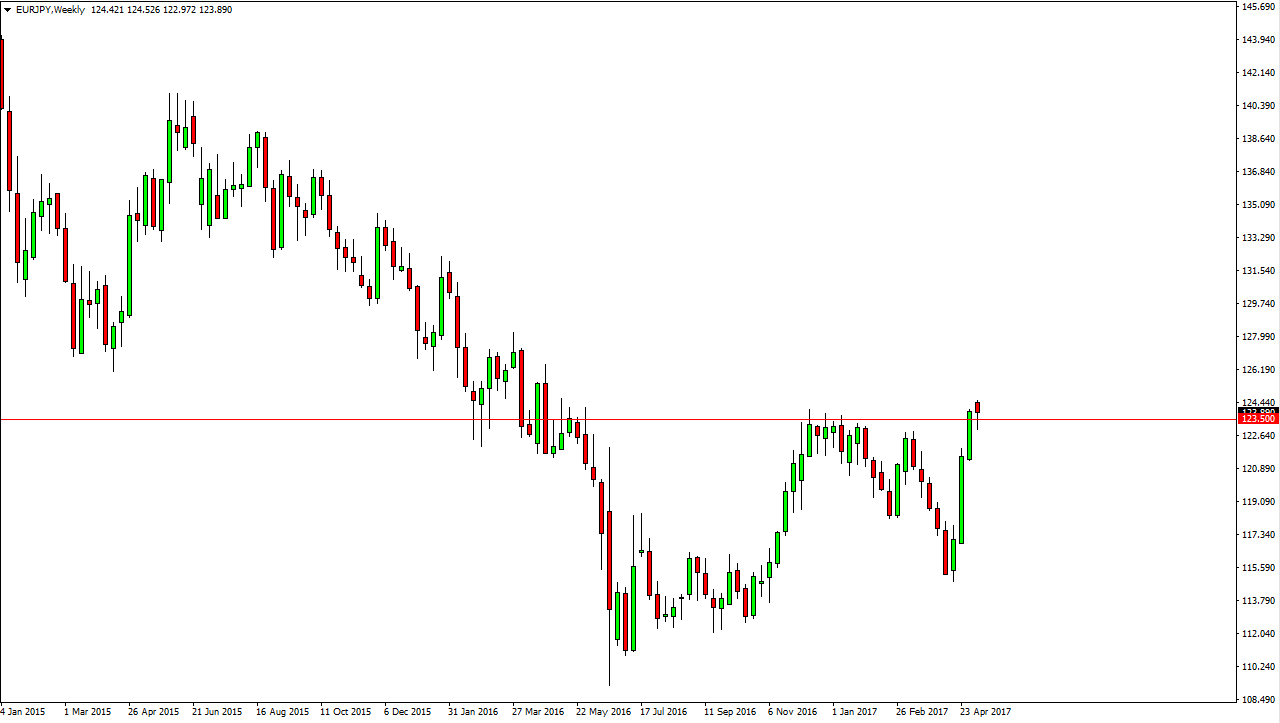

EUR/JPY

The EUR/JPY pair initially gapped higher at the beginning of the week, but then turned around to fall significantly. We found support below though, and formed a hammer on the weekly chart. The hammer of course is a bullish sign, and I think if we can break above the top of the range for the week, the market continues to reach towards the 125 level, and then eventually the 126.5 level. If we break down below the bottom of the range for the week, that could send this market down to the 120 handle.

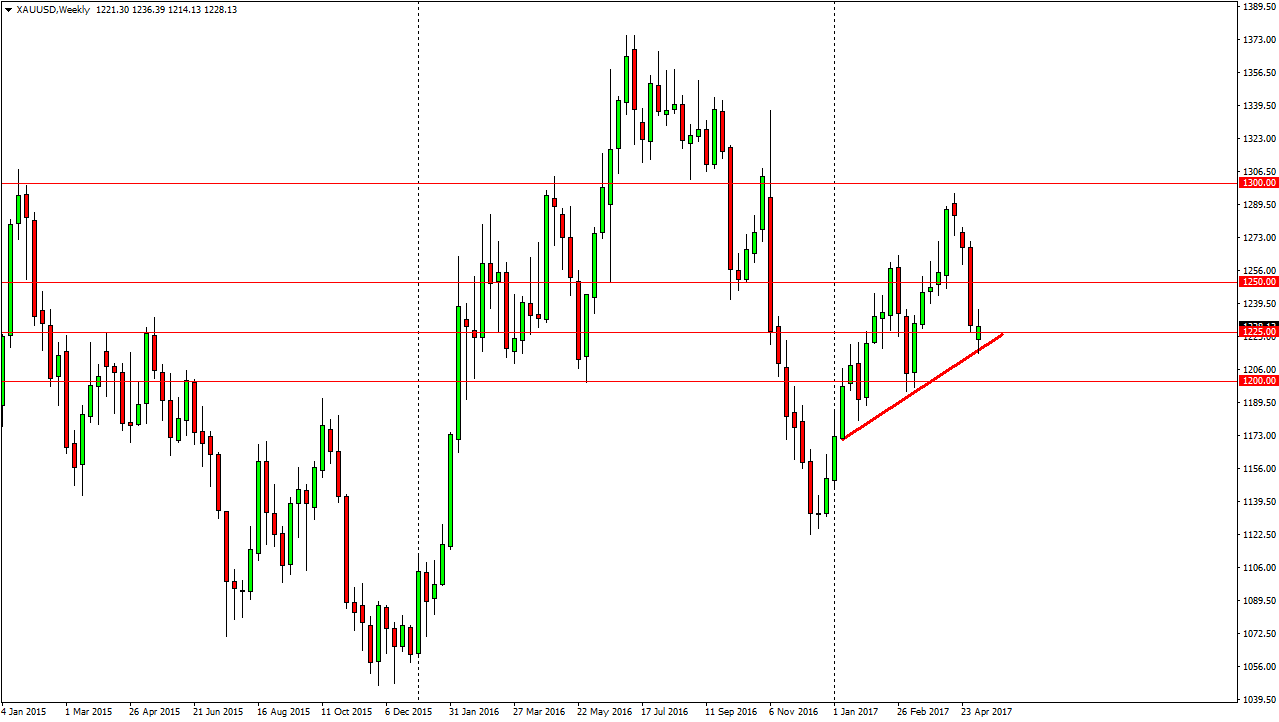

XAU/USD

Gold had a volatile week against the US dollar, initially shooting higher and then pulling back to form a bit of a negative candle as we bounced around just above the trendline as you can see. That of course is a bullish sign, but I need to see this market break above the weekly candle to start buying. Alternately, if we break down below the candle, that’s a very negative sign and send this market down to the $1200 level.