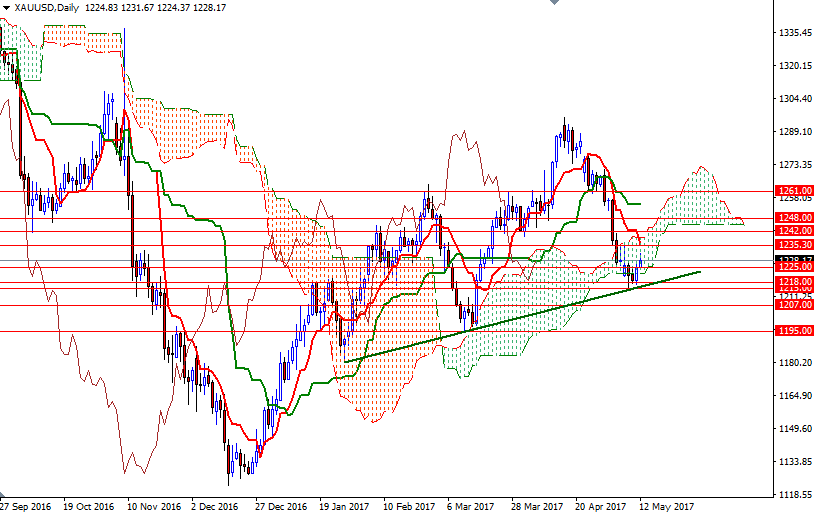

Gold prices rose for a second straight session and settled at $1228.17 an ounce on Friday as a series of economic data out of the world’s largest economy disappointed the market and weighed on the American dollar. The XAU/USD pair initially headed lower but found enough support in the $1218/5 area and moved back up, headed towards the 4-hourly Ichimoku cloud. Although Friday’s U.S. retail sales and consumer price index numbers fell short of market expectations, investors are still confidently expecting the Federal Reserve to raise interest rates at its next meeting.

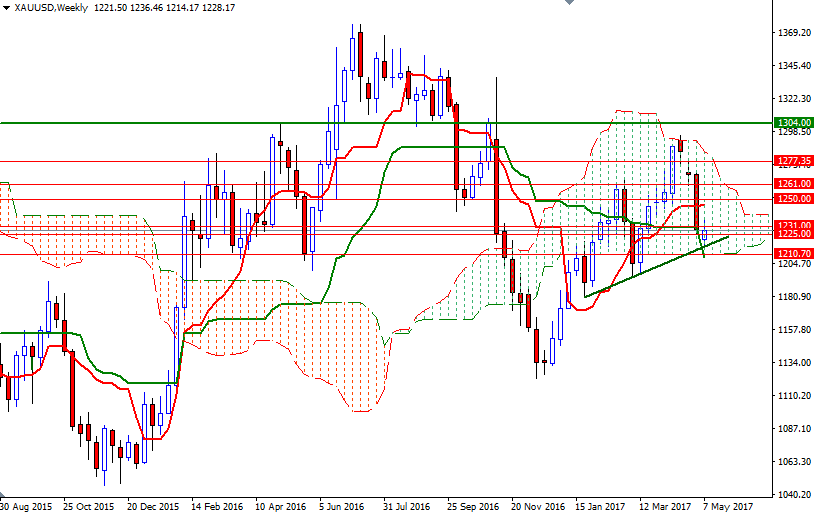

The prospect of additional rate hikes may prove a headwind for gold prices, but the strength in the euro (since political risks in the region waned) is another variable in the equation to pay attention. Some selling pressure in the U.S. stock market could also aid the bulls. From a chart perspective, trading below the area occupied by 4-hourly Ichimoku cloud suggests that higher prices will attract short-term sellers. However, I expect down swings to be limited until prices fall through 1210.70-1207, a key support converging with the bottom of the weekly cloud. Of course, in order to reach there, the bears have capture the bulls’ strategic camp in the 1218/5 zone first. Closing below 1207 paves the way for 1198/5.

To the upside, there are hurdles such 1231 and 1236.50-1235.30. XAU/USD has to pass through 1236.50-1235.30 to set sail for 1242. If the market anchors somewhere above the Ichimoku cloud on the H4 chart, it would be a sign of a stronger recovery and open a path to the next barrier in the 1250/48 area. A daily close above 1250 implies that the bulls are ready to march towards the 1261 level.