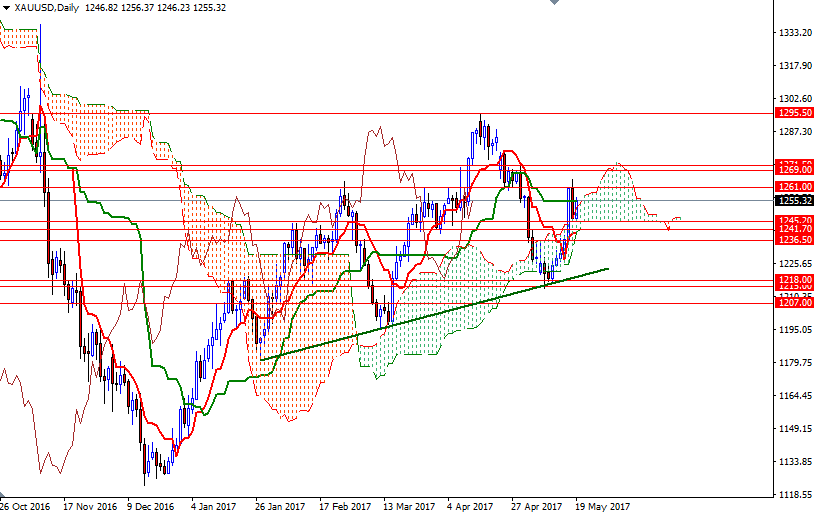

Gold prices settled at $1255.32 an ounce on Friday, gaining 2.23% on the week, as political turmoil in the U.S. and weakness in the dollar lent some support to the precious metal. The XAU/USD pair extended its gains after the market climbed above the top of the daily Ichimoku cloud, but failed to break through the resistive 1265/1 zone. While recent upbeat economic data backed expectations for faster growth in the second quarter and a Fed rate hike in July, fears that U.S. stocks may fall further are keeping investors nervous.

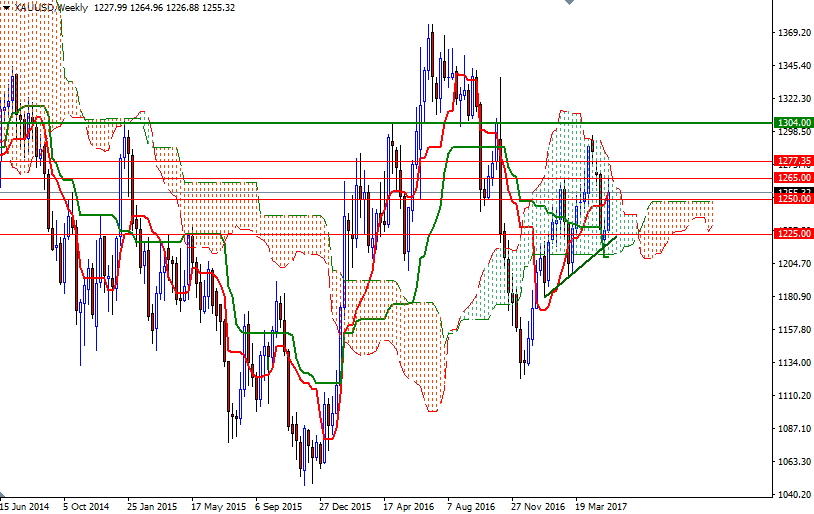

From a chart perspective, there are two things that catch my attention at first glance. Although the solid resistance in the 1265/1 area caused a pause in the upwards movement as expected, XAU/USD is currently residing above the Ichimoku cloud on both the daily and 4-hourly time frames.This outlook, along with the positively aligned Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line), suggests that the bulls have the medium-term technical advantage.

However, at this point, the market won’t have much room to go until prices pass through the aforementioned resistance in the 1265/1 area, the confluence of a horizontal resistance and the top of the weekly cloud. If XAU/USD convincingly climbs above 1265, then the next stop will be 1271.50-1269. A daily close above 1271.50 paves the way for a test of 1277.35-1276. Once beyond there, the bulls will be aiming for 1295/2. To the downside, keep an eye on the 1245.20-1241.70 area, where the bottom of the daily cloud and the Tenkan-sen converge. A break down below that area would be needed to give the bears short-term confidence. In that case, it is likely that the market will pay a visit to 1236.50-1235.30. This is a strategic support for the bears to capture if they intend to increase selling pressure and make an assault on the 1231-1229.50 region.