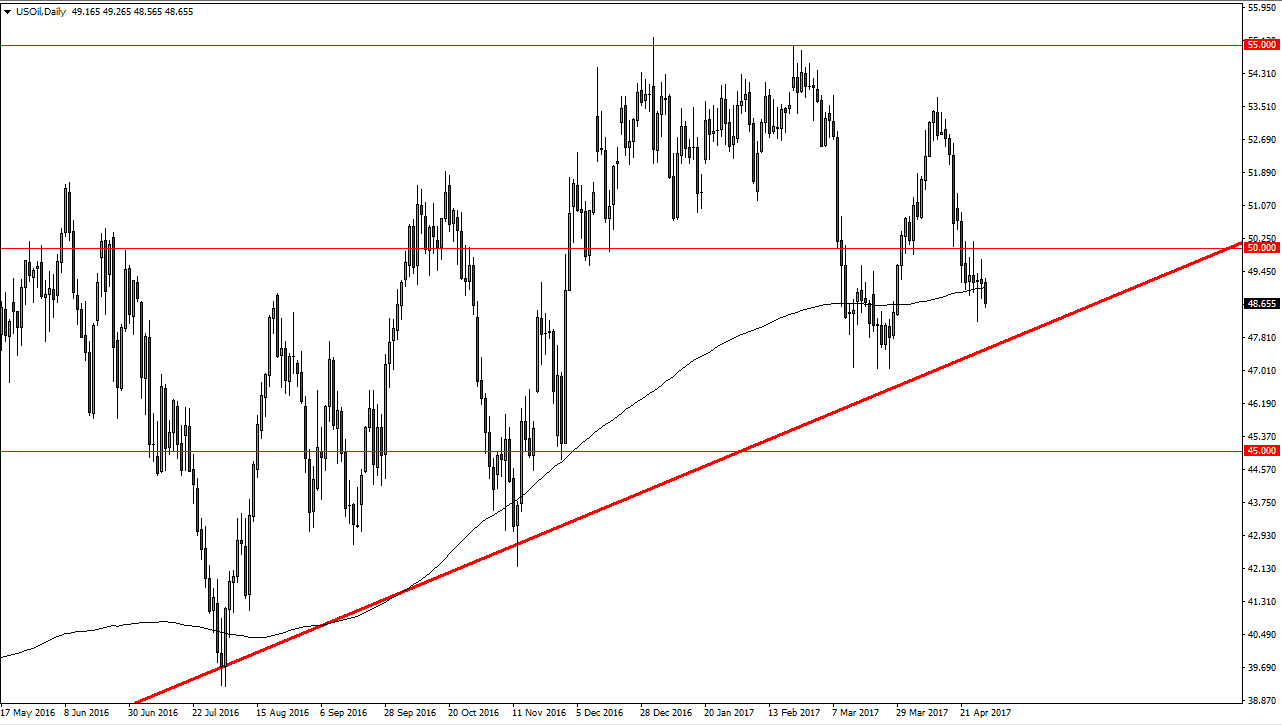

WTI Crude Oil

The crude oil market fell during the session on Monday, as traders came back to work. We are currently dancing around the 200 day exponential moving average, and dancing just above the uptrend line. That being the case, it’s likely that the market should continue to find buyers underneath but if we can break down below the $47.50 level, I think that the market will reach to the $45 handle. Alternately, if we can bounce off of the uptrend line, we will more than likely go looking for the $50 level at that point. There are a lot of moving pieces at the moment, but I believe it’s only a matter of time before the sellers will more than likely find another reason to get involved, be a breakdown or some type of exhaustion on a shorter-term chart.

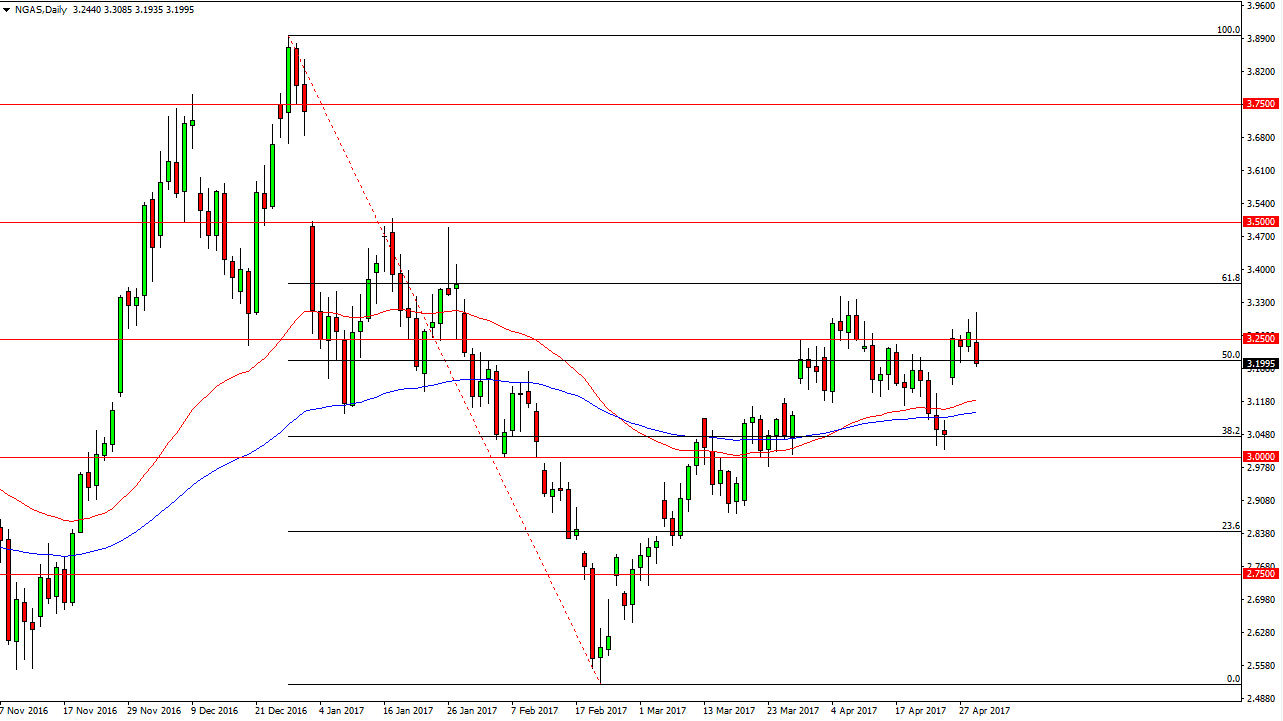

Natural Gas

Natural gas markets initially rallied on Monday, breaking well above the $3.25 level. The market turned back around to form a reasonably exhaustive candle, and I believe because of this we will more than likely drop to fill the gap below. However, we do have major moving average is just below, and that more than likely will offer a bit of support. A supportive candle underneath could be a nice buying opportunity as we clearly have had a lot of bullish pressure lately. Alternately, if we can break above the top of the shooting star like candle for the session on Monday, then I believe that the market will test the $3.33 level, or perhaps even breakout above there and reach towards the $3.50 level. Short-term traders might be able to short this market, but it is going to be difficult to hang on to the trade for any real length of time as the gap will more than likely attract a lot of volume.