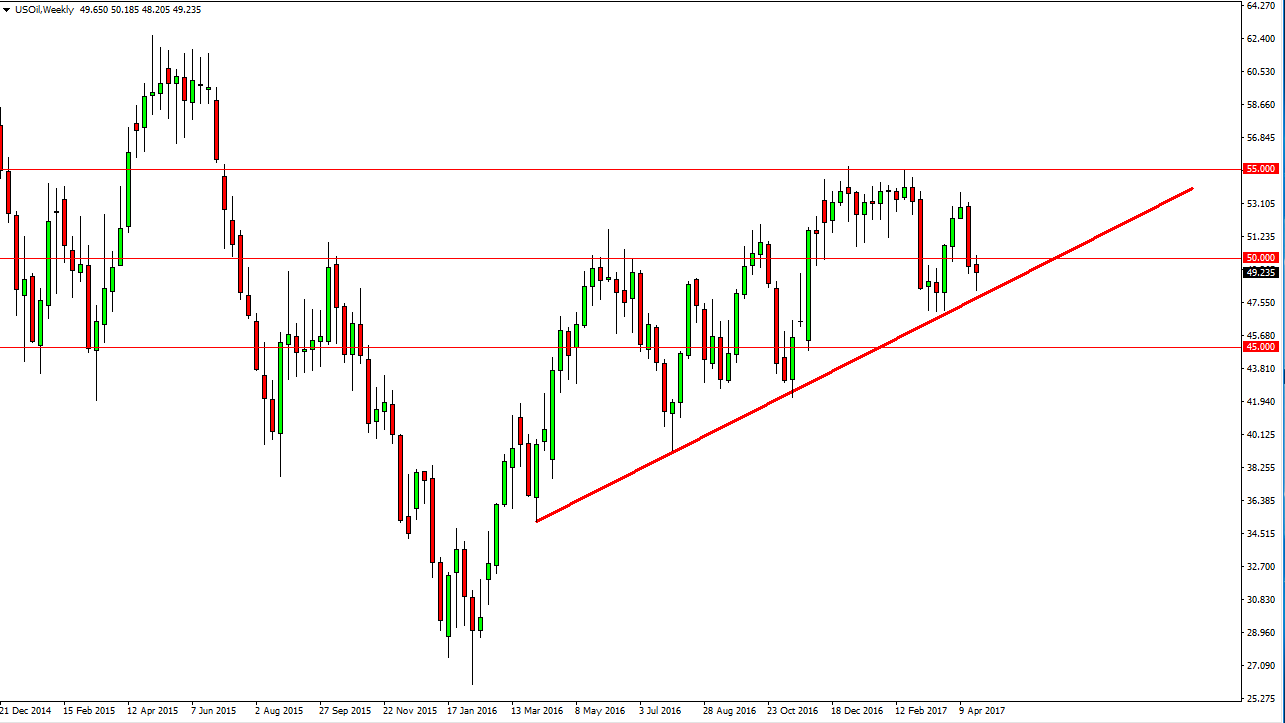

Without a doubt, one of the most interesting markets lately has been the WTI Crude Oil market, and the petroleum complex overall. There are a lot of moving pieces currently, and that makes the trading of the commodity very difficult. However, as we close out the month of April I notice something on the charts that gives me a little bit of a “heads up” as to what could happen next.

At the end of the last week of April, we had formed a hammer that sits just below the psychologically important and previously proven important $50 handle. The hammer of course is a bullish sign and it sits on top of a significant uptrend line that started it back in March 2016. Because of this, I believe that the next couple of weeks will be vital as to where this market goes next.

Patience will be needed

You will certainly have to wait until the market makes up its mind before putting money to work. However, I think if we can break down below the $47 level, the market will break down significantly and reach towards the $45 handle. I believe we will probably break down below there as well but there could be a significant bounce off that level as it should be psychologically important. Alternately, and a bit more obvious, if we break above the weekly candle from the fourth week of April, which is obsessively breaking above the $50 level, I think that the market should continue to go higher, perhaps reaching towards the $55.

A lot of this will come from whether traders believe in the OPEC production cuts, which currently look a bit shaky at best. Also, you’re going to have to watch the inventory numbers every week as per usual, because we have a real battle going on.