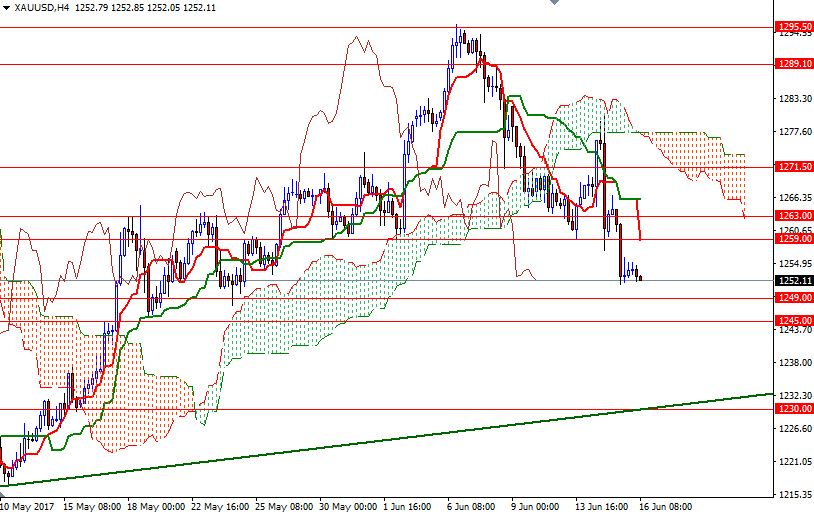

Gold prices fell $6.75 an ounce yesterday, extending losses from Wednesday’s session, and touched the lowest level in nearly four weeks on technical selling and as the dollar continued to appreciate. The XAU/USD pair retreated to the $1250.70-$1249 area as expected after the $1260/59 support gave way. Today the market is trying to stay above $1250.70 for a rebound to this broken support.

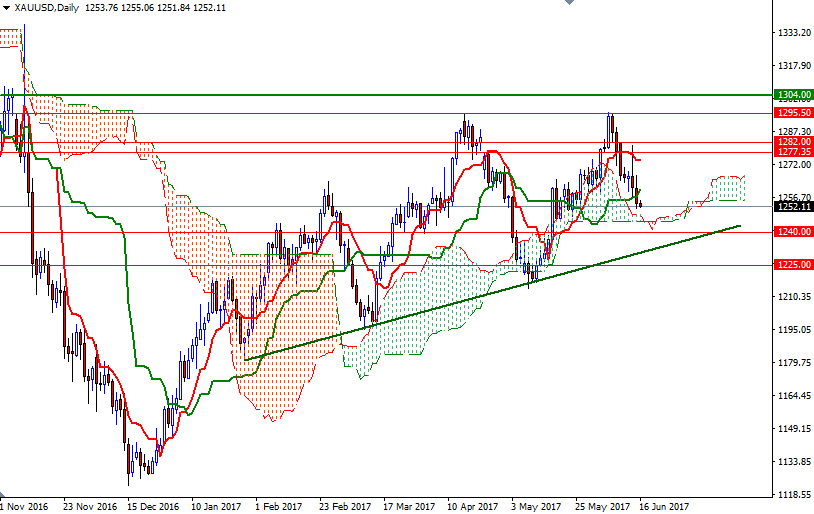

XAU/USD is trading below the Ichimoku cloud on the 4-hour time frame. We have negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines, along with a Chikou Span (closing price plotted 26 periods behind, brown line)/Price cross in the same direction. All these suggest that the bears have the near-term technical advantage. However, the market has to get down below 1249 to test the 1245 level, the bottom of the daily cloud. If this support is broken, then the 1240 level, which happens to be the top of the weekly cloud, will be the next stop.

The bulls have to lift prices back above the 1260/59 zone if they don’t intend to give up. In that case, I think they will an opportunity to challenge the bears waiting in the 1266/3 region. A daily close beyond 1266 implies that the market is about to march towards the 1271.50-1269 area, the bottom of the 4-hourly cloud.