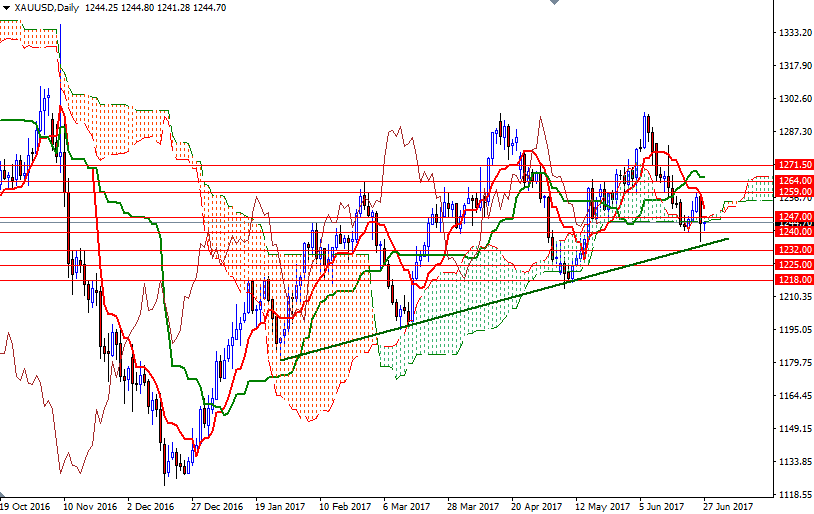

Gold prices fell $12.75 an ounce on Monday, surrendering the majority of the gains made over the past three sessions, as the dollar firmed ahead of a speech by Federal Reserve Chair Janet Yellen. Despite weaker-than-expected durable goods orders numbers, expectations that Janet Yellen will maintain a positive outlook on the U.S. economy weighed on the market. XAU/USD headed towards the bullish trend-line after prices dropped below the $1249-$1247 area, but found support around there and closed the day above the $1240-$1239 support.

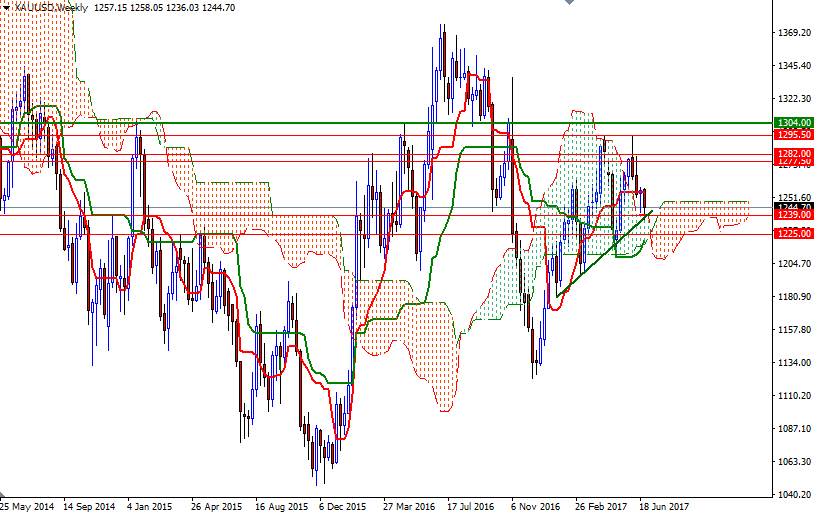

For the last couple of weeks, since the market failed to climb back above the Ichimoku clouds on the 4-hour chart, I have been emphasizing the possibility of a drop towards the medium-term trend-line originating in January. Apparently the market is trying to hold above this strategic area today, but the 4-hourly cloud continues to be resistive. At this point, I think the bulls have to push prices back above the 1250/47 area, where the bottom of the cloud, the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) converge in order to test the 1255/4 zone. Once above there, we could possibly see the bulls making a run for 1260.50-1259.

However, if the bears increase pressure and drag prices below 1240/39, then it is likely that the market will test 1236/4. Down below, keep an eye on the anticipated support zone between 1232 and 11230. A break below there could send prices back to the 1225 level.