Gold prices ended slightly higher Tuesday but the trading range was relatively tight as investors awaited the outcome of the Federal Reserve’s two-day policy meeting. The prospect of higher interest rates worked against the precious metal but expectations of a dovish statement limited the downside. The XAU/USD pair swung between the $1260 and the $1269 levels.

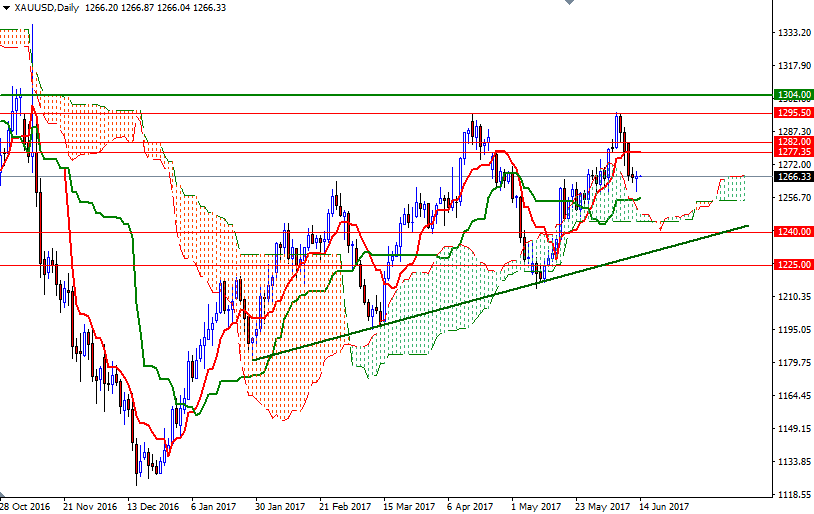

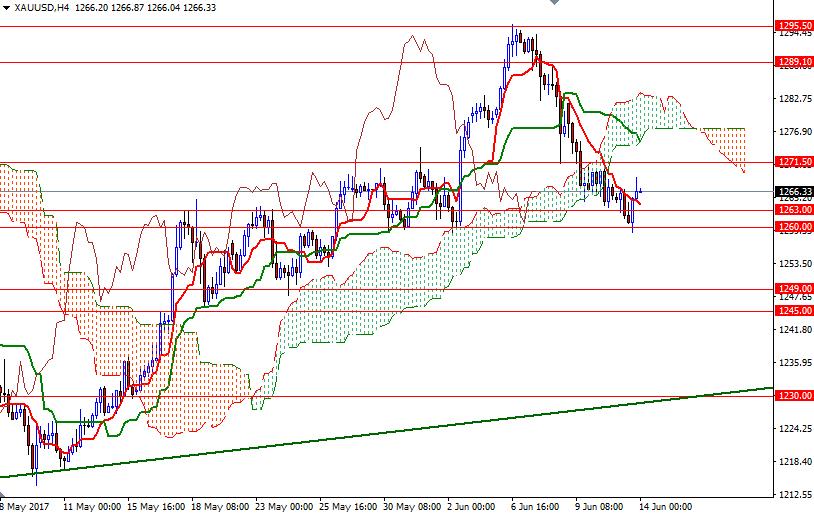

The U.S. central bank will publish updated economic projections, and Chair Yellen is scheduled to give a post-meeting press conference. Traders are also keen to see if the Fed provides more details on its plans to shrink the size of its balance sheet this year. While trading above the daily and the weekly Ichimoku clouds suggest the bulls have the medium-term technical advantage, residing below the clouds on the H4 chart implies that prices could see downside risks in the near term.

However, as I mentioned in my previous analysis, XAU/USD has to get down below 1260/59 in order to test the 1254.50 support level. If this support is broken, then the 1250.70-1249 area will be the next stop. To the upside, the initial resistance stands in the 1271.50-1269 area. The bulls will have to push through this barrier if they intend to make an assault on the 1277.50-1275 zone. Beyond there, the bears will be waiting in the 1283/2 region. A daily close above 1283 would be a sign of a stronger bullish recovery, suggesting a move up to 1289.10-1288.