The gold market was rather volatile last month. Prices dropped to the critical $1215 level, the confluence of a horizontal support and a medium-term bullish trend line, but ultimately found strong support there to climb all the way back to the $1271.50-$1269 area, leaving a long lower shadow on the monthly candle. The weakness in the dollar, political uncertainty in Washington and worries over the UK general election have recently bolstered demand for the precious metal.

The UK will have a general election on 8 June and the latest polls shows that the gap between the two major parties is narrowing. After the elections market players will turn their attention to the U.S. Federal Reserve’s policy meeting. Friday’s disappointing monthly jobs report raised doubts about the path for higher interest rates, but the majority of investors still believe it is very likely that the Fed will raise borrowing costs later this month.

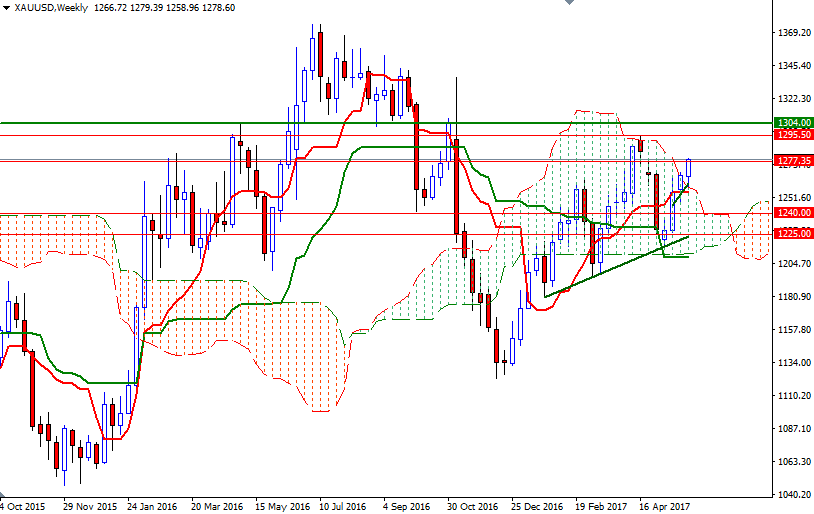

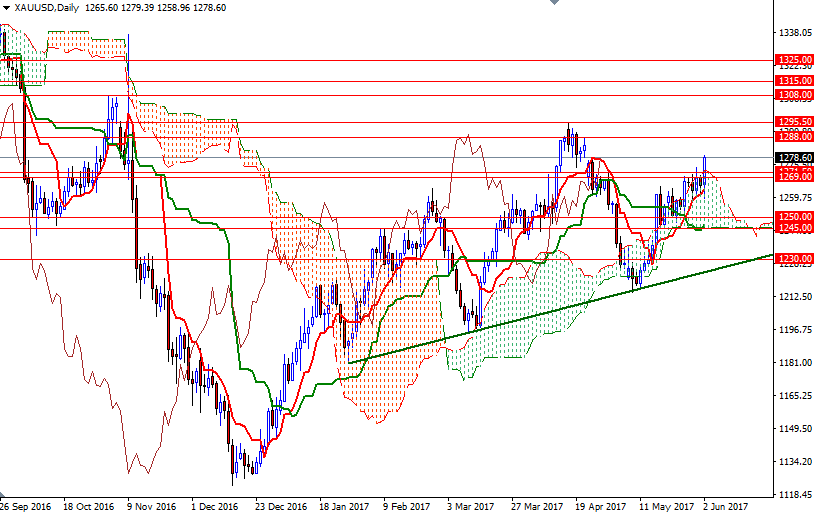

From a chart perspective, it appears that there will be more upside price action this week. The market is residing above the Ichimoku clouds on almost all time frames and we have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines. However, there are tough challenges ahead such as 1288 and 1295/2, so these barriers can trigger profit taking and fuel downside momentum ahead of the FOMC meeting. In other words, this month could be as volatile as the previous one, especially in case the Fed hints further monetary policy tightening in September. The bears have to eliminate the support in the 1259/8 area to pull prices back to 1245 level. If XAU/USD fails to hold above there, 1240/39 and 1230/25 will be the next targets. On the other hand, if the bulls continue to dominate the market and push prices successfully beyond 1295.50, then the 1308/4 area may be tested. Breaking up above there on a weekly basis means the market will be aiming for 1315 and 1325.