Gold prices fell to a one-month low on Monday as the US dollar continued to strengthen following more hawkish rhetoric from last week’s Federal Reserve meeting. Gains in US equities also made gold less attractive. The S&P 500 and the Dow industrial average hit record highs as a rebound in technology shares encouraged investors. There is no major economic data which is due for release this week for the US so speeches by Federal Reserve officials will likely dominate headlines.

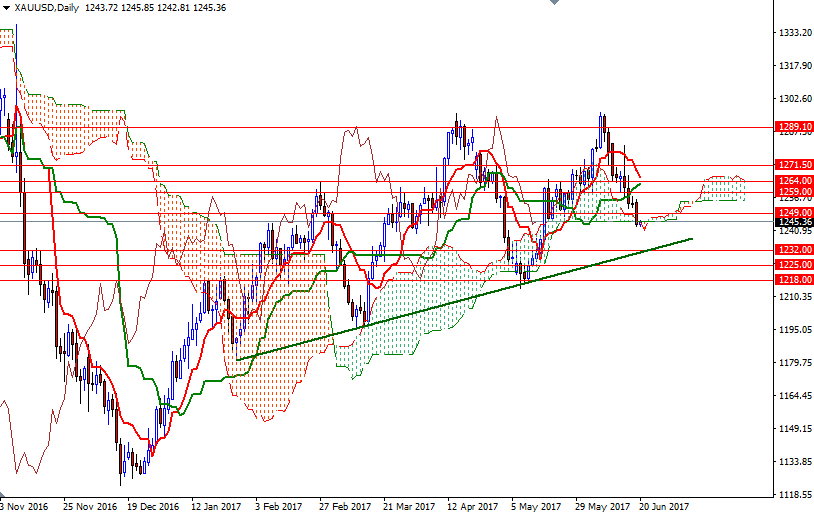

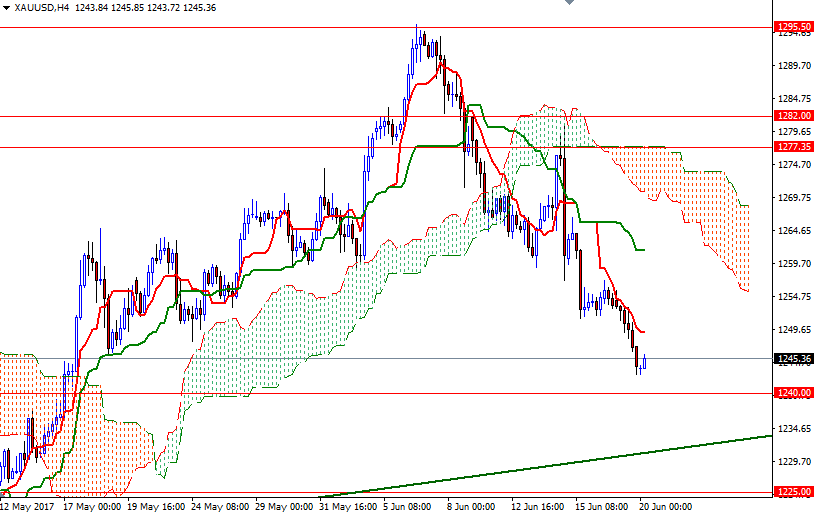

From a chart perspective, trading below the Ichimoku cloud on the 4-hour chart suggests XAU/USD is still vulnerable to the downside. As I pointed out in my weekly analysis, there is a possibility that prices will test the medium-term bullish trend-line before reversing its course. However, beware that prices are just around the daily cloud and the top of the weekly cloud is right below at 1240.

If XAU/USD finds support in the vicinity, expect a rebound towards the 1251/49 zone. The bulls need to push the market above 1251 to visit 1254. A successful break up above 1254 brings in 1260/59. On the other hand, if prices drop through 1240/39, then look for further downside with 1236/5 and 1232/0 as targets. Closing below the 1230 level on a daily basis suggests the bears are getting ready to challenge 1225.