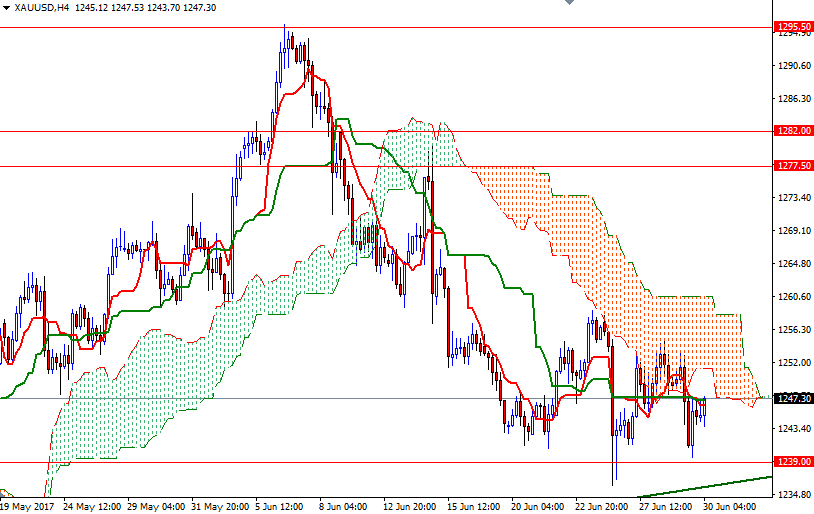

Gold prices ended Thursday’s session down $4.32 an ounce but remained within the trading range of the past two weeks. XAU/USD tested the $1240-$1239 area after the market failed to get back above the $1254 level. So far prices were unable to penetrate the Ichimoku cloud on the 4-hour chart, while buying interest near the $1240 level put a floor in trading range.

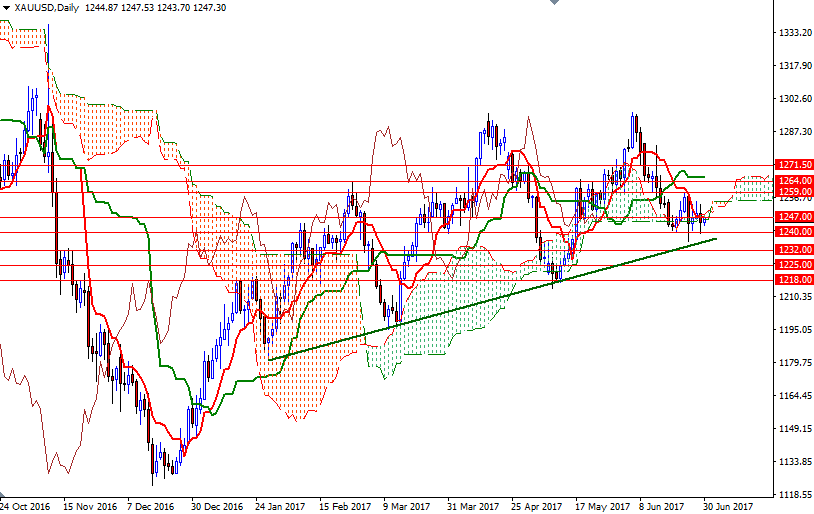

Downside risks remain as the market trades below the 1260.50-1259 area, the confluence of a horizontal resistance and the top of the 4-hourly cloud, though prices don’t have much room to go until we break down below the medium-term bullish trend-line. The bears will need to capture 1240/39 and 1236/4 to tackle the strategic support in the 1232/0 zone. A successful drop below 1230 could foreshadow a move to 1225.

To the upside, the initial resistance stands at 1254, followed by 1260.50-1259. Closing above 1260.50, at least on a daily basis, is essential for a bullish continuation towards 1273.50-1271.50. On its way up, expect to see resistance between the 1264 and the 1266 levels.