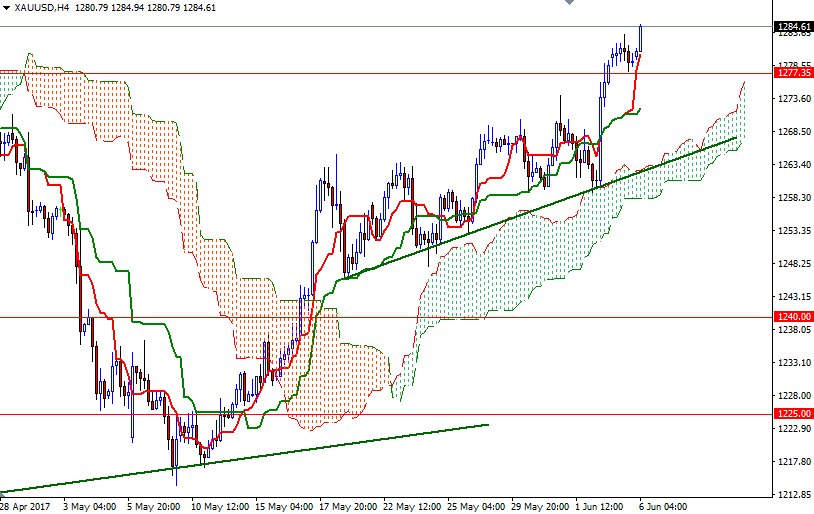

Gold prices ended a choppy, two-sided trading session slightly lower yesterday, but ultimately found support just above the 1277.35-1276 area. Confirming that this previous resistance, which was broken on Friday, now flipped to support encouraged buyers and pushed prices higher in the Asian session today. Geopolitical tensions in the Middle East and upcoming elections in the U.K. should continue to be supportive but bear in mind that the ECB policy meeting this week could cause extra volatility.

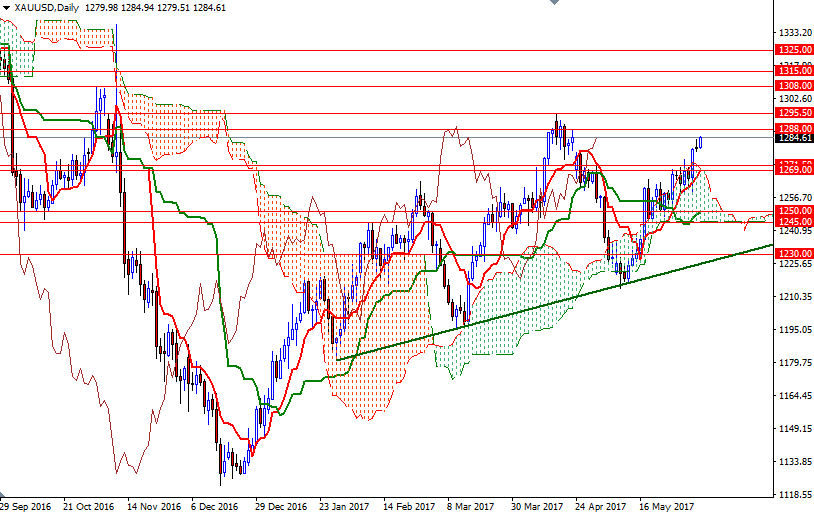

XAU/USD is trading above the Ichimoku clouds on the weekly, the daily and the 4-hourly charts and the Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) are positively aligned, indicating that the bulls still have the medium-term technical advantage.

It looks as if the market will test the initial resistance at 1288 today. Penetrating this barrier cloud could prolong the bullish momentum and open a path to 1295.30-1292. Gold needs to close above 1295.30 to gather momentum for 1308/4. On the other hand, a successful drop below the 1277.35-1276 support zone could foreshadow a move to 1269/8. The bears have to drag the market below there if they intend to increase pressure and challenge the bulls waiting in the 1265/3 area.