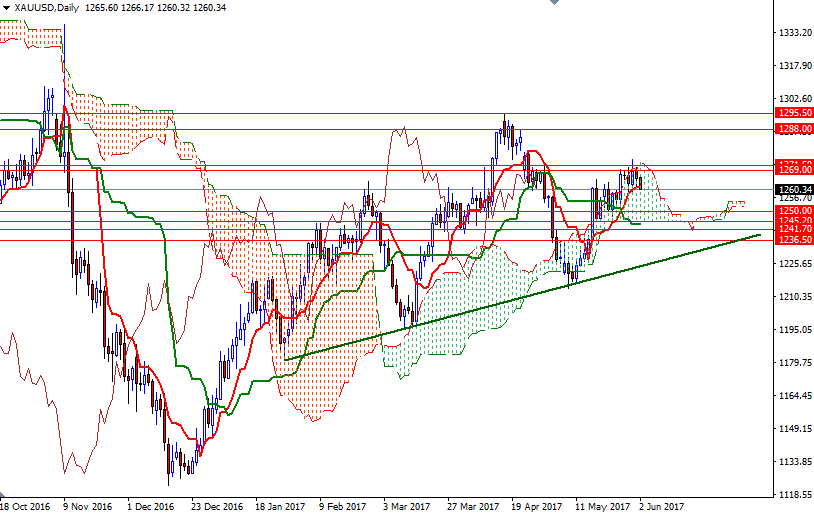

Gold prices fell $3.41 an ounce on Thursday as better-than-expected U.S. economic data, which supported the case for a Federal Reserve interest rate hike this month, led to a bounce in the dollar. The market was not able to break through the resistance in the $1271.50-$1269 area, and ultimately extended its losses after prices pierced below a support in the $1265-$1263 region. The XAU/USD pair is currently trading at $1260.34, lower than the opening price of $1265.60.

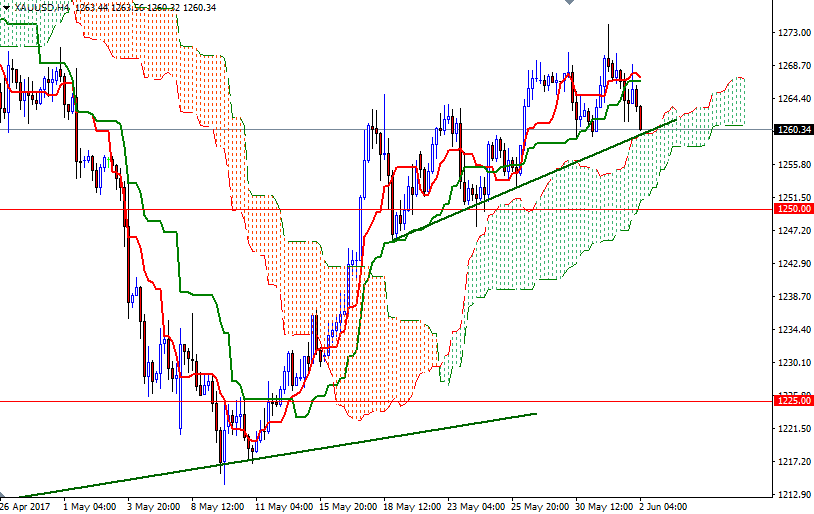

It appears that the market is going to test the support at the 1259 level where the top of the 4-hourly Ichimoku cloud and a short-term bullish trend coincide. The bears have to overcome this barrier so that they can make a move to 1256.50-1254. The area occupied by the cloud on the H4 chart should be supportive, so we need to get down below there to visit the 1251/0 zone. If this support is broken, the 1245 level will be the next target.

However, if the 4-hourly cloud hinders the bears’ progression, we may see a rebound to 1265/3. The bulls will need to push prices back above there to approach the critical 1271.50-1269 area. A break up above 1271.50 could give the bulls the extra fuel they need to reach the 1277.35-1276 zone.