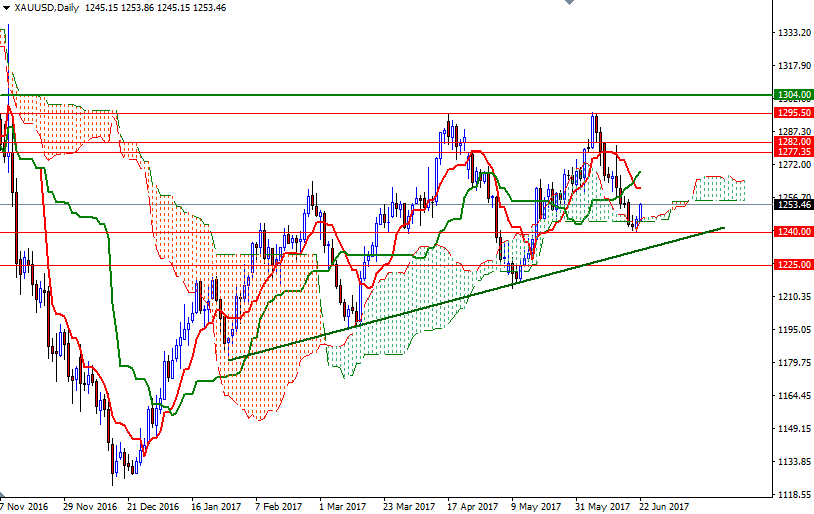

Gold prices ended Wednesday’s session up $3.82 an ounce, snapping a four-day losing streak, as a retreat in the dollar sparked some short-side profit taking. The XAU/USD pair has dropped nearly 4.1% since the market peaked at $1296. After testing the $1242-$1240 support zone for the second time yesterday, the precious metal has managed to break through the $1251-$1249 area in early Asian session today and reached the $1254 level as anticipated.

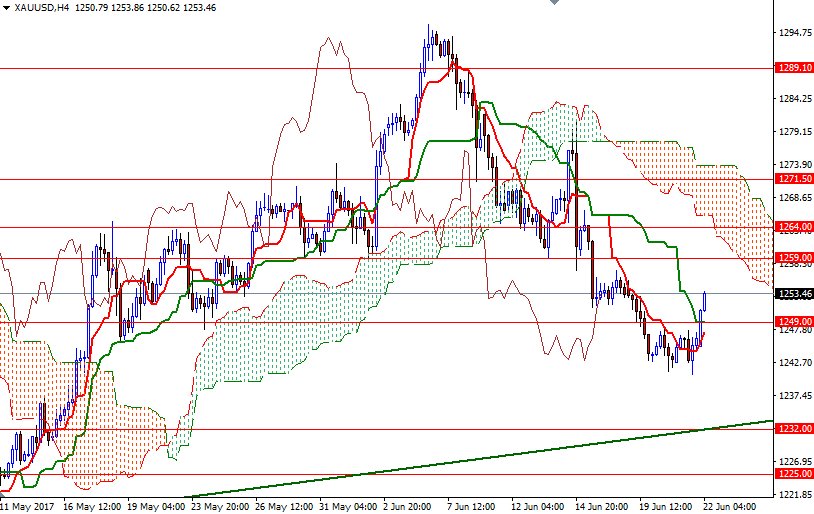

This reaction pushed prices above the Ichimoku cloud on the hourly chart but it seems that the market is stalling near the 1254 level, which represents the 23.6% retracement of the fall from 1296 to 1240.70. Although holding the initial key support above 1240 (the top of the weekly cloud) is a positive sign, prices are still below the cloud on the 4-hour chart, and XAU/USD has to penetrate 1254 in order to approach there. If the bulls are able to break through 1260/59, then 1262 and 1264 will be the next targets.

To the downside, keep an eye on the 1249/7 zone, where the the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are located on the H4 chart. If prices drop back below 1247, it is likely that we will revisit the 1242/0 area. A daily close below 1240 would encourage a sell-off towards 1232/0.