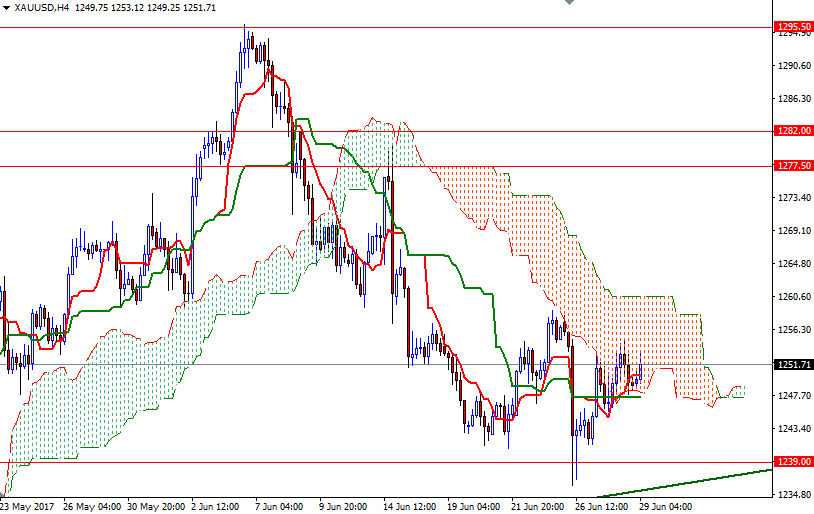

Gold inched higher on Wednesday as the dollar’s weakness persisted but a strong session for equities did limit buying interest. XAU/USD tested the initial barrier at around the $1254 level, but was not able to penetrate. As a result, prices returned to the bottom of the Ichimoku cloud on the 4-hour chart.

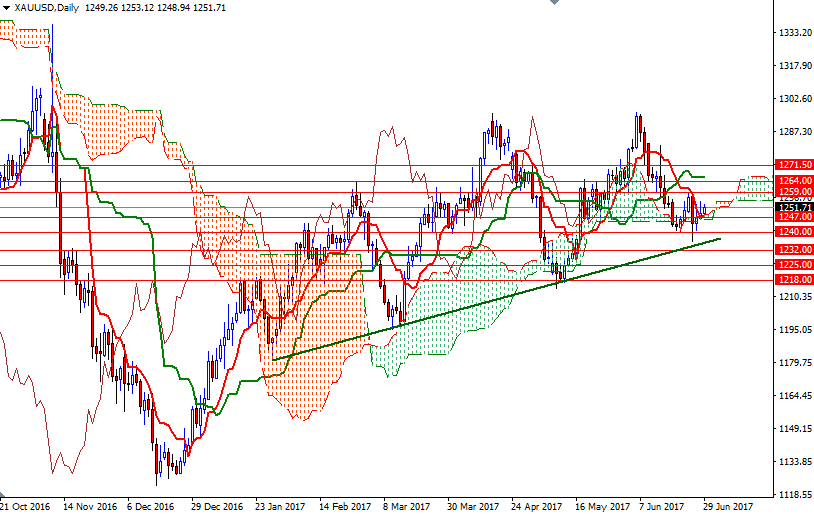

Prices are above the clouds on the daily and the weekly time frames, indicating that the bulls have the medium-term technical advantage. However, the market is still trapped inside the 4-hourly cloud. These clouds not only identify the trend but also represent support and resistance zones. Basically, the overall trend is up when prices are above the cloud, down when prices are below the cloud and flat when they are in the cloud itself. At this point, another thing to pay attention is that both the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are completely flat, pointing out a lack of momentum.

It seems that the bulls want to challenge the 1254 level again today. If the market can confidently get above there, it has the potential to proceed to the 1260.60-1259 area, where the top of the 4-hourly Ichimoku cloud sits. A break through there brings in 1264. On the other hand, if the bears take over and push XAU/USD below 1247/6, then we may see a drop to 1240/39. Falling through this support could would open up the risk of a move towards the 1236/4 zone.