Gold prices ended higher on Wednesday, erasing all of the previous day’s losses, as the dollar edged lower. The precious metal’s gains, however, were limited by expectations the U.S. Federal Reserve will hike interest rates this month. The market initially tested the support around the $1259 level before heading back to the $1271.50-$1269 area.

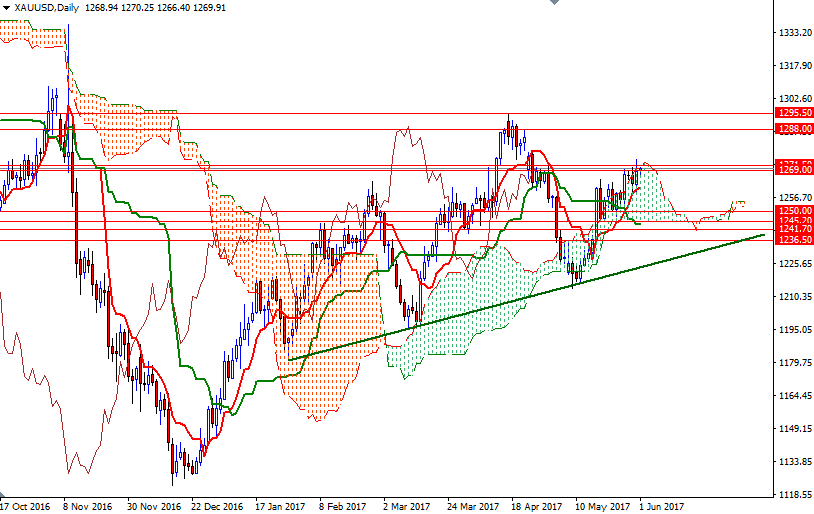

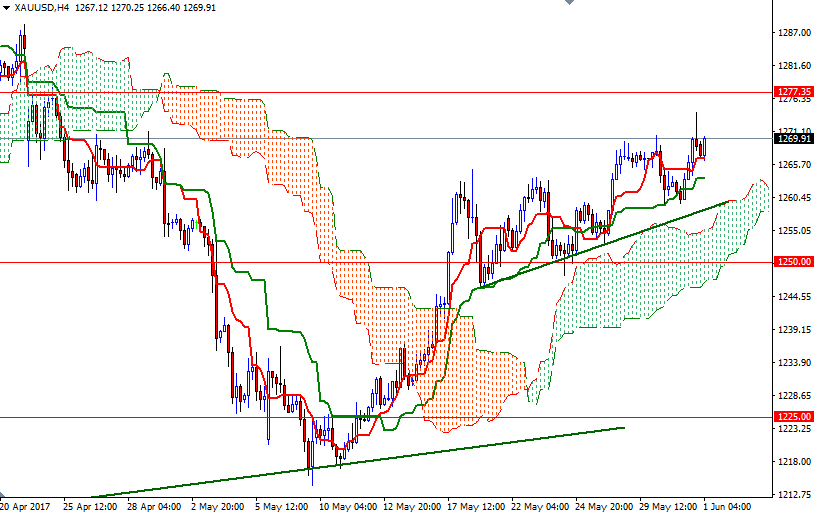

The XAU/USD pair is challenging this barrier again today, but it appears that market players are hesitant to go heavily long ahead of highly anticipated U.S. jobs data. The bulls still have the medium-term technical advantage, with the market trading below the Ichimoku clouds on the weekly and the 4-hourly time frames, but where prices will go in the short-term depends on the outcome of the test of 1271.50-1269.

The candlestick with a tall upper shadow (4-hour chart) suggest that we shouldn’t rule out a pull back to 1265/3 if the market fails to climb above 1271.50. The bears will need to capture this camp in order to make an assault on the 1259 level, which happens to be the top of the 4-hourly cloud. A break down below there implies that 1256.50-1254 will be the next target. On the other hand, if XAU/USD convincingly penetrates 1271.50-1269, then we may see the bulls making a fresh attempt to 1277.35-1276. A daily close above 1277.35 makes me think that the market is getting ready to tackle 1283/2.