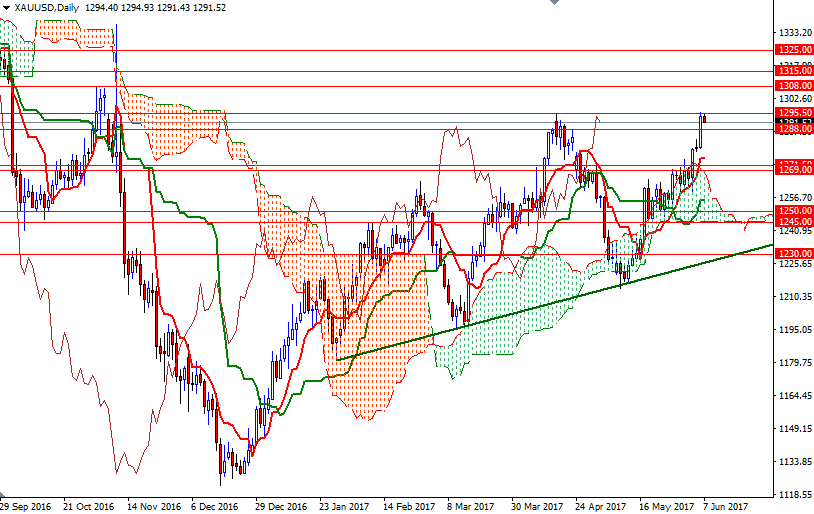

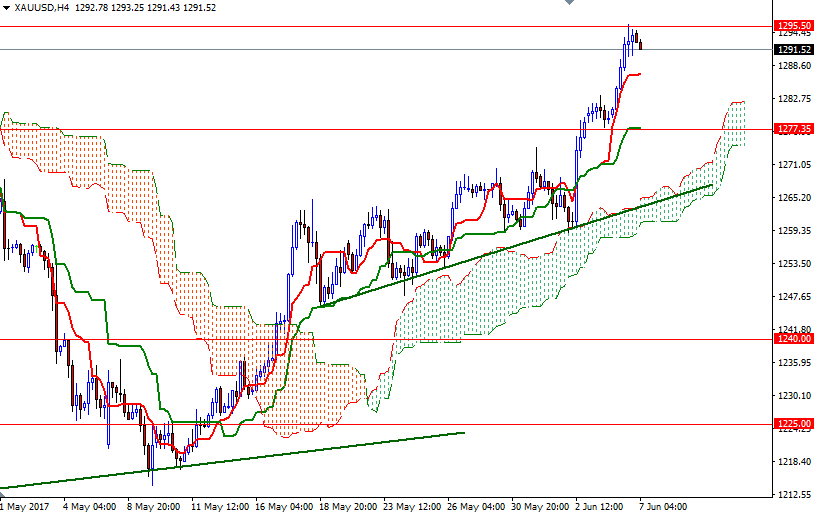

Gold prices rose $14.01 an ounce on Tuesday, hitting the highest level since November 9, as investors sought safety from tensions in the Middle East, upcoming British election and the European Central Bank policy meeting. The XAU/USD pair extended its gains after the broken $1277.35-$1276 resistance flipped to support and pushed prices higher, but not surprisingly the resistance at 1295.50, which caused the market to reverse back in mid-April, saw some profit taking. Gold is currently trading at $1291.52, lower than the opening price of $1294.40.

From a short-term perspective, it would make sense to keep an eye on the 1290 level, which happens to be the Kijun-Sen (twenty six-period moving average, green line) on the H1 chart. If prices drop below there, the market will tend to retreat towards the 1288-1286.40 area, where the bottom of the Ichimoku cloud on the M30 time frame sits. The bears will have to push prices back below there in order to revisit the 1283/2 zone.

To the upside, the initial resistance stands at the 1295.50 level. If the bulls can capture this strategic camp, look for further upside with 1300 and 1308/4 as targets. Closing beyond this solid technical resistance would signal a push up to 1315.