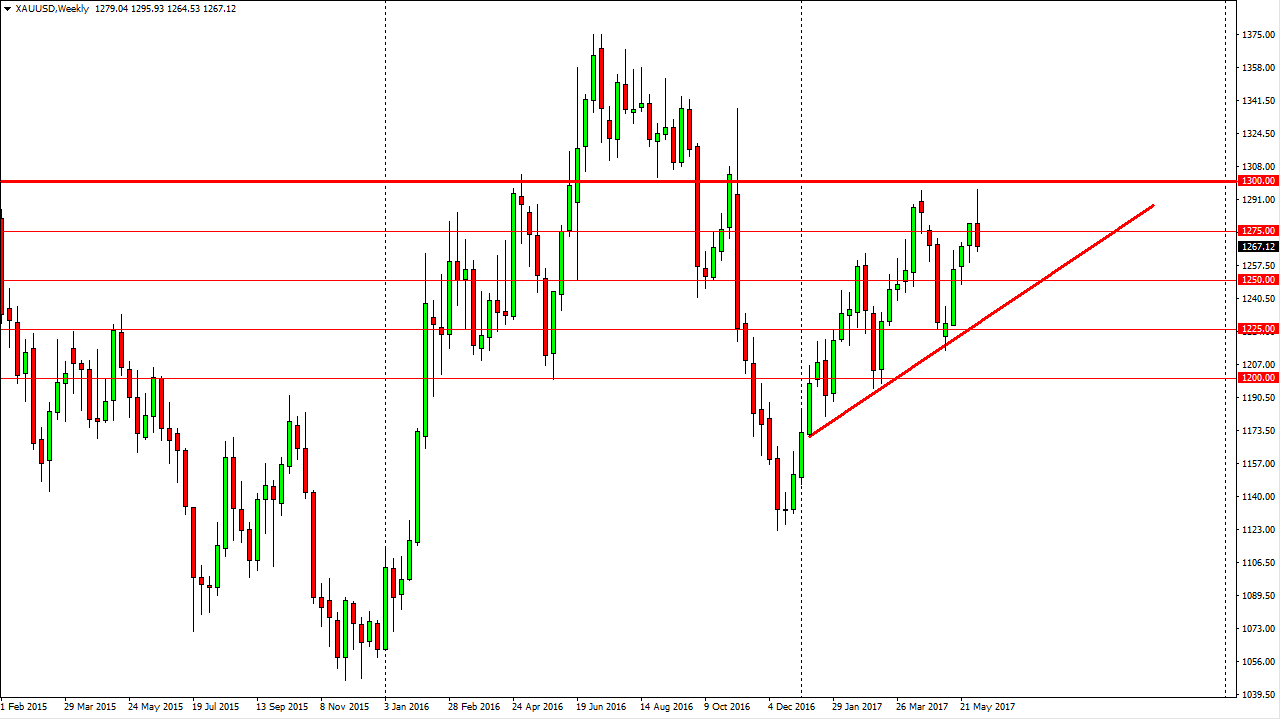

Gold

Gold markets initially tried to rally during the week, but found enough resistance near the $1300 level to turn around and form a massive shooting star. You can see that I have an uptrend line underneath, and I believe that we are going to go looking for support below. I think that eventually we will get buyers in this market, but in the short term I suspect that we will see some bearish pressure.

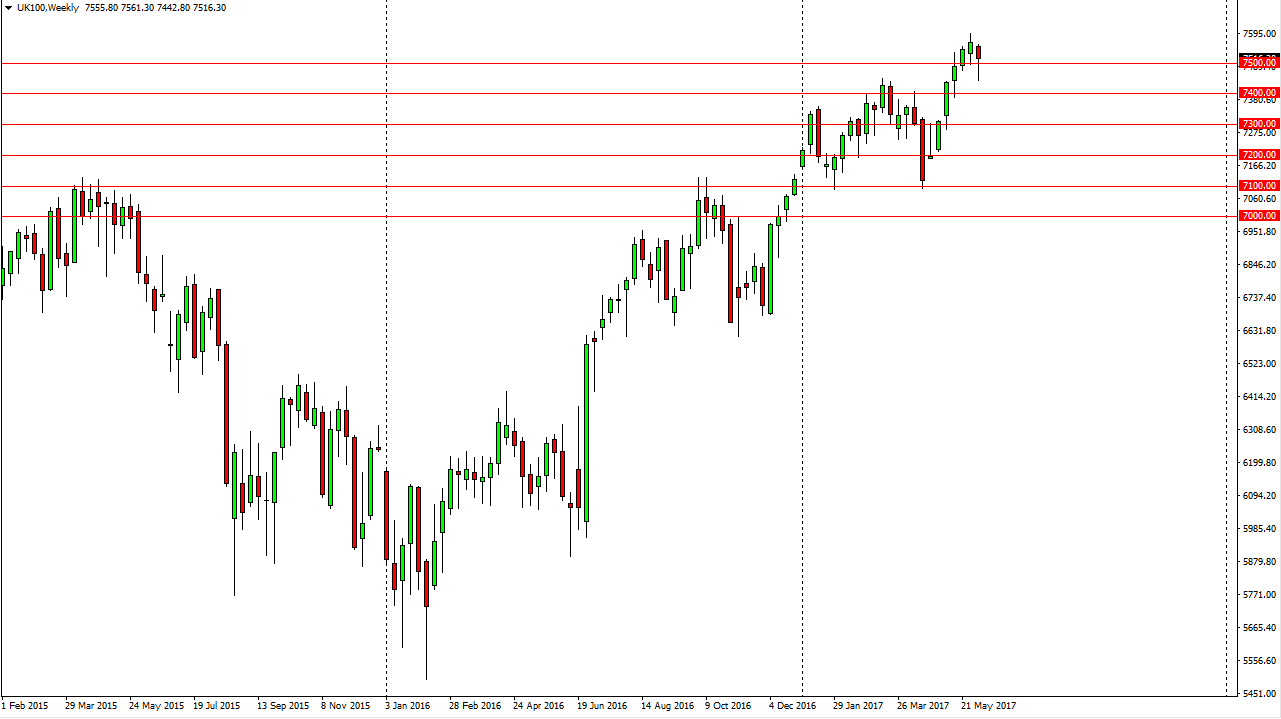

FTSE 100

The FTSE 100 fell significantly during the week, but turned around to break above the 7500 level. Ultimately, the weekly candle was a hammer. That being the case, the market looks as if it is ready to go higher, and therefore I think that every time we drop from here, the buyers will return to take advantage of what has been an extraordinarily strong uptrend.

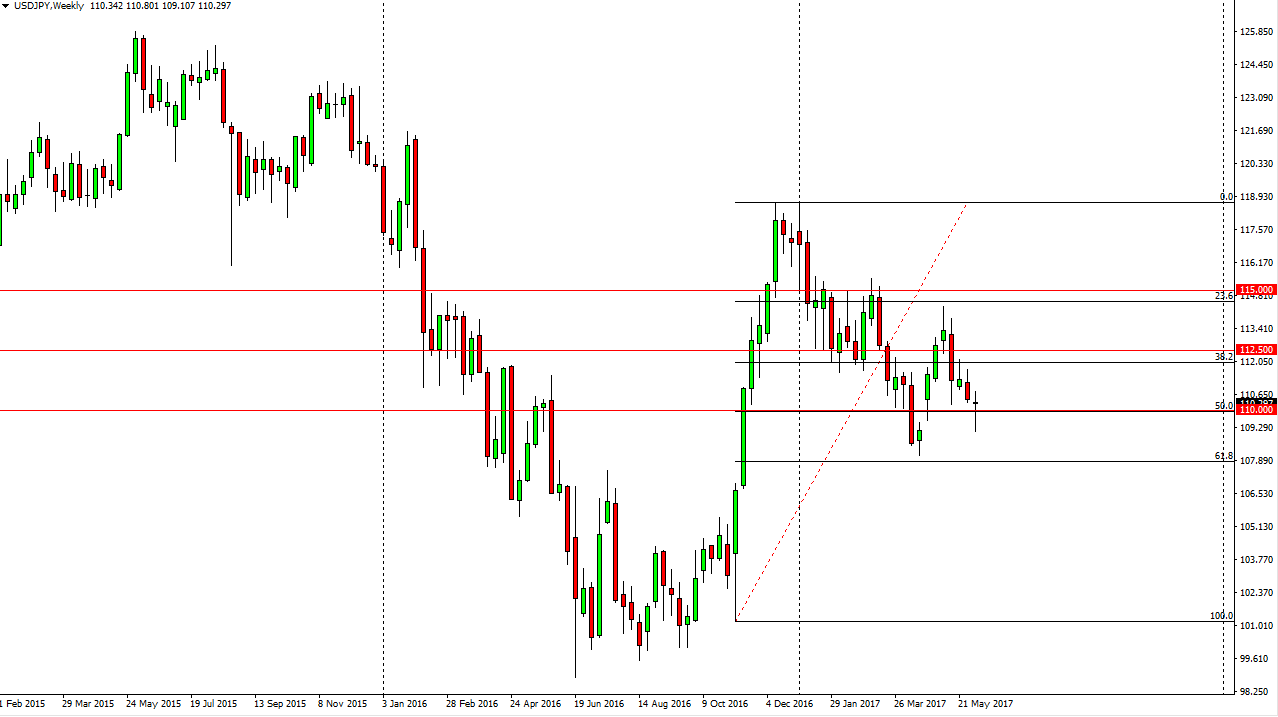

USD/JPY

The US dollar fell against the Japanese yen initially during the week but found enough support underneath the 110 level to bounce and print a hammer. A break above the top of the hammer is a bullish sign, and I think at that point the market will probably go hunting the 112 level, and then the 112.50 level after that. Pullbacks should continue to offer buying opportunities.

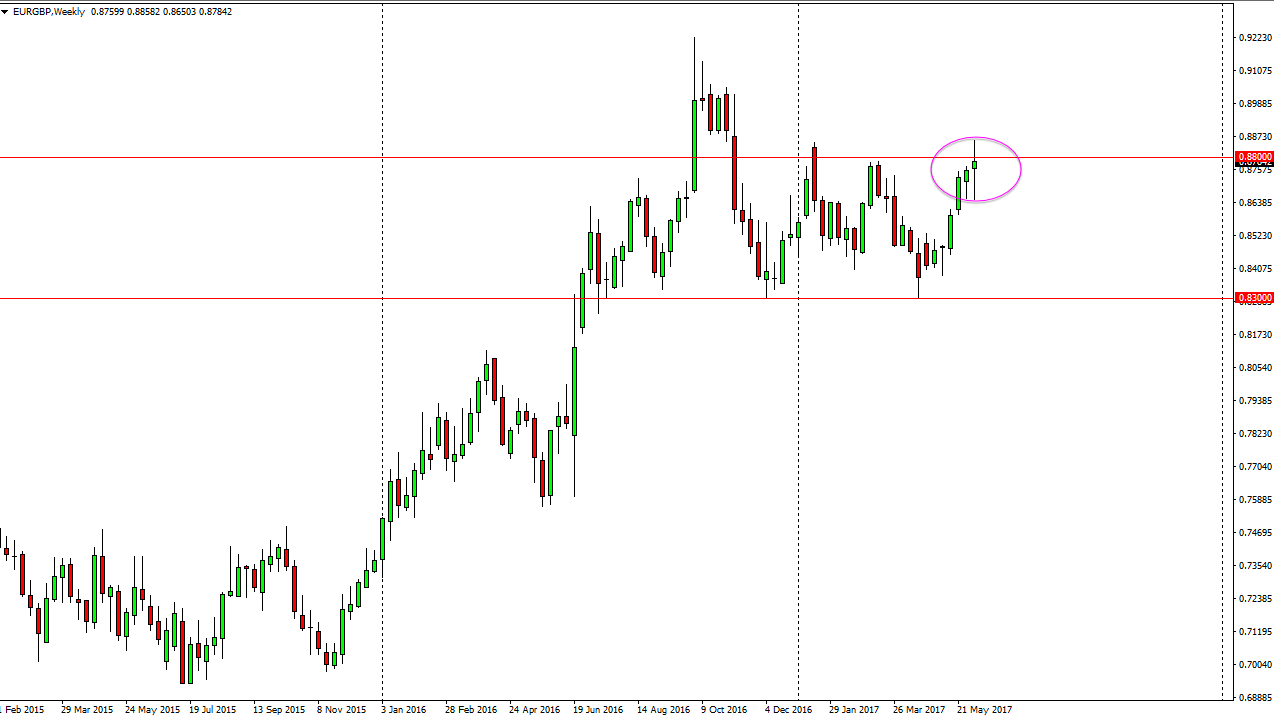

EUR/GBP

The EUR/GBP pair had a very volatile ride during the week, as we tested the 0.88 level for resistance. We found that there, even considering that the British elections turned out completely different than anticipated. Having said that, I believe that if we can break above the top of the candle for the week is a very bullish sign and should send this market looking for the 0.90 level.