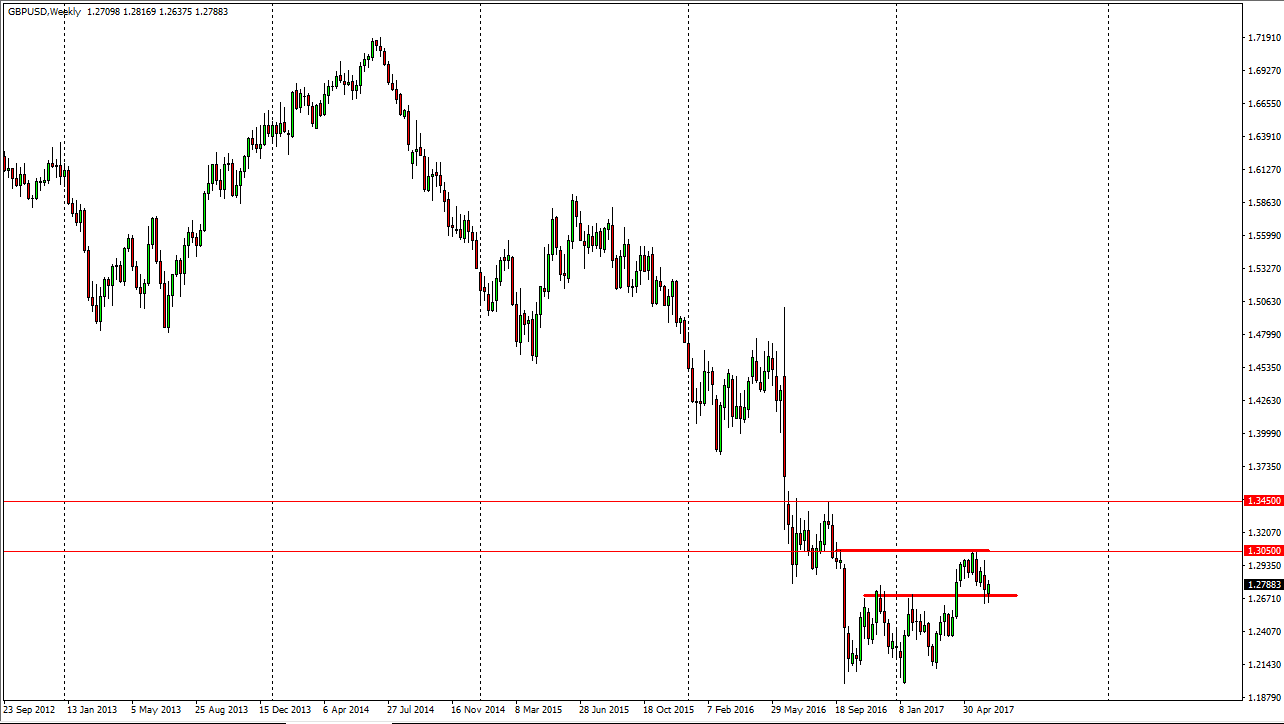

GBP/USD

The British pound fell initially during the week but found enough support to turn things around and form a bullish candle. By doing so, the market looks as if it is going to go looking for the 1.3050 over the next couple of weeks. Alternately, if we breakdown below the bottom of the range for the week, I think the market will then continue to go lower.

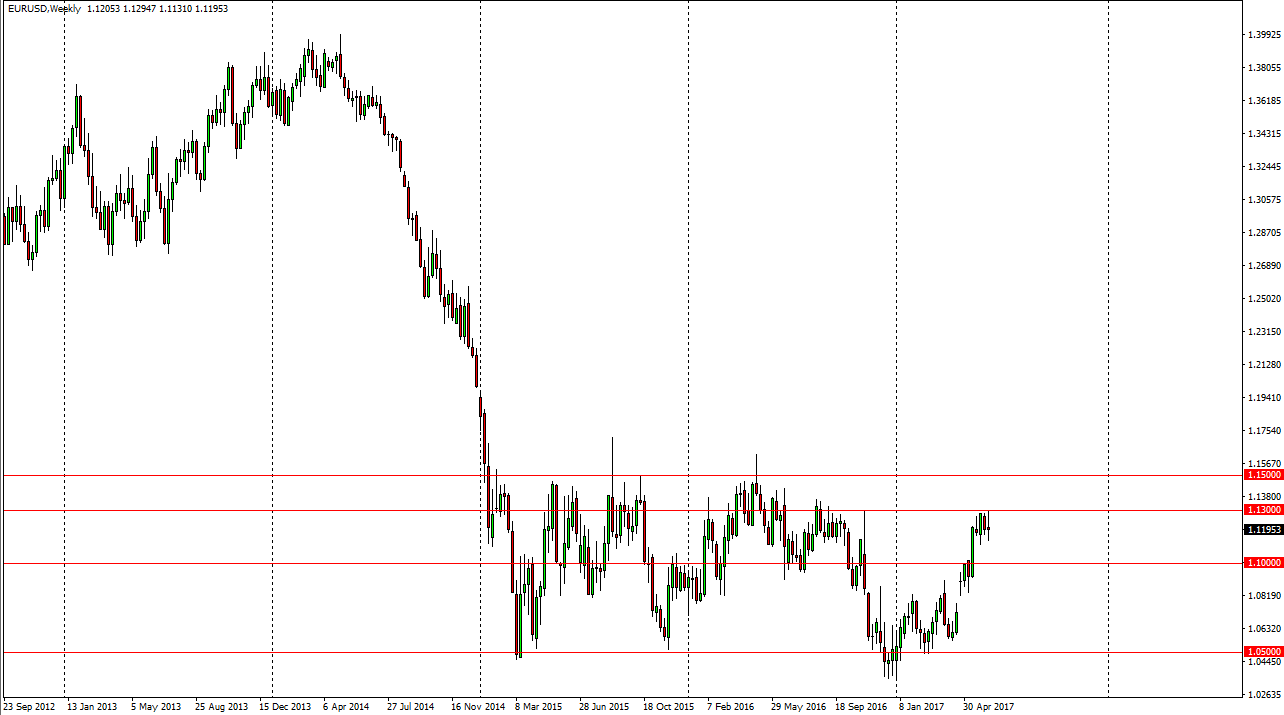

EUR/USD

The EUR continues to go back and forth, topping around between the 1.11 level on the bottom and the 1.13 level on the top. Ultimately, if we can break above the 1.13 handle, the market should then go to the 1.15 level. If we breakdown below the 1.11 level, then I think the market goes looking for the 1.10 handle. Volatility will remain high regardless of which direction we go.

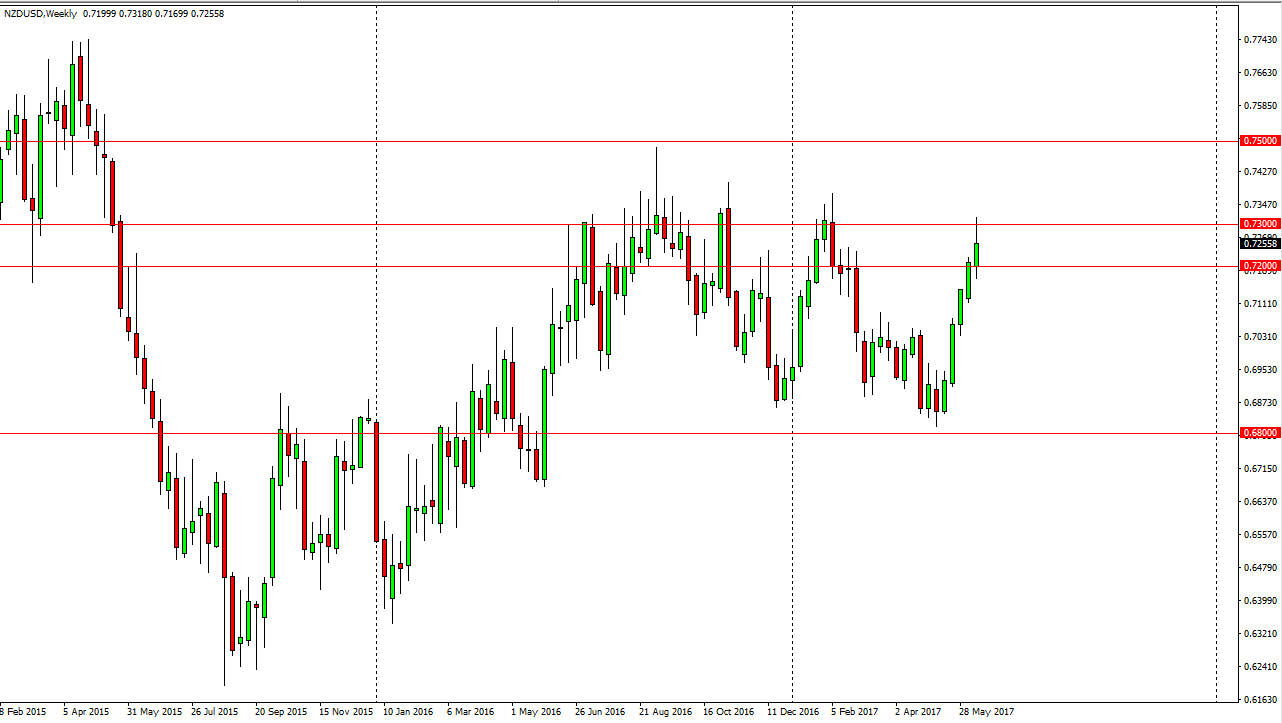

NZD/USD

The New Zealand dollar tried to rally during the week, but gave back some of the gains just above the 0.73 level. I believe that a breakdown below the bottom of the weekly range could send this market much lower. That being the case, I’m looking to sell on that move as we are a bit overextended. Alternately, we break above the top of the range for the week, then the buyers will probably go aiming for the 0.75 handle after that.

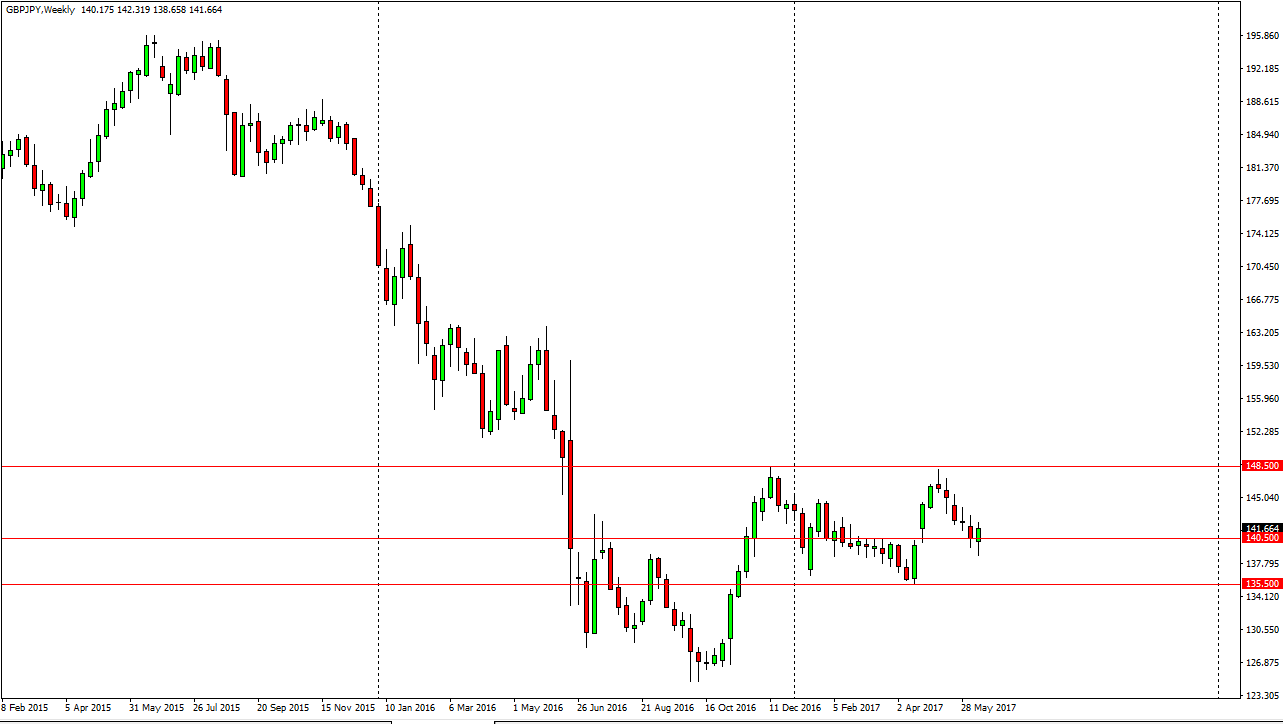

GBP/JPY

The British pound initially fell against the Japanese yen, but found enough bullish pressure underneath to turn things around and form a hammer like candle. Because of this, I believe that the market is going to continue to go towards the 148.50 level. I believe that the buyers are coming back, but if we do breakdown below the bottom of the weekly range, then we should go hunting for the 135.50 handle underneath.