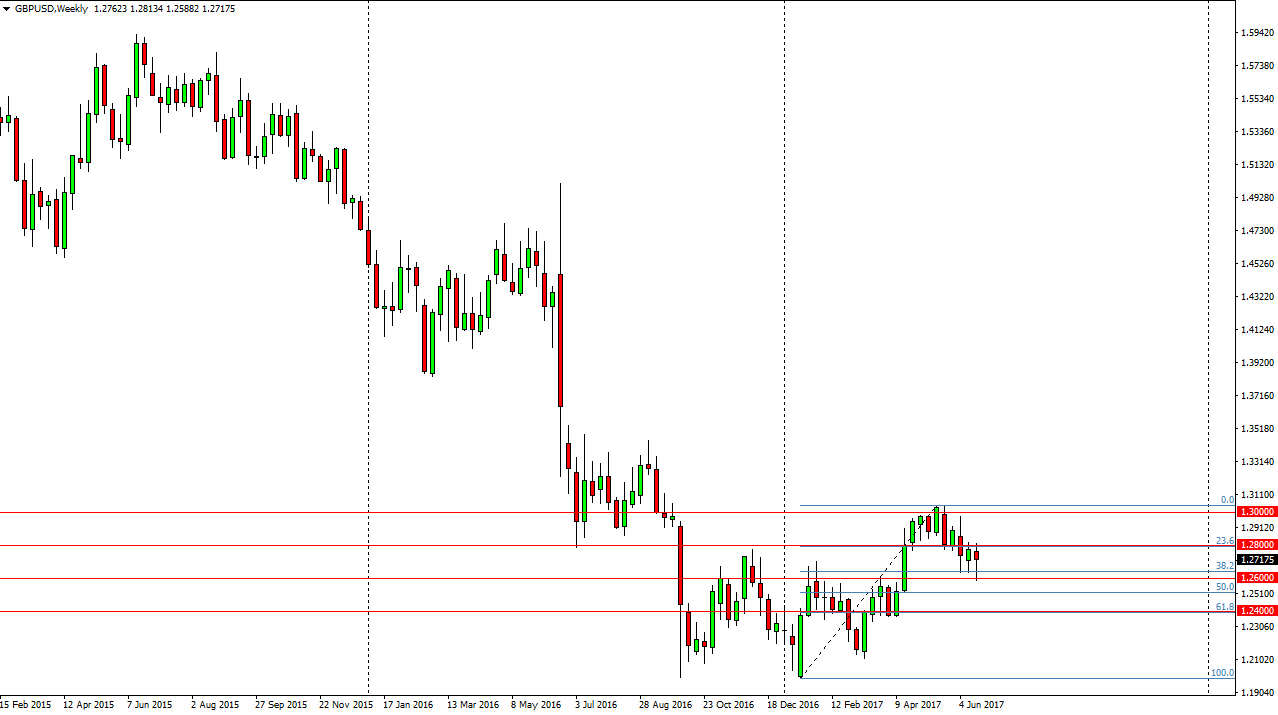

GBP/USD

The British pound initially fell during the week but found enough support at the 1.26 level to turn around and form a weekly hammer. Because of this, I believe that the buyers are going to return, and perhaps try to push this market back towards the 1.30 handle. A break above the 1.2815 level has me buying.

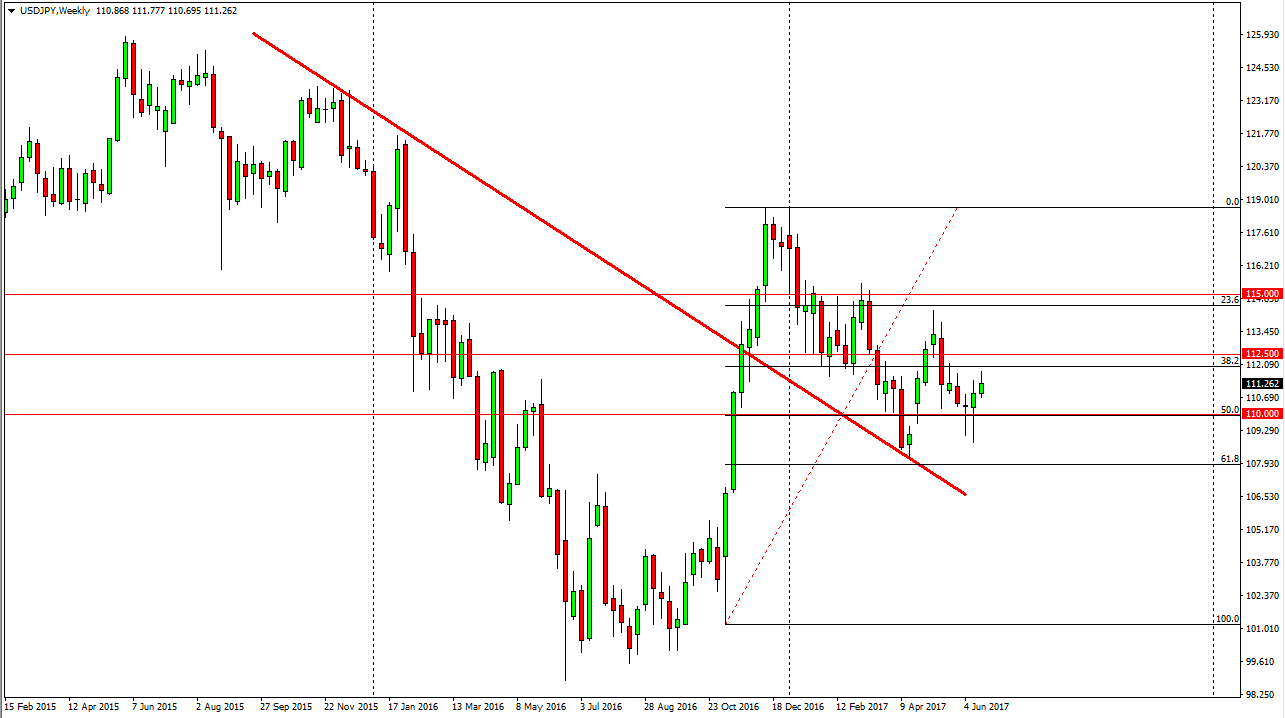

USD/JPY

The US dollar rallied during the week, breaking above the top of the candle from the previous week. I think that short-term pullbacks will be buying opportunities. Ultimately, I expect that this market will go looking for the 112.50 level above. A break above there should send this market even higher, perhaps reaching towards the 114 level. I believe that there is a significant amount of support at the 110 level.

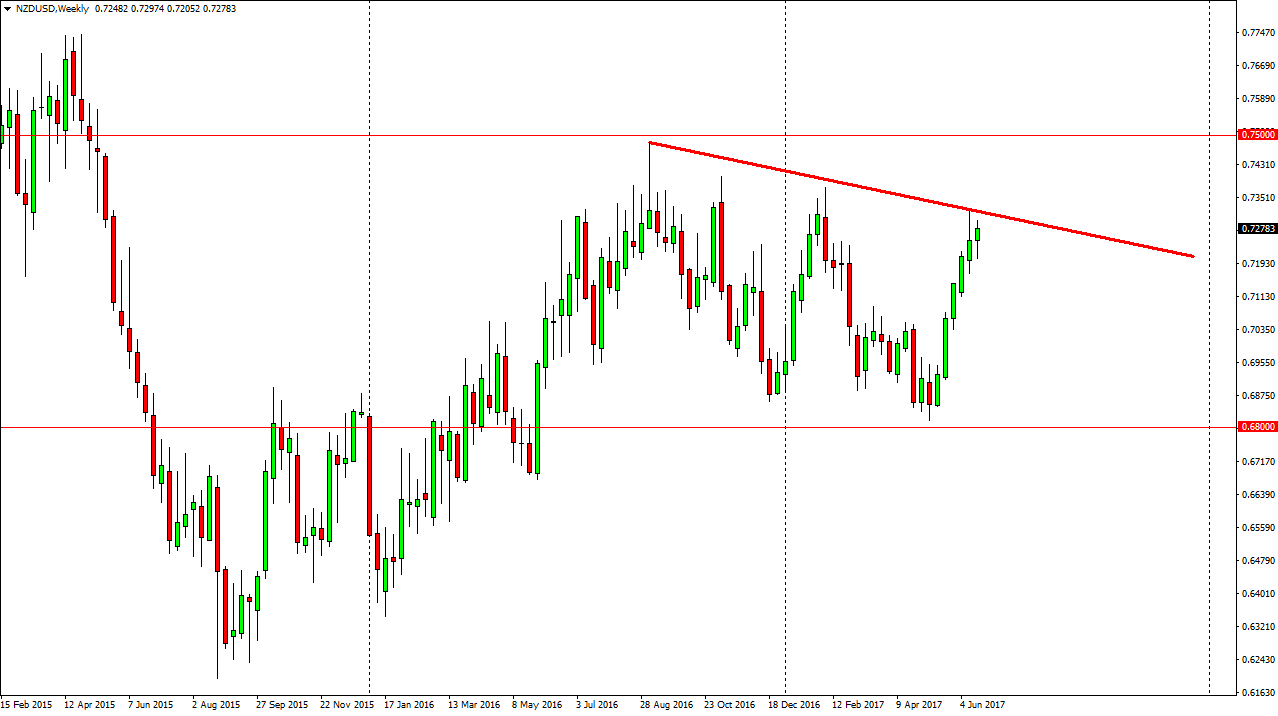

NZD/USD

The New Zealand dollar initially fell during the week, but turned around and bounced enough to form a bullish candle. The that being the case, I feel that a break above the downtrend line marked on the chart should send the New Zealand dollar are looking towards the 0.75 level going forward.

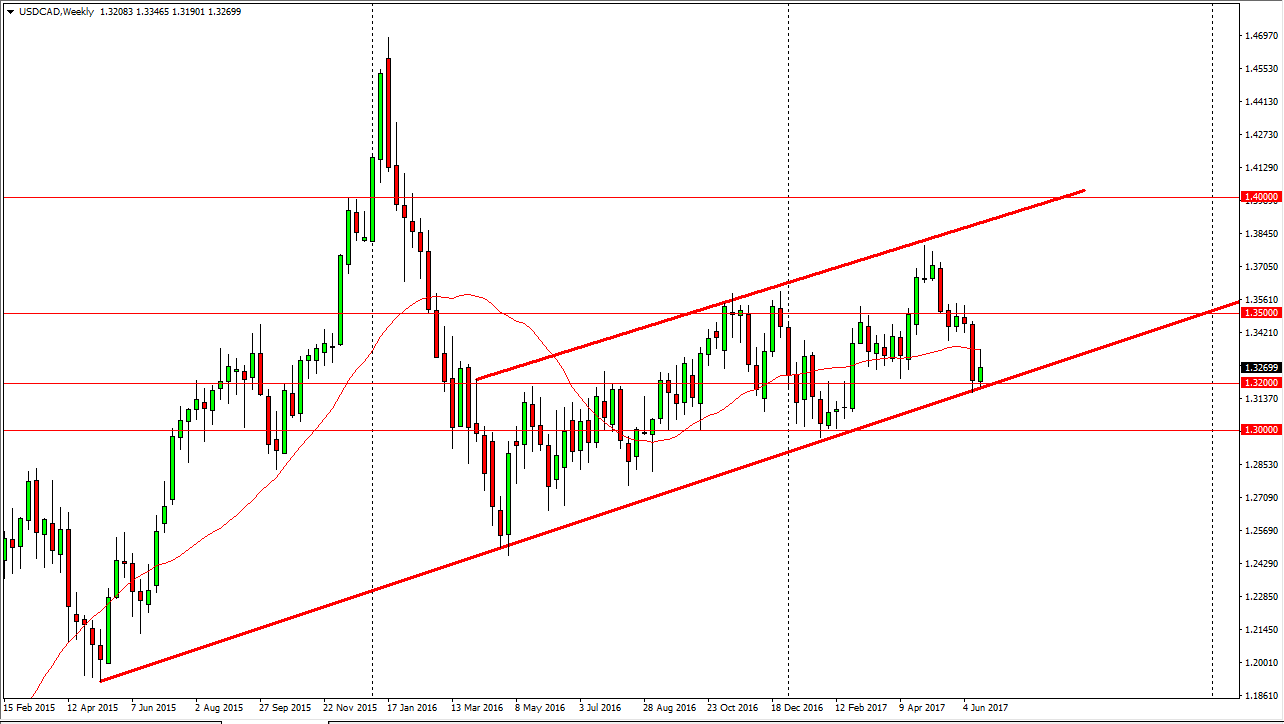

USD/CAD

The US dollar initially tried to rally during the week, but turned around to show signs of weakness. Pay attention to the crude oil market, it will drive where this pair goes. If we can break down below the uptrend line underneath, I feel that the market goes down to the 1.30 level. Alternately, we can break above the top of the range for the week, I feel that the market and goes to the 1.35 handle.